IonQ (NYSE: IONQ) is one of the hottest stocks on Wall Street right now. Shares of the company soared by nearly 400% in the last three months of 2024.

But is IonQ a stock that investors can buy and hold for the long term? Let's find out.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Image source: Getty Images.

Understanding IonQ's business

IonQ designs quantum computers, which operate on a different set of principles than a traditional computer. The details of what makes quantum computers different can be confusing -- while traditional computers operate on bits, which can only exist as a value of 0 or 1, quantum computers operate on qubits, which can be anywhere in between those two possible states. That allows quantum computers to operate much faster than traditional computers, and they can perform calculations that are too time-consuming or complex for conventional computers.

Indeed, the leap from traditional computing to quantum computing could be analogous to the evolution from steam power to rocket engines. It could usher in a new level of computation that can solve problems that seem impossible today.

The practical applications are seemingly endless: enormous advancements in drug development, medical breakthroughs, vastly improved weather and climate models, engineering advancements, and perhaps even artificial general intelligence (AGI).

So, as a leader in quantum computing, it's no wonder that IonQ is attracting so much attention.

Where will IonQ be in 5 years?

So much of the excitement surrounding IonQ is due to the overall potential of quantum computing. However, that potential is a double-edged sword.

If it continues to make significant advancements in the technology, the company is well positioned to benefit over the next five years. On the other hand, if those technological advancements fail to materialize, or if a competitor beats IonQ to them, it's possible that it could lose support among investors.

That's because it remains a young company that lacks a steady stream of profits and the positive free cash flow that supports a mature business.

As of its most recent quarter (ending on Sept. 30), IonQ reported revenue of $12.4 million. That may seem like a decent amount of money, but let's put it in context. Meta Platforms made $40.6 billion in revenue in its most recent quarter. That works out to $450 million per day, or $19 million per hour.

In other words, IonQ's potential may be big, but its actual footprint today remains tiny when compared to the true corporate titans.

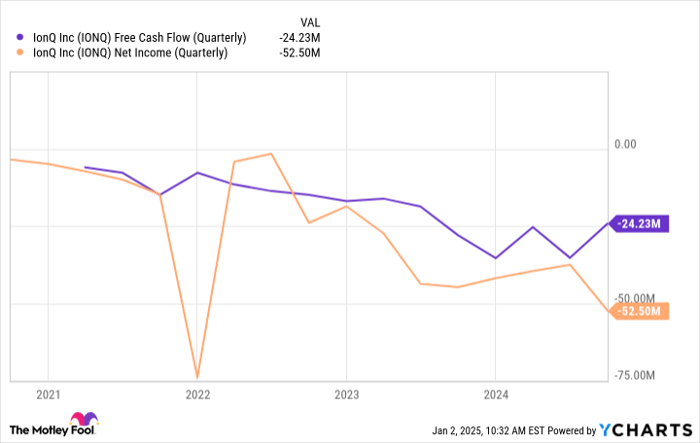

Case in point: IonQ remains unprofitable and is yet to record a quarter with positive free cash flow.

IONQ free cash flow (quarterly); data by YCharts.

Granted, these conditions aren't unusual for a young company that is working on a new and innovative technology. However, investors should be aware of the risks.

For investors willing to stay the course for many years to come, IonQ has ample cash on its balance sheet at $365 million. That means it can fund operations for several years, given its most recent cash burn rate of roughly $100 million per year. After that, the company will need to do one or more of the following:

- Generate cash from its operations,

- Raise additional funding via the debt markets, or

- Raise funds through a secondary stock offering.

IonQ is a viable business that generates a modest amount of revenue. However, the company isn't profitable right now, and it doesn't generate positive free cash flow. That puts it stock out of bounds for value investors and even some growth investors.

In short, this is an exciting company in a promising field. Where the stock will end up five years from now really depends on what breakthroughs (if any) occur in quantum computing. Therefore, you should exercise caution with IonQ stock.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $348,216!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $47,425!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $480,681!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of December 30, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's board of directors. Jake Lerch has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Meta Platforms. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.