Fintel reports that on December 19, 2024, Wells Fargo upgraded their outlook for C4 Therapeutics (NasdaqGS:CCCC) from Equal-Weight to Overweight.

Analyst Price Forecast Suggests 287.97% Upside

As of December 3, 2024, the average one-year price target for C4 Therapeutics is $14.92/share. The forecasts range from a low of $4.04 to a high of $40.95. The average price target represents an increase of 287.97% from its latest reported closing price of $3.84 / share.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for C4 Therapeutics is 29MM, a decrease of 12.72%. The projected annual non-GAAP EPS is -3.44.

What is the Fund Sentiment?

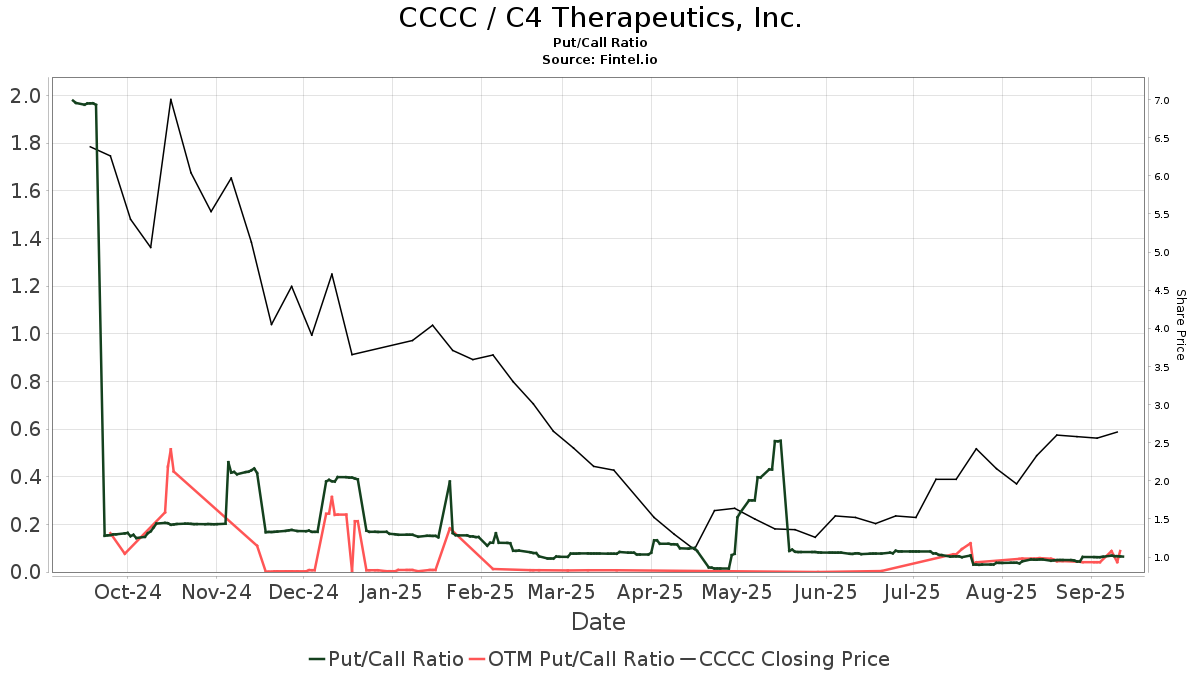

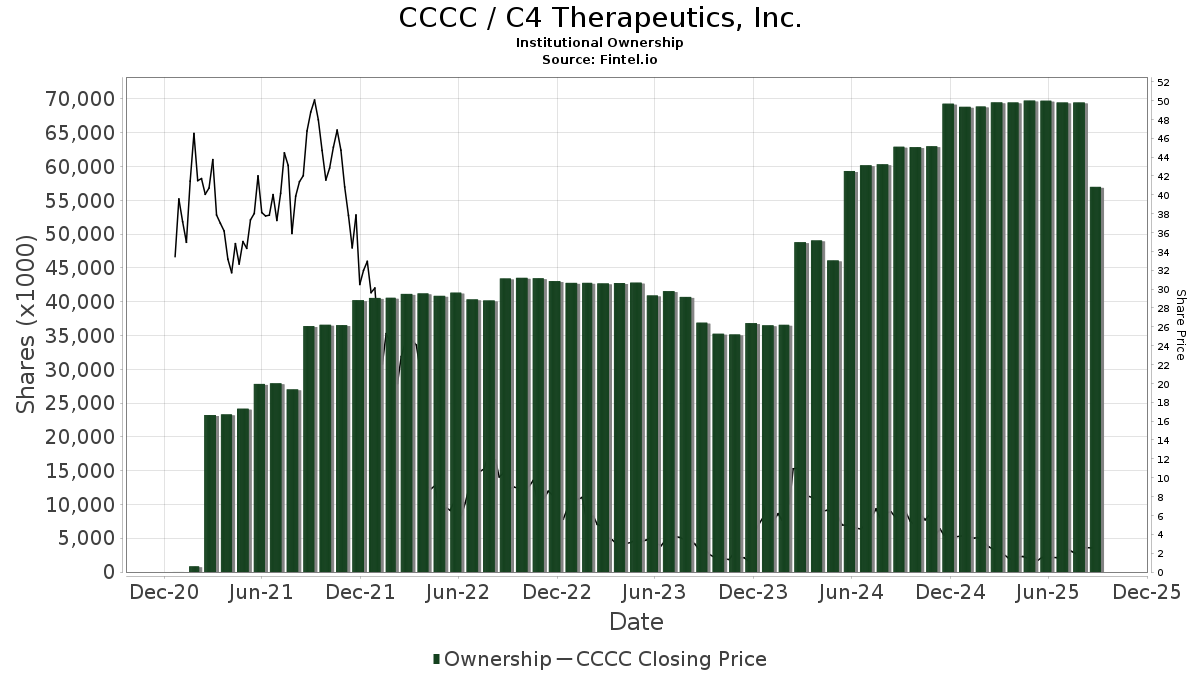

There are 253 funds or institutions reporting positions in C4 Therapeutics. This is an increase of 66 owner(s) or 35.29% in the last quarter. Average portfolio weight of all funds dedicated to CCCC is 0.12%, an increase of 9.84%. Total shares owned by institutions increased in the last three months by 9.96% to 69,197K shares.  The put/call ratio of CCCC is 0.40, indicating a bullish outlook.

The put/call ratio of CCCC is 0.40, indicating a bullish outlook.

What are Other Shareholders Doing?

Lynx1 Capital Management holds 6,881K shares representing 9.75% ownership of the company. No change in the last quarter.

Soleus Capital Management holds 6,604K shares representing 9.36% ownership of the company. In its prior filing, the firm reported owning 4,052K shares , representing an increase of 38.64%. The firm increased its portfolio allocation in CCCC by 76.56% over the last quarter.

