Carvana’s CVNA primary sources of operating cash flows are derived from the sale of retail vehicles, wholesale vehicles, originated loans and complementary products, including vehicle service contracts, GAP waiver coverage and other related offerings. The main uses of cash in operating activities include inventory purchases, personnel-related expenses and customer acquisition costs.

For the years ended Dec. 31, 2024 and 2023, Carvana generated $918 million and $803 million in cash from operating activities, respectively. The $115 million year-over-year increase was largely driven by improved operating performance and a $274 million reduction in interest paid, attributed to higher paid-in-kind (PIK) interest on the Senior Secured Notes in 2024. PIK allows companies to conserve cash in the near term and is commonly utilized by rapidly growing businesses.

In 2024, Carvana's operating performance strengthened due to higher unit sales and record annual revenues, leading to significant profitability milestones. The used car retailer reported an all-time high net income, adjusted EBITDA and GAAP operating income. Carvana anticipates sequential growth in both retail units sold and adjusted EBITDA in the second quarter, projecting new all-time company records for both measures. Expected improvement in the company’s operating performance will continue to drive its operating cash flow.

In addition to operating cash flows, Carvana generates cash through financing activities, including short-term revolving inventory and finance receivable facilities, real estate and equipment financing, debt issuances and equity offerings. Historically, these financing activities have supported the company’s growth, market expansion and strategic initiatives and this trend is expected to continue. Cash provided by and used in financing activities totaled $261 million in 2024 and $868 million in 2023. CVNA carries a Zacks Rank #3 (Hold) at present.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Cash Flow Performance of CVNA’s Competitors

In 2024, Group 1 Automotive, Inc. GPI reported a $396.1 million increase in net cash provided by operating activities compared to the prior year. However, on an adjusted basis, Group 1’s operating cash flow declined $36.9 million due to a $103.5 million drop in net income and a $440.1 million reduction in floorplan notes payable.

Lithia Motors, Inc. LAD reported a $897.5 million year-over-year rise in operating cash flow in 2024, driven by its maturing financing receivables portfolio and lower inventory levels at more established locations. Lithia’s current free cash flow deployment strategy allocates 35-45% toward acquisitions, 25% toward capital expenditures, innovation and diversification and 30-40% toward shareholder returns through dividends and share repurchases.

Carvana’s Price Performance, Valuation and Estimates

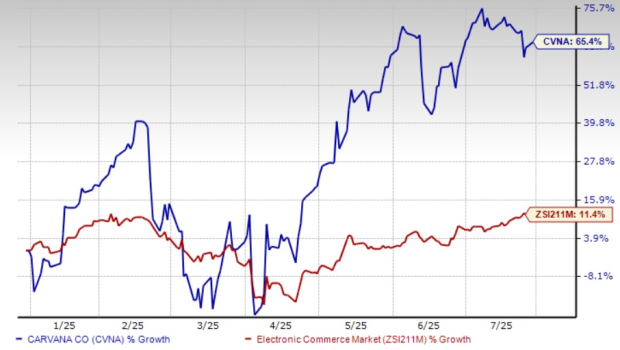

Carvana has outperformed the Zacks Internet – Commerce industry year to date. CVNA shares have surged 65.4% compared with the industry’s growth of 11.4%.

YTD Price Performance

Image Source: Zacks Investment Research

From a valuation perspective, Carvana appears overvalued. Going by its price/sales ratio, the company is trading at a forward sales multiple of 3.46, higher than its industry’s 2.17.

Image Source: Zacks Investment Research

EPS Estimates Revision

The Zacks Consensus Estimate for 2025 and 2026 EPS has moved up 5 cents and 8 cents, respectively, in the past seven days.

Image Source: Zacks Investment Research

Higher. Faster. Sooner. Buy These Stocks Now

A small number of stocks are primed for a breakout, and you have a chance to get in before they take off.

At any given time, there are only 220 Zacks Rank #1 Strong Buys. On average, this list more than doubles the S&P 500. We’ve combed through the latest Strong Buys and selected 7 compelling companies likely to jump sooner and climb higher than any other stock you could buy this month.

You'll learn everything you need to know about these exciting trades in our brand-new Special Report, 7 Best Stocks for the Next 30 Days.

Download the report free now >>Group 1 Automotive, Inc. (GPI) : Free Stock Analysis Report

Lithia Motors, Inc. (LAD) : Free Stock Analysis Report

Carvana Co. (CVNA) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.