Howmet Aerospace Inc. HWM is benefiting from strong momentum in the commercial aerospace market, which remains its key growth driver. In the second quarter of 2025, the commercial aerospace market contributed more than half of the company’s revenues, accounting for 52% of the total business. In the same period, sales from this market grew 8% year over year, following a 9% increase in the first quarter.

Air travel demand has remained resilient through 2024 and into 2025, which is fueling the demand for wide-body aircraft and also encouraging original equipment manufacturers (OEMs) to increase their spending. This trend has been positive for Howmet, as higher aircraft usage results in increased demand for the parts and products it supplies. Also, airlines are increasingly investing in fuel-efficient, lower-emission aircraft, which benefits the company given its role as a key supplier of advanced components.

Positive production trends at major aircraft manufacturers support Howmet’s performance as well. Boeing is expected to gradually recover production, particularly for its 737 MAX jets, following the resolution of a worker strike. This recovery is likely to increase demand for Howmet’s engine spares and other components. Also, Airbus is maintaining healthy build rates for its A320/321 aircraft, creating additional opportunities for HWM in the engine spares demand.

Strong travel demand and rising aircraft production are expected to keep fueling Howmet’s momentum. The commercial aerospace market will likely remain its primary business catalyst in the near term.

Performance of HWM’s Peers in the Commercial Aerospace Market

Among its major peers, Textron Inc. TXT reported 5.4% sales growth in the second quarter of 2025. Revenues from Textron’s Aviation segment increased 2.8% year over year in the same period. The solid performance of Textron’s segment was primarily driven by higher aftermarket parts and services revenues, in addition to increased aircraft revenues.

It’s another peer, GE Aerospace GE, is riding on the solid demand for LEAP, GEnx & GE9X engines and services within the Commercial Engines & Services business. Revenues from GE Aerospace’s Commercial Engines & Services business jumped 30% year over year in second-quarter 2025. This growth is supported by increasing air traffic, fleet renewal and expansion activities. During the second quarter, GE Aerospace inked a deal with Qatar Airways to supply more than 400 GE9X and GEnx engines. It represents the largest widebody engine deal in the company’s history.

HWM's Price Performance, Valuation and Estimates

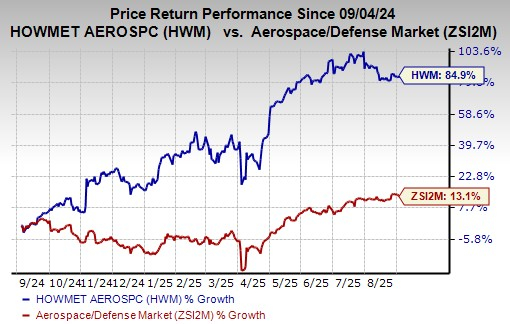

Shares of Howmet have surged 84.9% in the past year compared with the industry’s growth of 13.1%.

Image Source: Zacks Investment Research

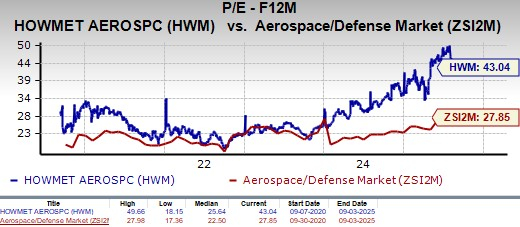

From a valuation standpoint, HWM is trading at a forward price-to-earnings ratio of 43.04X, above the industry’s average of 27.85X.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for HWM’s earnings has been on the rise over the past 60 days.

Image Source: Zacks Investment Research

The company currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Radical New Technology Could Hand Investors Huge Gains

Quantum Computing is the next technological revolution, and it could be even more advanced than AI.

While some believed the technology was years away, it is already present and moving fast. Large hyperscalers, such as Microsoft, Google, Amazon, Oracle, and even Meta and Tesla, are scrambling to integrate quantum computing into their infrastructure.

Senior Stock Strategist Kevin Cook reveals 7 carefully selected stocks poised to dominate the quantum computing landscape in his report, Beyond AI: The Quantum Leap in Computing Power.

Kevin was among the early experts who recognized NVIDIA's enormous potential back in 2016. Now, he has keyed in on what could be "the next big thing" in quantum computing supremacy. Today, you have a rare chance to position your portfolio at the forefront of this opportunity.

See Top Quantum Stocks Now >>GE Aerospace (GE) : Free Stock Analysis Report

Textron Inc. (TXT) : Free Stock Analysis Report

Howmet Aerospace Inc. (HWM) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.