We Need a Constant Focus on Bringing IPOs to Market

U.S. public companies have created as much as $24 trillion in wealth for American households over the past 30 years.

Public equity markets offer many unique benefits to retail investors. Prices are transparent, trades are inexpensive to execute, and the prices available to retail investors are comparable to the most sophisticated investors. Most importantly, public equity markets are accessible to all investors.

That makes it even more important for equity markets to be attractive to companies too, so all U.S. households can benefit from the growth of companies and their products.

But recent headlines have generated talk about the shrinkage of U.S. listings. Here we dig into the data to understand why that’s happening.

It’s not a lack of entrepreneurs

Many point to the heady days of the 1990’s when the U.S. market saw around 400 IPOs per year and U.S.-listed companies peaked at over 7,000. The data from decades before and after that seem to confirm that the 90’s really weren’t “normal.” Consequently, our analysis here starts at 2004.

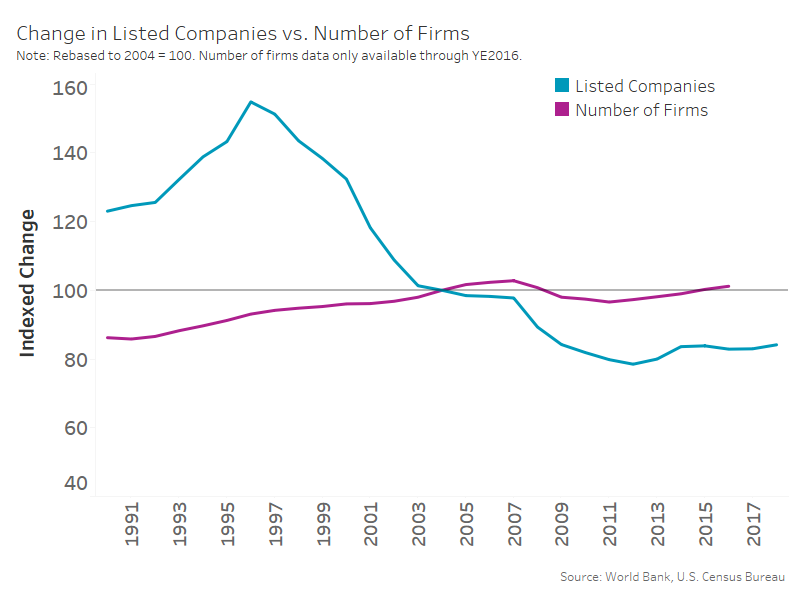

According to U.S. Census Bureau data, since 2004 the count of registered U.S. firms has actually grown about 1% to roughly 5.95 million. Over the same time, the count of listed (public) companies has fallen about 16%.

That would seem to indicate that the problem isn’t a lack of entrepreneurs and small business start-ups in the U.S.A.

Chart 1: Count of listed companies has fallen about 16% since 2004

M&A takes its toll

Looking at our own data, since 2004 Nasdaq net listings have fallen about 17%. That’s despite us adding nearly 2,000 IPOs, equating to about 60% of all IPOs over this 15-year period.

One of the big reasons is that nearly 2,300 of our listings were acquired through merger activity during the period. That doesn’t always reduce the opportunities for investors. In stock deals, participants remain invested in the market and total market cap may not fall at all.

Listing exchanges also spend a lot of time maintaining regulatory functions and standards. A core regulatory function of exchanges is to monitor listed companies for compliance with listing standards to ensure investor protection and public confidence in the market. A statistic that may be surprising to some is that regulatory de-listings accounted for about 23% of the total reduction of our listings over that period.

Chart 2: Since 2004, IPOs on Nasdaq have been outpaced by regulatory de-listings and companies lost through mergers

How fast do we need to run to stand still?

Based on our estimates, the U.S. market needs to bring at least 178 IPOs to market per year just to maintain the level of listed companies year-over-year.

Chart 3: U.S. IPOs since 2008, by listing venue

The good news is that in recent years the IPO market has been quite healthy. In fact, in the years since the JOBS Act passed, from 2013 to today, we estimate the market has seen around 220 new IPOs listed per year.

Even though the IPO market is healthy, it’s still only just keeping pace with the companies leaving the market. Growing listings, and bringing private companies to market, need to remain in focus.