Fintel reports that Wax Asset Management has filed a 13G/A form with the SEC disclosing ownership of 0.67MM shares of Core Molding Technologies, Inc. (CMT). This represents 7.5% of the company.

In their previous filing dated January 31, 2022 they reported 0.47MM shares and 5.40% of the company, an increase in shares of 43.55% and an increase in total ownership of 2.10% (calculated as current - previous percent ownership).

Analyst Price Forecast Suggests 4.41% Upside

As of February 6, 2023, the average one-year price target for Core Molding Technologies is $16.32. The forecasts range from a low of $16.16 to a high of $16.80. The average price target represents an increase of 4.41% from its latest reported closing price of $15.63.

The projected annual revenue for Core Molding Technologies is $377MM, an increase of 3.68%. The projected annual EPS is $1.36, an increase of 47.19%.

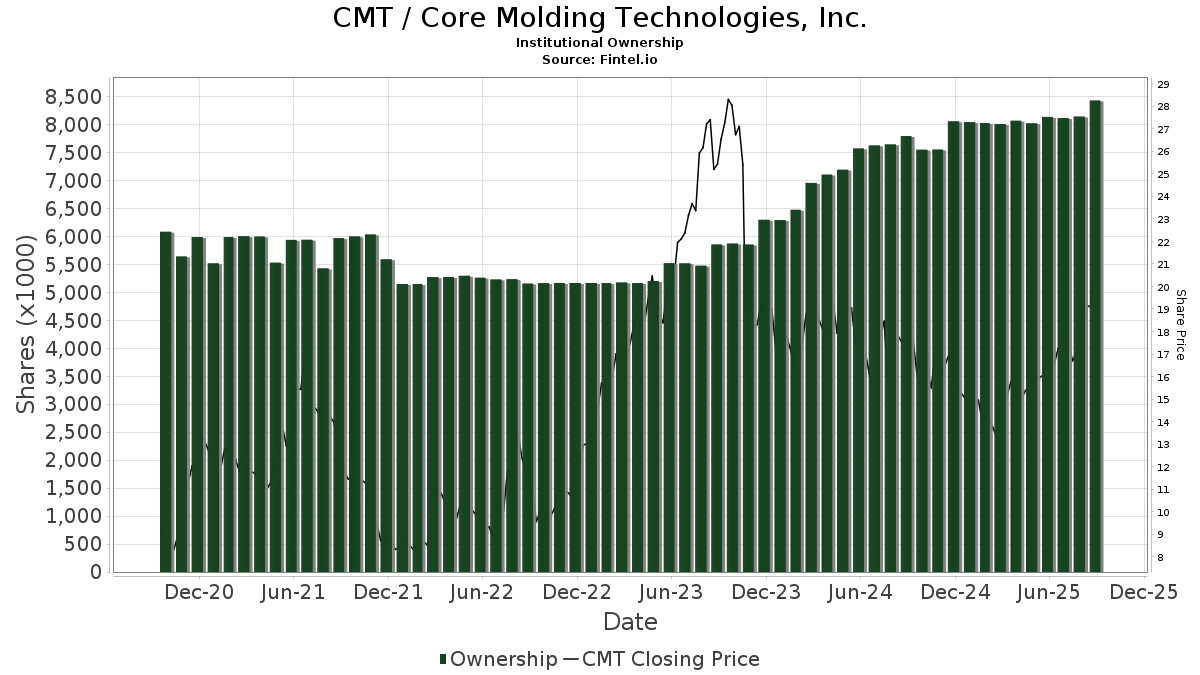

Fund Sentiment

There are 81 funds or institutions reporting positions in Core Molding Technologies. This is a decrease of 0 owner(s) or 0.00%.

Average portfolio weight of all funds dedicated to US:CMT is 0.0709%, an increase of 13.6343%. Total shares owned by institutions decreased in the last three months by 0.86% to 5,122K shares.

What are large shareholders doing?

Renaissance Technologies holds 490,164 shares representing 5.83% ownership of the company. In it's prior filing, the firm reported owning 519,364 shares, representing a decrease of 5.96%. The firm increased its portfolio allocation in CMT by 21.85% over the last quarter.

Gamco Investors, Inc. Et Al holds 467,191 shares representing 5.55% ownership of the company. In it's prior filing, the firm reported owning 470,191 shares, representing a decrease of 0.64%. The firm increased its portfolio allocation in CMT by 15.30% over the last quarter.

Heartland Advisors holds 405,000 shares representing 4.81% ownership of the company. No change in the last quarter.

HRTVX - HEARTLAND VALUE FUND Investor Class holds 405,000 shares representing 4.81% ownership of the company. No change in the last quarter.

EQ ADVISORS TRUST - 1290 VT GAMCO Small Company Value Portfolio Class IA holds 344,000 shares representing 4.09% ownership of the company. In it's prior filing, the firm reported owning 345,000 shares, representing a decrease of 0.29%. The firm increased its portfolio allocation in CMT by 13.94% over the last quarter.

Core Molding Technologies Declares $0.05 Dividend

Core Molding Technologies said on May 9, 2018 that its board of directors declared a regular quarterly dividend of $0.05 per share ($0.20 annualized). Shareholders of record as of May 21, 2018 received the payment on May 31, 2018. Previously, the company paid $0.05 per share.

At the current share price of $15.63 / share, the stock's dividend yield is 1.28%. Looking back five years and taking a sample every week, the average dividend yield has been 1.14%, the lowest has been 1.00%, and the highest has been 1.29%. The standard deviation of yields is 0.08 (n=12).

The current dividend yield is 1.67 standard deviations above the historical average.

Core Molding Technologies Background Information

(This description is provided by the company.)

Core Molding Technologies and its subsidiaries operate in the composites market as one operating segment as a molder of thermoplastic and thermoset structural products. The Company's operating segment consists of two component reporting units, Core Traditional and Horizon Plastics. The Company offers customers a wide range of manufacturing processes to fit various program volume and investment requirements. These processes include compression molding of sheet molding compound ('SMC'), bulk molding compounds ('BMC'), resin transfer molding ('RTM'), liquid molding of dicyclopentadiene ('DCPD'), spray-up and hand-lay-up, glass mat thermoplastics ('GMT'), direct long-fiber thermoplastics ('D-LFT') and structural foam and structural web injection molding ('SIM'). Core Molding Technologies serves a wide variety of markets, including the medium and heavy-duty truck, marine, automotive, agriculture, construction, and other commercial products. The demand for Core Molding Technologies' products is affected by economic conditions in the United States, Mexico, and Canada. Core Molding Technologies' manufacturing operations have a significant fixed cost component. Accordingly, during periods of changing demand, the profitability of Core Molding Technologies' operations may change proportionately more than revenues from operations.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.