Shares of Remitly Global (NASDAQ: RELY), the digital remittance payment specialist, were heading south in November as investors balked at its third-quarter earnings report, though the numbers were generally better than expected.

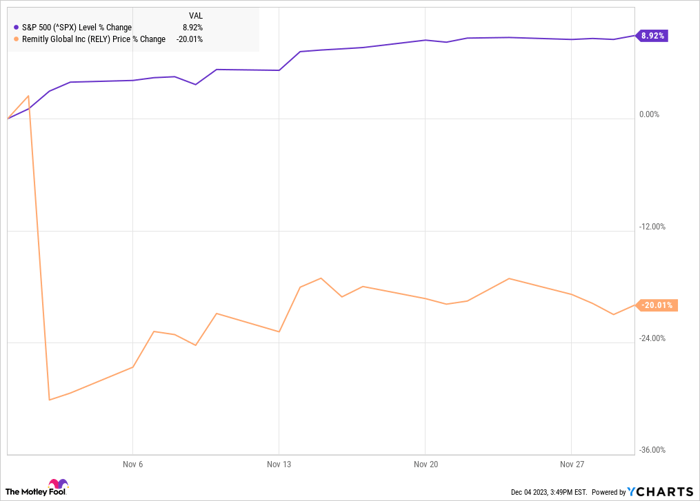

Instead, investors seemed to believe that the stock had become overheated after earlier gains this year and that the third-quarter numbers didn't warrant such rapid appreciation. As a result, the stock fell 20%, according to data from S&P Global Market Intelligence.

As you can see from the chart, shares tumbled early in the month on the report but recovered some of those losses over the duration of the month.

Remitly comes up short

Remitly has positioned itself as a disruptor in the massive money transfer industry, taking market share away from incumbents like Western Union and Moneygram. In general, that's been a winning strategy, as the company has delivered rapid growth and improved profitability, but it wasn't enough to please investors in the third-quarter earnings report.

Remitly reported a 42% increase in active customers to 5.4 million. It saw send volume increase 36% to $7.5 billion, which drove revenue up 43% to $241.6 million. This was better than the consensus at $239.2 million.

On the bottom line, adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) improved from a loss of $3.7 million in the quarter a year ago to $10.5 million. However, it reported a generally accepted accounting principles (GAAP) loss of $0.20 per share, in line with the period a year ago, but worse than the consensus at a per-share loss of $0.16.

Over the next two weeks, the stock drifted higher, as some investors saw the sell-off as a buying opportunity, and Citigroup said as much, adding that the fundamental growth story on the stock was unchanged.

What's next for Remitly?

Looking ahead, Remitly also raised its guidance for the full year, calling for revenue of $935 million-$943 million, representing 43%-44% growth and above its previous range of $915 million-$925 million. On the bottom line, management also raised its adjusted EBITDA guidance from $33 million-$40 million to $36 million-$41 million and said it continued to expect a GAAP net loss for the year.

Remitly is penetrating a massive remittance market valued at around $1 trillion and rapidly taking market share. The industry also tends to be recession proof, as immigrants prioritize sending money back home over other expenses that they can cut back on.

Given the market opportunity and Remitly's growth rate, the stock looks like a good buy at the current price.

10 stocks we like better than Remitly Global

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

They just revealed what they believe are the ten best stocks for investors to buy right now... and Remitly Global wasn't one of them! That's right -- they think these 10 stocks are even better buys.

*Stock Advisor returns as of December 4, 2023

Citigroup is an advertising partner of The Ascent, a Motley Fool company. Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.