Affirm Holdings, Inc. AFRM has established a distinct position in the bustling Buy Now, Pay Later (BNPL) market by focusing on transparency, catering to high-ticket purchases and offering flexible financing options. But as the fintech landscape grows and rivalry intensifies, the company is transforming its strategy to tackle the growing competition in the fintech and BNPL space.

While it used to be primarily associated with financing larger purchases like Peloton bikes, travel bookings or fancy electronics, AFRM is now teaming up with smaller, everyday buys. Its recent collaboration in low-ticket purchases includes Costco and World Market. This shift in strategy shows the company’s aim to attract a wider audience and boost transaction volumes. Total transactions rose 45.6% year over year to 31.3 million in the third quarter of fiscal 2025 on the back of a significant surge in repeat customer transactions.

Affirm doesn’t charge late fees, provides clear payment schedules and discloses interest rates upfront. This approach is appealing to young buyers who are cautious about credit. It is making investments in ML-driven underwriting and real-time decision making to ensure it maintains credit quality while broadening its reach. As of March 31, 2025, AFRM’s active merchants were 358,000, up 23% year over year.

By striking a thoughtful balance between innovation and discipline, Affirm is working to solidify its position in both premium and everyday consumer financing. To outlast well-funded rivals, the company must grow profitably, build smart partnerships, navigate regulations and keep consumer trust intact.

How Are Competitors Faring?

Some of AFRM’s competitors in the fintech space are PayPal Holdings, Inc. PYPL and Block, Inc. XYZ.

PayPal is a powerful player in the digital payments market with its Pay Later offerings, which directly compete with AFRM’s business strategy. PayPal’s “Pay Monthly” targets high-ticket purchases, while “Pay in 4” serves low-ticket, interest-free purchases. PayPal’s net revenues increased 1% year over year to $7.8 billion in the first quarter of 2025.

Afterpay, owned by Block, is best known for allowing its customers to split their lower-ticket purchases into four interest-free payments. Block’s Gross Payment Volume rose 4.4% year over year in the first quarter of 2025. The BNPL platform’s Gross Merchandise Value grew 13% year over year in the same quarter.

Affirm’s Price Performance, Valuation & Estimates

Over the past year, AFRM’s shares have skyrocketed 133.3% compared with the industry’s rise of 38.3%.

Image Source: Zacks Investment Research

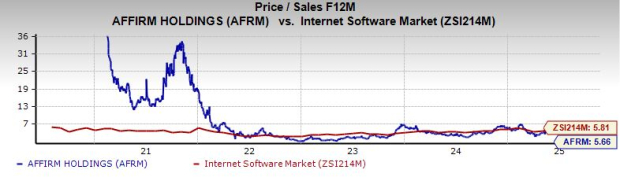

From a valuation standpoint, AFRM trades at a forward price-to-sales ratio of 5.66, below the industry average of 5.81.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for Affirm’s fiscal 2025 earnings implies 101.8% growth from the year-ago period.

Image Source: Zacks Investment Research

Affirm currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Higher. Faster. Sooner. Buy These Stocks Now

A small number of stocks are primed for a breakout, and you have a chance to get in before they take off.

At any given time, there are only 220 Zacks Rank #1 Strong Buys. On average, this list more than doubles the S&P 500. We’ve combed through the latest Strong Buys and selected 7 compelling companies likely to jump sooner and climb higher than any other stock you could buy this month.

You'll learn everything you need to know about these exciting trades in our brand-new Special Report, 7 Best Stocks for the Next 30 Days.

Download the report free now >>PayPal Holdings, Inc. (PYPL) : Free Stock Analysis Report

Affirm Holdings, Inc. (AFRM) : Free Stock Analysis Report

Block, Inc. (XYZ) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.