NIO Inc. NIO has been implementing a comprehensive set of cost-cutting and efficiency-improvement measures to achieve profitability. The company has systematically reviewed all projects and organizational functions and halted or delayed initiatives that are unlikely to yield a return on investment within the year.

To enhance operational efficiency, NIO introduced the Veeco product line, an integrated R&D mechanism combining resources from its NIO, ONVO and Firefly brands. Similarly, in its industrialization cluster, NIO restructured logistics, quality and supply-chain functions by eliminating overlapping roles and optimizing workflows. Sales and service teams have also undergone performance-driven reforms.

NIO consolidated roles and responsibilities across back-end departments to boost productivity and reduce operational costs. These collective efforts are expected to reflect in improved results starting from the second quarter.

NIO has set specific cost-reduction targets. It planned to lower R&D spending by 15% in the second quarter, with a further goal of reducing the expense to RMB 2-2.5 billion by the fourth quarter, indicating a decline of 20-25% year over year.

Meanwhile, the company is exercising strict control over SG&A expenses, balancing marketing investments against returns and plans to reduce these costs sequentially. By the fourth quarter, NIO targets non-GAAP SG&A expenses to be within 10% of its revenues as part of the broader breakeven target. NIO carries a Zacks Rank #3 (Hold) at present.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Cost Optimization Strategies of NIO’s Peers

XPeng Inc. XPEV recorded seven straight months of vehicle margin improvements in the first quarter of 2025, driven mainly by ongoing cost-cutting initiatives and the benefits of economies of scale. With projected production growth and stronger volume potential in the third and fourth quarters, XPeng anticipates achieving greater scale, which should further reduce cost allocations and boost vehicle margins. XPeng expects its overall gross margin to approach the high-teens range, positioning it to reach profitability by the fourth quarter.

In the first quarter of 2025, Li Auto’s LI SG&A expenses declined 15% year over year. This reduction was mainly caused by lower employee compensation, enhanced operational efficiency and reduced spending on marketing and promotions. Li Auto is realizing significant cost savings as its partners become more capable and engage in closer collaboration.

NIO’s Price Performance, Valuation and Estimates

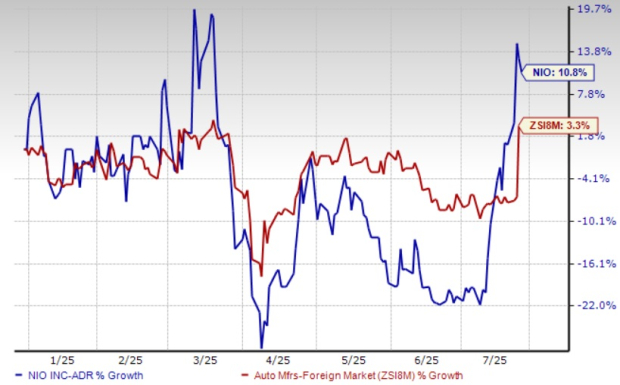

NIO has outperformed the Zacks Automotive-Domestic industry year to date. Its shares have gained 10.8% compared with the industry’s growth of 3.3%.

YTD Price Performance

Image Source: Zacks Investment Research

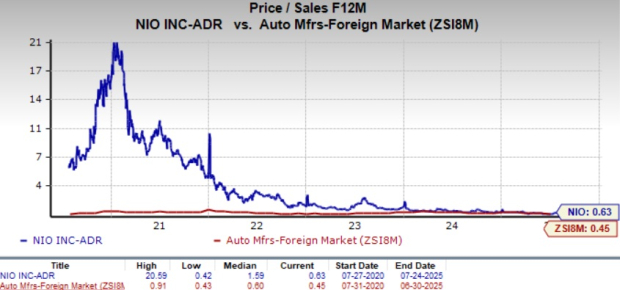

From a valuation perspective, NIO appears overvalued. Going by its price/sales ratio, the company is trading at a forward sales multiple of 0.63, higher than the industry’s 0.45.

Image Source: Zacks Investment Research

NIO’s EPS Estimates Revision

The Zacks Consensus Estimate for 2025 EPS has moved up 16 cents in the past 60 days. The same for 2026 EPS has moved down a penny in the past 30 days.

Image Source: Zacks Investment Research

Research Chief Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpNIO Inc. (NIO) : Free Stock Analysis Report

Li Auto Inc. Sponsored ADR (LI) : Free Stock Analysis Report

XPeng Inc. Sponsored ADR (XPEV) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.