Rigetti Computing, Inc.’s RGTI shares have gained more than 2,800% in the past year as investors showed excitement over its quantum breakthroughs. However, Rigetti’s weak fundamentals and lofty valuation raised doubts about its future growth trajectory and how investors should position themselves toward the stock. Let’s see in detail –

What's Behind Rigetti's Quantum Leap?

Rigetti's shares have soared over the past year as the company secured major contracts and made significant progress in advanced quantum computing technology. Rigetti's 36-qubit quantum system achieved 99.5% accuracy in key operations, marking a breakthrough toward developing a 100+ qubit chiplet-based system by the year's end.

Rigetti signed a $5.8 million deal with the U.S. Air Force Research Laboratory to further develop quantum networking technology. It also received orders for two 9-qubit Novera quantum computing systems worth nearly $5.7 million, scheduled for delivery next year.

Additionally, capital is pouring into the quantum computing sector, benefiting dedicated companies like Rigetti. JPMorgan Chase & Co. JPM announced plans to invest about $10 billion in various innovative fields, including quantum computing. This has driven the stocks of quantum computing companies, including Rigetti, higher.

Rigetti's Massive Gains — Boom or Bubble?

Ongoing contracts and continuous breakthroughs in quantum computing may give Rigetti's stock the momentum needed to keep climbing. However, quantum computing remains in its early stages, and companies in this field require substantial funding for research and development. Rigetti recently completed a $350 million equity offering, providing the company with enough cash to continue operations and easing concerns about funding stability.

Rigetti's business model also offers a competitive edge over rivals and positions it for growth once quantum technology becomes mainstream. The company has its own quantum processing units (QPUs), programming language and the Quantum Cloud Services (QCS) platform.

Yet, it remains uncertain whether Rigetti can sustain its current explosive growth. The company's fundamentals do not fully support its soaring valuation. Rigetti's operating losses increased 24% year over year to $19.8 million in the second quarter, while revenues fell 42% to $1.8 million, citing investors.rigetti.com.

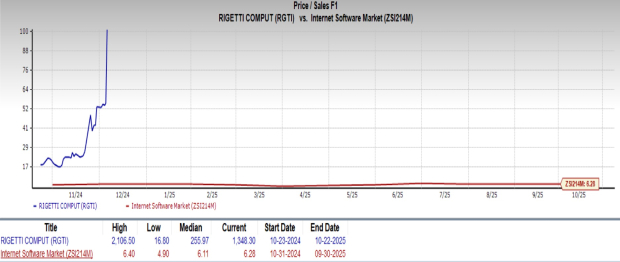

Furthermore, Rigetti faces stiff competition from larger players like Alphabet Inc. GOOGL and International Business Machines Corporation IBM, making it a potential takeover target. Additionally, Rigetti's forward price-to-sales (P/S) ratio is an astronomical 1,348.30, compared with the Internet - Software industry's 6.28. This indicates the stock is vulnerable to a broader market correction.

Image Source: Zacks Investment Research

Overall, RGTI stock shows signs of being a bubble that could eventually burst. Risk-averse investors should steer clear of the stock, as it remains a speculative investment. Risk-takers may choose to capitalize on the potential growth opportunities. Currently, Rigetti has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

Radical New Technology Could Hand Investors Huge Gains

Quantum Computing is the next technological revolution, and it could be even more advanced than AI.

While some believed the technology was years away, it is already present and moving fast. Large hyperscalers, such as Microsoft, Google, Amazon, Oracle, and even Meta and Tesla, are scrambling to integrate quantum computing into their infrastructure.

Senior Stock Strategist Kevin Cook reveals 7 carefully selected stocks poised to dominate the quantum computing landscape in his report, Beyond AI: The Quantum Leap in Computing Power.

Kevin was among the early experts who recognized NVIDIA's enormous potential back in 2016. Now, he has keyed in on what could be "the next big thing" in quantum computing supremacy. Today, you have a rare chance to position your portfolio at the forefront of this opportunity.

See Top Quantum Stocks Now >>JPMorgan Chase & Co. (JPM) : Free Stock Analysis Report

International Business Machines Corporation (IBM) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Rigetti Computing, Inc. (RGTI) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.