After delivering steady top-line momentum in the third quarter, Walmart Inc. WMT raised its fiscal 2026 net sales guidance to the range of 4.8-5.1% at constant currency (or cc). This marked an increase from the prior range of 3.75-4.75%.

The lift followed a third quarter, wherein total revenues advanced 5.8% (up 6% at cc), courtesy of consistent strength in e-commerce, positive transaction counts and share gains across major categories. WMT’s upgraded sales guidance indicates that management sees enough stability in these trends to carry through the remainder of the year.

The key question now depends on the company’s performance in the fourth quarter. Walmart envisions fourth-quarter sales growth in the range of 3.75-4.75% at cc. This range sets the performance level required to meet the raised fiscal 2026 sales guidance. However, Walmart also acknowledged factors that will shape fourth-quarter comparisons.

The timing shift of Flipkart’s Big Billion Days event into the third quarter is expected to affect the year-over-year pattern. The International segment also continues to navigate price investments in Mexico, which may influence quarterly dynamics.

Nonetheless, Walmart enters the quarter with healthy inventory levels and continued traction in areas like store-fulfilled delivery and advertising. By raising the full-year sales view, management has defined a higher bar. The question is whether fourth-quarter execution can meet the expectations that the company has now set for itself.

What Target and Kroger Expect Out of Sales

Target TGT reported third-quarter fiscal 2025 net sales of $25.3 billion, marking a decline of 1.5% from last year. TGT also posted a 2.7% drop in comparable sales, though digital comparable sales edged up 2.4%. Target expects a low single-digit decline in fourth-quarter sales, keeping near-term expectations muted as the company works through softer store traffic and uneven category trends.

Kroger KR reported second-quarter fiscal 2025 sales of $33.94 billion (nearly flat year over year), while its identical sales without fuel grew 3.4%. KR expects identical sales without fuel growth of 2.7-3.4%, up from the prior estimate of 2.25-3.25%. Kroger’s stronger guidance reflects steadier food-at-home demand and improving trends across key departments.

WMT’s Stock Price Performance, Valuation & Estimates

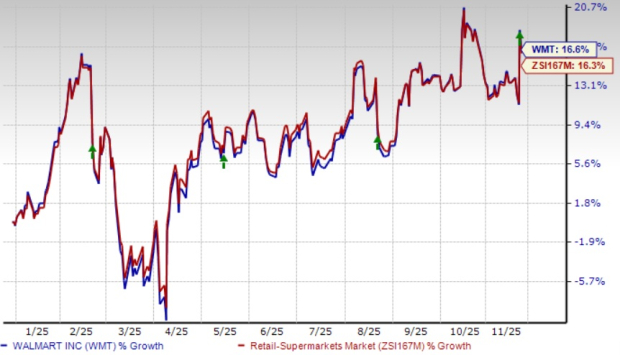

Shares of Walmart have risen 16.6% year to date compared with the industry’s growth of 16.3%.

WMT Price Performance Versus Industry

Image Source: Zacks Investment Research

From a valuation standpoint, WMT trades at a forward price-to-earnings ratio of 36.74, higher than the industry’s average of 33.52.

WMT’s Valuation Compared to Industry

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for WMT’s fiscal 2026 and 2027 earnings implies year-over-year growth of 4.4% and 11.5%, respectively.

Walmart currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the favorite stock to gain +100% or more in the months ahead. They include

Stock #1: A Disruptive Force with Notable Growth and Resilience

Stock #2: Bullish Signs Signaling to Buy the Dip

Stock #3: One of the Most Compelling Investments in the Market

Stock #4: Leader In a Red-Hot Industry Poised for Growth

Stock #5: Modern Omni-Channel Platform Coiled to Spring

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor. While not all picks can be winners, previous recommendations have soared +171%, +209% and +232%.

Download Atomic Opportunity: Nuclear Energy's Comeback free today.Target Corporation (TGT) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

The Kroger Co. (KR) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.