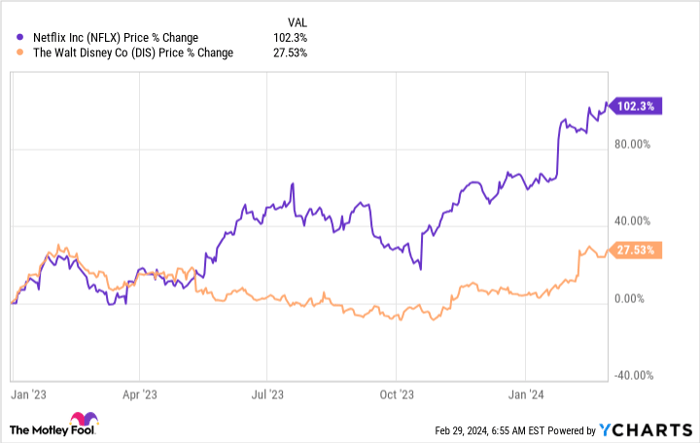

I've been skeptical of Netflix (NASDAQ: NFLX) for years, but 2023 was the year I started warming up to the idea of finally buying. For one thing, I needed a few stocks to replace my long-term market-losing position in Walt Disney (NYSE: DIS), which I finally exited after the most recent rally. It's a late decision that cost me, as Netflix has been the obvious outperformer over the last year-plus since I put Disney on the chopping block.

In fact, much of the traditional media industry is a mess right now, with the exception of Netflix. Here's what finally pushed me over the edge to pull the trigger on Netflix -- even after the stock doubled in the last year.

Data by YCharts.

Netflix is now profitable by all measures

As I've explained for years, despite being a Netflix subscriber, I could never bring myself to own a slice of the business itself because of a lack of profitability. Sure, Netflix has been showing GAAP net income for quite some time. But on a free cash flow basis (which includes the money paid for the company to create content, versus GAAP net income which amortizes this key expense over time), Netflix was decidedly unprofitable.

But that changed in grand fashion in 2023. As Netflix has grown up, it has turned highly profitable by all measures over the last year. Free cash flow is now being cranked out at an even higher rate than GAAP net income.

Data by YCharts.

Of course, the market has taken note of Netflix's more profitable advance as well -- thus the big stock run-up, especially since the start of 2023. Shares now trade for a premium 50 times trailing 12-month earnings, or nearly 40 times trailing 12-month free cash flow. Surely it's too late to buy now, right?

Years of profitable expansion lay ahead

Netflix's subscriber base continues to rise higher. This media business has fewer international border confines than the traditional U.S. TV business, and Netflix's steady investment over the years in a diverse set of content has positioned it well. Total subscribers grew 13% year over year in Q4 2023 to surpass 260 million.

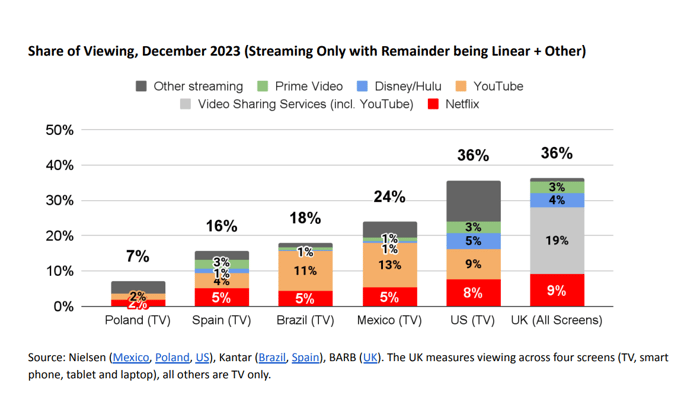

The world is still a very large place, though, and Netflix still estimates its share of global screen time at just a single-digit percentage. Subscription pricing keeps rising too, and an ads business is now being built, putting Netflix on track to eventually become something resembling what traditional cable is today (except for the consumer ability to more carefully select what they want to watch at any given moment). Nevertheless, steady subscriber growth remains a key reason Netflix can sustain a low-teens revenue growth rate in the years to come.

Chart source: Netflix.

Along the way, management has stated that it intends to continue gradually increasing those profit margins. On a free cash flow basis, 2024 is expected to yield a similar result to the $6 billion the company generated in 2023, owing to Netflix ramping up from a content production pause in the U.S. due to actor and writer strikes last year. Despite this near-term flattish outlook, however, Netflix remains a highly profitable business with ample cash to fund its expansion plans.

And shareholders are now being rewarded too. Netflix returned $6 billion of that cash last year via stock repurchases. That's another reason for optimism going forward, despite the rich valuation on the stock.

In all, the story has changed dramatically at Netflix, and what has emerged from the bear market of the last couple of years is healthy growth and a profitable media business. I plan on buying more Netflix stock as the year progresses.

Should you invest $1,000 in Netflix right now?

Before you buy stock in Netflix, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Netflix wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 26, 2024

Nick Rossolillo and his clients have positions in Netflix. The Motley Fool has positions in and recommends Netflix and Walt Disney. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.