As Q4 GDP Expectations Soar, Can the Momentum Continue?

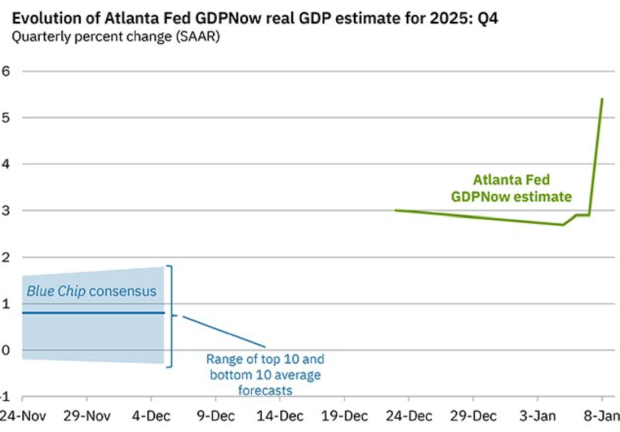

The “GDPNow” forecast is a real-time, data-based “nowcast” of the current U.S. real Gross Domestic Product (GDP) growth rate, generated by the Federal Reserve Bank of Atlanta. GDPNow leverages the freshest monthly economic data, such as retail sales, housing starts, and trade balances, to imitate the official calculation method of the U.S. Bureau of Economic Analysis (BEA). The Atlanta Fed’s GDPNow is among the most widely followed GDP forecasts due to its accuracy. The Atlanta Fed’s latest GDP forecast now projects a massive 5.4% Q4 GDP expansion, largely due to a narrowing trade deficit.

Image Source: Zacks Investment Research

Meanwhile, in a recent appearance on the “All-In” podcast, U.S. Commerce Secretary Howard Lutnick said that he believes that the U.S. can achieve 5-6% GDP growth in 2026. GDP of such an elevated magnitude would be unheard of for an open economy that is the size of the United States, but is it possible?

A Dovish Fed Chair Will Replace Jerome Powell

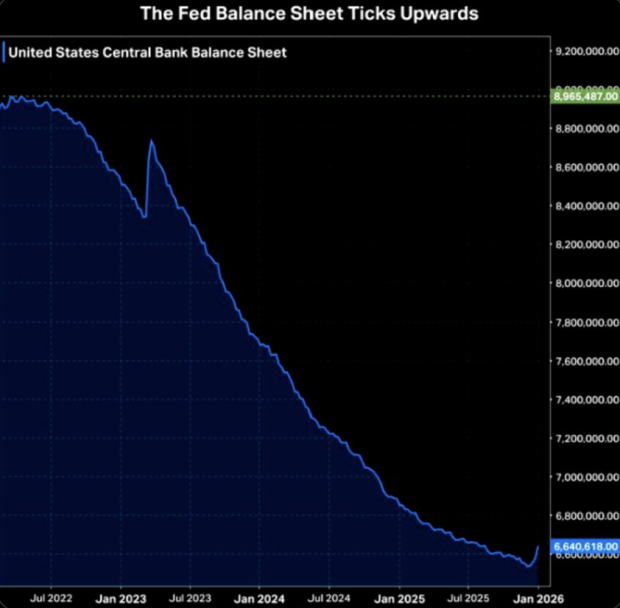

By now, it’s no secret that the Trump Administration wants to see much lower interest rates. With the inflation rate falling, the market is pricing in multiple interest rate cuts in 2026. Meanwhile, the current Fed Chair, Jerome Powell, who has been “hawkish” and slow to cut interest rates, will have his term end in May. According to Treasury Secretary Scott Bessent, President Trump has narrowed the field of Fed Chair candidates to four, and his pick will be announced at the end of this month. The candidates, who include Kevin Hassett, Kevin Warsh, Christopher Waller, and Rick Rieder, are all far more “dovish” than Jerome Powell. A “dovish” Fed Chair replacement means more liquidity, and a hotter economy is likely in 2026. Finally, the Fed’s balance sheet ticked up for the first time in two years, suggesting expansionary monetary policy.

Image Source: Zacks Investment Research

Government Reopening will Have a Positive Impact on GDP

In Q4, the longest government shutdown in history occurred (43 days). According to Howard Lutnick, GDP was likely 1.5% lower than it would have been had the government remained open. In other words, the economy is already stronger than the Q4 GDP number will suggest.

The AI Bull Market & Building Boom Continues

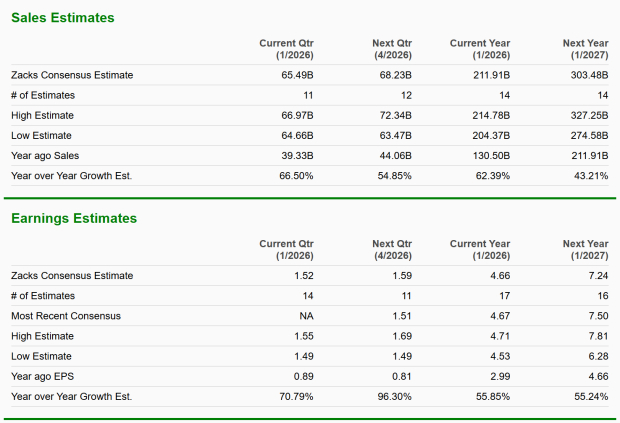

Nvidia (NVDA) is the most critical AI stock and the best gauge of the strength of the AI buildout. Recently, Nvidia CEO Jensen Huang confirmed that his company has strong revenue visibility through 2026. Zacks Consensus Analyst Estimates agree with Huang and forecast robust double-digit top-and-bottom-line growth through next year.

Image Source: Zacks Investment Research

Additionally, “pick and shovel” AI energy plays such as Bloom Energy (BE) and Oklo (OKLO) will benefit, leading to a snowballing effect.

$1.5 Trillion Defense Budget Will Drive the Economy

Amid a shifting and uncertain geopolitical environment, President Donald Trump is calling for a ~40% increase in the U.S. Defense budget to a mind-boggling $1.5 trillion. Defense and drone stocks like Lockheed Martin (LMT) and Red Cat Holdings (RCAT) will benefit.

Deregulation, Tariff Dividend, & Largest Tax Return in History

The Trump Administration will seek to drive economic growth in 2026 by sunsetting cumbersome regulations. Meanwhile, President Trump has suggested that a portion of the billions in tariff revenue may be paid out to Americans through a special tariff dividend. Finally, the 2026 tax season is expected to provide the largest tax refund in U.S. history, providing yet another stimulus to the already hot U.S. economy.

Bottom Line

While a 5-6% GDP growth rate for an economy as massive as the United States was once considered unthinkable, the alignment of historical stimulus and a shift in monetary policy suggests the ceiling is moving higher.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the favorite stock to gain +100% or more in the months ahead. They include

Stock #1: A Disruptive Force with Notable Growth and Resilience

Stock #2: Bullish Signs Signaling to Buy the Dip

Stock #3: One of the Most Compelling Investments in the Market

Stock #4: Leader In a Red-Hot Industry Poised for Growth

Stock #5: Modern Omni-Channel Platform Coiled to Spring

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor. While not all picks can be winners, previous recommendations have soared +171%, +209% and +232%.

Download Atomic Opportunity: Nuclear Energy's Comeback free today.Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Bloom Energy Corporation (BE) : Free Stock Analysis Report

Red Cat Holdings, Inc. (RCAT) : Free Stock Analysis Report

Oklo Inc. (OKLO) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.