What happened

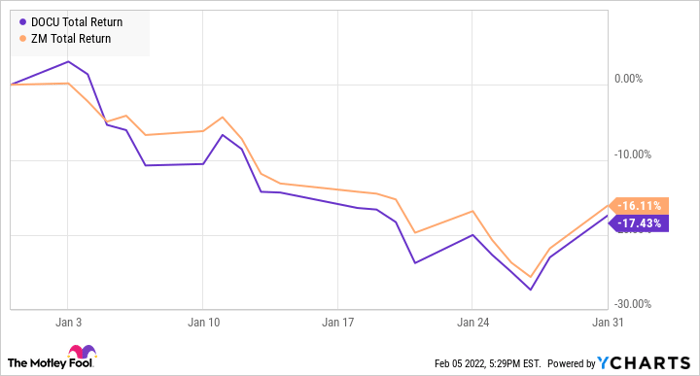

DocuSign (NASDAQ: DOCU) fell 17.4% in January, according to data from S&P Global Market Intelligence. There was no major news about the company, but shares took a beating as investors continued to pull capital away from growth stocks and work-from-home pandemic stocks. High valuation, rising interest rates, and improved management of omicron variant outbreaks all played a major role. The forces behind DocuSign's moves become much clearer when its stock chart is compared to that of Zoom Video Communications (NASDAQ: ZM).

DOCU Total Return Level data by YCharts

So what

DocuSign is struggling with the combination of brutal market forces and unimpressed investors. The company's December earnings report underwhelmed investors. Despite the company topping estimates for the third quarter, DocuSign's outlook was considered disappointing. Just as we saw with other work-from-home stocks, investor expectations rose to unsustainable levels during the early stages of the pandemic. The stocks are taking a beating as things become more rational.

Image source: Getty Images.

The prospects of Fed tapering and rate hikes are also bad news for growth stocks. Investor risk appetite is falling, making it harder to maintain exceptionally high valuation ratios. As capital flows toward value stocks, some high-flyers of the past two years are suffering.

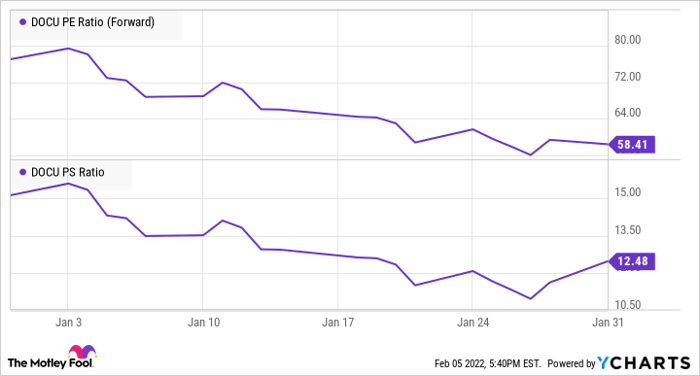

DocuSign is a great example of this trend in action. Its forward P/E ratio fell from 80 to 58, and its price-to-sales ratio dropped from nearly 16 to 12.5.

DOCU PE Ratio (Forward) & Price-to-Sales Ratio data by YCharts

These are the potential buying opportunities that investors search for, but it's important to confirm that DocuSign can turn it around based on long-term fundamentals.

Now what

DocuSign doesnt reportearnings again until March, so the next month will be dictated by the market for growth stocks and pandemic stocks. Its current price-to-sales ratio looks reasonable below 12. A forward P/E close to 50 might seem a bit rich during Fed tapering, but its 42% growth rate places its PEG ratio at a reasonable 1.2. Even if it slows to the 25% growth rate being forecast by analysts for next year, the current price is fair.

It's likely that DocuSign will dip further as the market reacts to ongoing interest rate hikes. For long-term investors who are excited about the company's growth catalysts, a temporary dip shouldn't be enough to scare you off.

10 stocks we like better than DocuSign

When our award-winning analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

They just revealed what they believe are the ten best stocks for investors to buy right now... and DocuSign wasn't one of them! That's right -- they think these 10 stocks are even better buys.

*Stock Advisor returns as of January 10, 2022

Ryan Downie has no position in any of the stocks mentioned. The Motley Fool owns and recommends DocuSign and Zoom Video Communications. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.