Wasatch Advisors holds 5,677K shares representing 8.04% ownership of the company. In its prior filing, the firm reported owning 4,847K shares , representing an increase of 14.62%. The firm increased its portfolio allocation in CCCC by 32.42% over the last quarter.

Ra Capital Management holds 4,878K shares representing 6.91% ownership of the company. No change in the last quarter.

Orbimed Advisors holds 4,378K shares representing 6.20% ownership of the company. In its prior filing, the firm reported owning 1,513K shares , representing an increase of 65.44%. The firm increased its portfolio allocation in CCCC by 228.50% over the last quarter.

C4 Therapeutics Background Information

(This description is provided by the company.)

C4 Therapeutics is a biopharmaceutical company focused on harnessing the body’s natural regulation of protein levels to develop novel therapeutic candidates to target and destroy disease-causing proteins for the treatment of cancer and other diseases. This targeted protein degradation approach offers advantages over traditional therapies, including the potential to treat a wider range of diseases, reduce drug resistance, achieve higher potency, and decrease side effects through greater selectivity.

Fintel is one of the most comprehensive investing research platforms available to individual investors, traders, financial advisors, and small hedge funds.

Our data covers the world, and includes fundamentals, analyst reports, ownership data and fund sentiment, options sentiment, insider trading, options flow, unusual options trades, and much more. Additionally, our exclusive stock picks are powered by advanced, backtested quantitative models for improved profits.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.