Mastercard’s MA service business is increasingly becoming an important component of its long-term growth strategy, strengthening the core payments franchise while improving resilience, profitability and strategic positioning. Although MA is better known for its card-based payment network, its Services segment—commonly known as Value-Added Services (VAS)—is increasingly driving sustainable revenue expansion and competitive differentiation.

Mastercard generates revenues largely from transaction volumes, and the service business diversifies its revenues. While traditional payment revenues are closely tied to consumer spending and economic cycles, services such as data analytics, cybersecurity, fraud prevention, consulting, loyalty solutions and open banking are less dependent on payment volumes and more focused on long-term client relationships. This diversification reduces earnings volatility and provides a steadier growth profile, which is highly valued by long-term investors.

The demand for Mastercard’s service offerings, like cybersecurity and data analytics, surged during COVID-19, providing revenue diversification benefits. Revenues from Value-Added Services grew 17.7% in 2023, 16.8% in 2024 and 22% year over year in the first nine months of 2025, driven by higher demand for consumer acquisition and engagement, as well as business and market insight services.

Mastercard's acquisitions (Recorded Future, Dynamic Yield, NuData, and others) and partnerships with the Monetary Authority of Singapore and Salesforce are further expanding its service business and strengthening cybersecurity capabilities, supporting continued growth in this segment as the payments business gains momentum.

Thus, the service business is increasingly becoming an essential lever of MA’s growth story.

What About its Peers?

Visa V and American Express AXP are increasingly leveraging service businesses to drive growth beyond transaction-based revenues.

Visa’s value-added offerings, including data analytics, fraud management, risk solutions, and advisory services, improve customer retention, diversify revenue streams and generate higher-margin, recurring income that is less exposed to economic fluctuations.

For American Express, services play an even more central role, as its closed-loop network uses proprietary data, loyalty programs, merchant solutions and premium benefits to boost spending, engagement and customer loyalty.

Overall, its service businesses enhance business stability, deepen client relationships and are essential to the long-term growth strategies of both Visa and AXP.

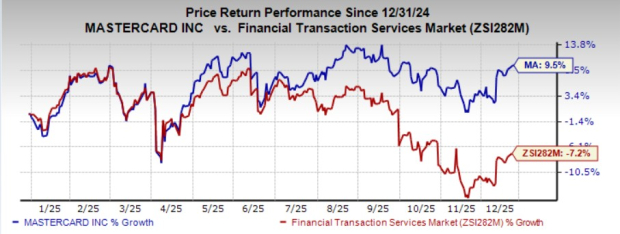

MA’s Price Performance

Shares of MA have gained 9.5% year to date, outperforming the industry.

Image Source: Zacks Investment Research

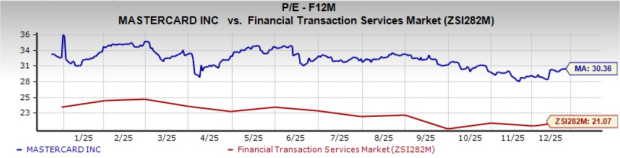

MA’s Expensive Valuation

Mastercard trades at a forward 12-month price-to-earnings ratio of 30.36, above the industry average of 21.07. It carries a Value Score of D.

Image Source: Zacks Investment Research

Estimate Movement for MA

The Zacks Consensus Estimate for MA’s fourth-quarter 2025 EPS and first-quarter 2026 EPS witnessed no movement in the last 30 days. The consensus estimate for 2025 and 2026 earnings moved down 1 cent each in the same time frame.

Image Source: Zacks Investment Research

The consensus estimate for MA’s 2025 and 2026 revenues and EPS indicates year-over-year increases.

MA stock currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Naming Top 10 Stocks for 2026

Want to be tipped off early to our 10 top picks for the entirety of 2026? History suggests their performance could be sensational.

From 2012 (when our Director of Research Sheraz Mian assumed responsibility for the portfolio) through November, 2025, the Zacks Top 10 Stocks gained +2,530.8%, more than QUADRUPLING the S&P 500’s +570.3%.

Now Sheraz is combing through 4,400 companies to handpick the best 10 tickers to buy and hold in 2026. Don’t miss your chance to get in on these stocks when they’re released on January 5.

Be First to New Top 10 Stocks >>Mastercard Incorporated (MA) : Free Stock Analysis Report

Visa Inc. (V) : Free Stock Analysis Report

American Express Company (AXP) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.