Shares of IT consultant EPAM Systems (NYSE: EPAM) rallied 15.5% on Thursday, as of 3:41 p.m. ET.

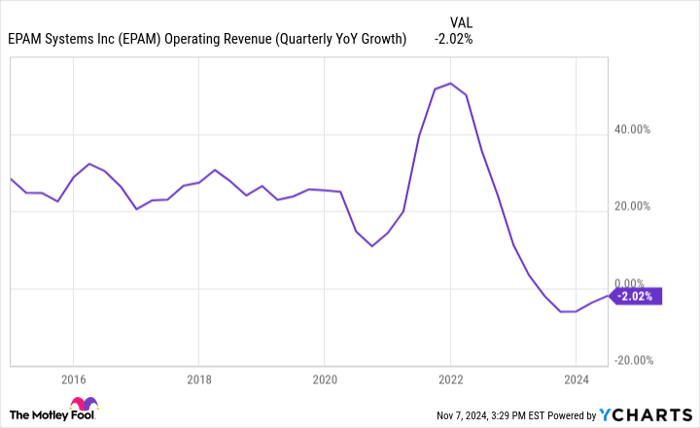

EPAM is a unique IT services firm, which prior to the Russian invasion of Ukraine had a lot of workers in Ukraine, Belarus, and Russia. Thus, the pivoting of the business away from Russia has been painful for the last two years, with EPAM's growth dipping into negative territory in 2023 and early 2024. However, this morning'searnings callseemed to show things may finally be turning the corner.

That gives EPAM a very interesting setup heading into 2025.

A stronger Q3 with a lift to full-year estimates

In the third quarter, EPAM's revenue grew 1.7% to $1.17 billion, with adjusted (non-GAAP) earnings per share of $3.12 growing 14.3% over the past year. Both figures beat analysts' expectations. Additionally, management raised its full-year revenue guidance to between $4.69 billion and $4.7 billion, up from prior guidance of $4.59 billion to $4.63 billion, while also raising its adjusted profit outlook for the year to a range between $10.73 and $10.81, up from a prior range between $10.20 to $10.40.

With a beat-and-raise quarter, it's no surprise to see the stock flying higher today.

EPAM is far down from highs, but is it cheap enough to buy?

While EPAM is soaring today and trades for 21.5 times its newly raised adjusted 2024 earnings estimates, the stock still remains 72% below 2021 all-time highs.

As you can see, prior to Russia's invasion of Ukraine, EPAM had been a 20%-plus grower, with growth surging to above 40% in the pandemic.

EPAM Operating Revenue (Quarterly YoY Growth) data by YCharts

While investors probably shouldn't expect a return to those growth rates, a lower interest rate environment and demand for artificial intelligence (AI) IT services could lead to a stronger 2025. Furthermore, EPAM is even a bit cheaper than its P/E ratio may indicate, as the company also holds just over $2 billion in cash, or over 15% of its market cap.

Thus, EPAM is certainly a name to have on your radar for 2025 turnaround stories.

Should you invest $1,000 in EPAM Systems right now?

Before you buy stock in EPAM Systems, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and EPAM Systems wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $892,313!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of November 4, 2024

Billy Duberstein and/or his clients have no position in any of the stocks mentioned. The Motley Fool has positions in and recommends EPAM Systems. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.