Astera Labs ALAB is strengthening its position in the rapidly growing AI infrastructure market through solid execution and platform expansion. In the third quarter of 2025, revenues jumped 104% year over year to $230.6 million, driven by strong demand for its connectivity solutions that power next-generation, high-speed AI data centers worldwide. This highlights the company’s growing importance in enabling rack-scale AI systems across global hyperscalers.

The long-term opportunity is significant. According to Grand View Research, the global AI infrastructure market is expected to grow to $223.45 billion by 2030 at a CAGR of 30.4%.

Astera Labs’ growth is led by expanding products like Scorpio Smart Fabric Switches, Taurus Ethernet SCMs and signal-conditioning solutions. These are core to its “AI Infrastructure 2.0” vision, built for accelerator-heavy, rack-scale systems that power advanced AI computing. Recent design wins with major hyperscalers highlight the company’s rising customer adoption and ecosystem strength.

Astera Labs recently acquired aiXscale Photonics GmbH, expanding into optical interconnects that offer higher bandwidth and longer reach to support large-scale AI workloads. The company also showcased its open-rack ecosystem at the OCP Global Summit in October 2025, reinforcing its leadership in standards-based connectivity such as PCIe 6, CXL and UALink.

However, challenges remain. Heavy dependence on a few hyperscaler customers, intense competition from giants like Broadcom, Marvell, AMD and Intel, and potential execution risks in scaling new technologies could weigh on growth. Still, with fourth-quarter revenue guidance of $245-$253 million, the company’s expanding AI platforms, ecosystem partnerships and continued innovation suggest Astera Labs is well-positioned to drive the next growth wave in AI connectivity.

Astera Labs Competes Hard in AI Infrastructure Space

Broadcom AVGO dominates AI infrastructure with its custom silicon, Ethernet switches and optical interconnects powering hyperscalers. The company’s vast scale, diversified semiconductor portfolio and strong infrastructure software give it a decisive competitive edge. Though its leadership in PCIe and AI accelerators is unmatched, exposure to weaker non-AI segments slightly tempers Broadcom’s overall growth momentum.

Credo Technology CRDO is evolving as a strong AI connectivity contender, with a vertically integrated, system-level design that spans SerDes IP, Retimer ICs and production. Credo Technology leads in Active Electrical Cables and optical DSPs, offering high efficiency, low power and superior reliability. Credo Technology’s new ZeroFlap 1.6 Tbps optical transceivers targeting 200 Gbps lanes strengthen its competitive edge in hyperscale AI networks.

ALAB’s Share Price Performance, Valuation & Estimates

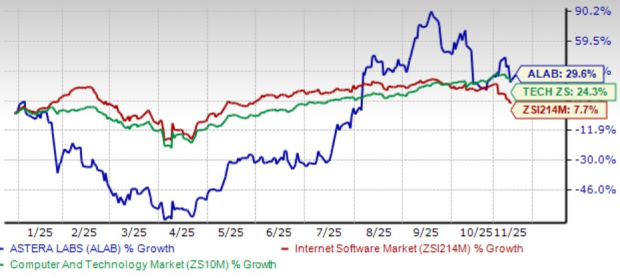

ALAB shares have risen 29.6% year to date, outperforming both the broader Zacks Computer & Technology sector’s return of 24.3% and the Zacks Internet - Software industry’s gain of 7.7%.

ALAB’s YTD Price Performance

Image Source: Zacks Investment Research

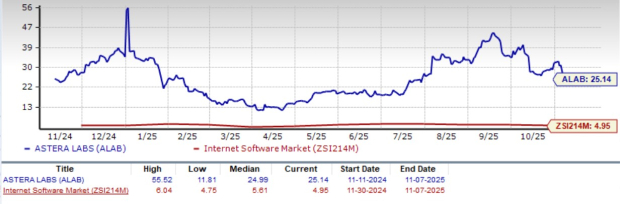

ALAB stock is trading at a premium, with a forward 12-month Price/Sales of 25.14X compared with the industry’s 4.95X. ALAB has a Value Score of F.

ALAB’s Valuation

Image Source: Zacks Investment Research

The consensus mark for 2025 earnings is pegged at $1.78 per share, up 12.7% over the past 30 days, suggesting 111.9% year-over-year growth.

Image Source: Zacks Investment Research

Astera Labs currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the favorite stock to gain +100% or more in the months ahead. They include

Stock #1: A Disruptive Force with Notable Growth and Resilience

Stock #2: Bullish Signs Signaling to Buy the Dip

Stock #3: One of the Most Compelling Investments in the Market

Stock #4: Leader In a Red-Hot Industry Poised for Growth

Stock #5: Modern Omni-Channel Platform Coiled to Spring

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor. While not all picks can be winners, previous recommendations have soared +171%, +209% and +232%.

Download Atomic Opportunity: Nuclear Energy's Comeback free today.Broadcom Inc. (AVGO) : Free Stock Analysis Report

Credo Technology Group Holding Ltd. (CRDO) : Free Stock Analysis Report

Astera Labs, Inc. (ALAB) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.