C3.ai, Inc. AI is placing increased focus on its partner ecosystem as a key growth driver. In fiscal 2025, 73% of agreements were completed through partnerships, with 193 agreements closed via this channel, up 68% from the prior year. In the fiscal fourth quarter, partner-supported bookings rose 419% year over year, with 59 agreements signed through collaborations. The company stated that this network is becoming central to expanding customer reach and advancing the adoption of enterprise AI applications.

The partnership with Microsoft MSFT continues to be a driving force, helping expand market reach. In the fiscal fourth quarter alone, 28 new agreements were closed, with a particular focus on manufacturing and chemicals. Similarly, the relationship with Alphabet’s GOOGL Google Cloud remains robust, creating additional avenues to connect with enterprises seeking scalable AI solutions. Amazon’s AMZN AWS also plays a role in enhancing delivery capabilities across global markets. To support these partnerships, the company invested in building demonstration applications on Microsoft’s Azure, Amazon’s AWS and Alphabet’s Google Cloud, enabling partner sales teams to showcase complex use cases to customers from the very first meeting.

Beyond technology platforms, advisory alliances are broadening the company’s distribution capacity. The initial agreement with McKinsey QuantumBlack in the fiscal fourth quarter marked a notable milestone, while the new collaboration with PwC targets industries such as financial services, manufacturing and utilities.

These alliances provide a larger salesforce footprint, joint marketing initiatives and faster adoption cycles for C3.ai’s applications. With partnerships materially advancing customer outcomes and supporting growth across diverse industries, the company views its ecosystem strategy as a key element in shaping the next phase of expansion.

AI’s Price Performance, Valuation & Estimates

Shares of C3.ai have lost 25.8% in the past year compared with the industry’s decline of 9.5%.

Image Source: Zacks Investment Research

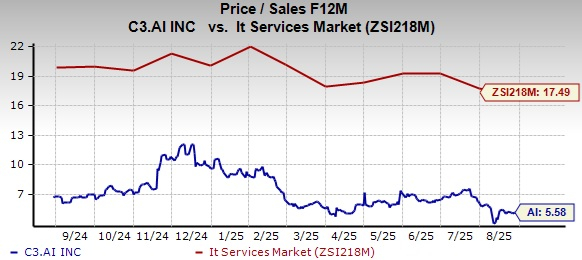

From a valuation standpoint, AI trades at a forward price-to-sales ratio of 5.58X, significantly below the industry’s average of 17.49X.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for AI’s fiscal 2026 earnings per share implies a year-over-year downtick of 239%, while the same for fiscal 2027 indicates a surge of 65.9%.

Image Source: Zacks Investment Research

AI stock currently has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Names #1 Semiconductor Stock

This under-the-radar company specializes in semiconductor products that titans like NVIDIA don't build. It's uniquely positioned to take advantage of the next growth stage of this market. And it's just beginning to enter the spotlight, which is exactly where you want to be.

With strong earnings growth and an expanding customer base, it's positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $971 billion by 2028.

See This Stock Now for Free >>Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

C3.ai, Inc. (AI) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.