Exxon Mobil Corporation XOM, is a well-known integrated energy giant operating across the entire oil and gas value chain.

With global interest steadily shifting toward enhanced air quality, demand for cleaner fuels and technologies that aid in improving air quality is expected to rise in the coming days. To address evolving societal needs, ExxonMobil has established a low-carbon business portfolio aligned with its core strengths. Assets of this new business include carbon capture and storage (CCS), hydrogen fuels and lithium metal.

CCS captures CO2 emissions from industrial sources, transports them and then permanently stores them deep underground to prevent the same from entering the atmosphere, reducing global warming and ocean acidification. The strategic U.S. Gulf Coast positioning allows CCS to leverage existing industrial hubs, transportation networks and cost-efficient storage reservoirs.

To meet rising demand, a few more CSS projects, along with partners, are going to be operational in the coming days, creating a pathway for enhanced cash flow while strengthening its business model. XOM generates the majority of its revenues from its upstream business.

Moreover, hydrogen fuel and lithium offer dependable, low-carbon power solutions to meet the rapidly growing energy needs of data centers.

BP & CVX Also Investing in CCS Like XOM

Other leading integrated giants are Chevron Corporation CVX and BP p.l.c. BP. Like XOM, BP and CVX are investing in their low-carbon businesses, which are developing economic projects to improve air quality. BP has its CCS facilities in the U.K. and aims to capture 20-30 megatons of carbon dioxide by 2030. Alternatively, CVX has its CCS project located in Australia, and has injected more than 11 million tons of carbon dioxide underground by November 2025.

XOM’s Price Performance, Valuation & Estimates

XOM shares have gained 10.8% over the past year compared with the 5.7% improvement of the composite stocks belonging to the industry.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

From a valuation standpoint, XOM trades at a trailing 12-month enterprise value to EBITDA (EV/EBITDA) of 7.69X. This is above the broader industry average of 4.87X.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

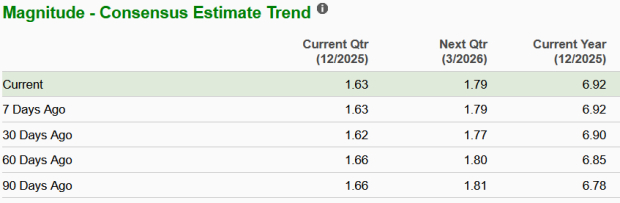

The Zacks Consensus Estimate for XOM’s 2025 earnings has been unchanged over the past seven days.

Image Source: Zacks Investment Research

ExxonMobil currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Radical New Technology Could Hand Investors Huge Gains

Quantum Computing is the next technological revolution, and it could be even more advanced than AI.

While some believed the technology was years away, it is already present and moving fast. Large hyperscalers, such as Microsoft, Google, Amazon, Oracle, and even Meta and Tesla, are scrambling to integrate quantum computing into their infrastructure.

Senior Stock Strategist Kevin Cook reveals 7 carefully selected stocks poised to dominate the quantum computing landscape in his report, Beyond AI: The Quantum Leap in Computing Power.

Kevin was among the early experts who recognized NVIDIA's enormous potential back in 2016. Now, he has keyed in on what could be "the next big thing" in quantum computing supremacy. Today, you have a rare chance to position your portfolio at the forefront of this opportunity.

See Top Quantum Stocks Now >>BP p.l.c. (BP) : Free Stock Analysis Report

Chevron Corporation (CVX) : Free Stock Analysis Report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.