Walmart Inc.’s WMT International unit stood out as the company’s strongest engine of growth in the third quarter of fiscal 2026, offering a clear window into how its global momentum is taking shape as the next year approaches.

Net sales in the Walmart International segment witnessed 11.4% growth in constant currency to $33.7 billion, supported by broad-based strength across Flipkart, China and Walmex. Adjusted operating income also moved higher by 16.9%, reaching $1.4 billion, reflecting better e-commerce economics and a healthier business mix. Segment e-commerce sales advanced 26% in the quarter, driven by marketplace activities, and store-fulfilled pickup and delivery services, with a higher proportion of digital sales across markets.

The growth was backed by a combination of improvements that came together at the right time. Flipkart benefited from the Big Billion Days event shifting into the quarter, which helped push e-commerce volume sharply higher. That momentum also flowed into advertising, where Flipkart led a substantial lift in international ad revenues.

China added its solid contribution, with sales climbing to $6.1 billion, up 21.8% in constant currency. Digital penetration in China reached roughly half of sales, supported by extremely fast fulfillment speeds that aim to deliver most orders within about an hour.

Taken together, WMT’s third-quarter results show its International segment benefiting from scalable digital growth, rising advertising contributions and improving fulfillment productivity. Whether these same levers can deliver similar lift through fiscal 2026 will depend on timing, mix and one-off items that shaped this quarter’s performance.

What the Latest Metrics Say About Walmart

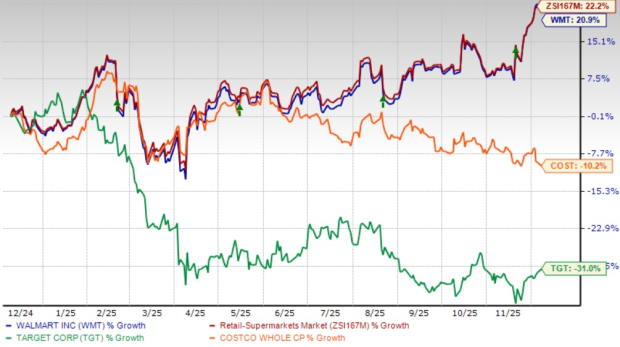

Walmart, which competes with Costco Wholesale Corporation COST and Target Corporation TGT, has seen its shares rally 20.9% in the past year compared with the industry’s growth of 22.2%. Shares of Costco have declined 10.2%, while Target tumbled 31% in the aforementioned period.

Image Source: Zacks Investment Research

From a valuation standpoint, Walmart's forward 12-month price-to-earnings ratio stands at 39.83, higher than the industry’s 36.1. WMT carries a Value Score of C. Walmart is trading at a premium to Target (with a forward 12-month P/E ratio of 12.03) but at a discount to Costco (43.71).

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for Walmart’s current financial-year sales and earnings per share implies year-over-year growth of 4.5% and 4.8%, respectively.

Walmart currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Radical New Technology Could Hand Investors Huge Gains

Quantum Computing is the next technological revolution, and it could be even more advanced than AI.

While some believed the technology was years away, it is already present and moving fast. Large hyperscalers, such as Microsoft, Google, Amazon, Oracle, and even Meta and Tesla, are scrambling to integrate quantum computing into their infrastructure.

Senior Stock Strategist Kevin Cook reveals 7 carefully selected stocks poised to dominate the quantum computing landscape in his report, Beyond AI: The Quantum Leap in Computing Power.

Kevin was among the early experts who recognized NVIDIA's enormous potential back in 2016. Now, he has keyed in on what could be "the next big thing" in quantum computing supremacy. Today, you have a rare chance to position your portfolio at the forefront of this opportunity.

See Top Quantum Stocks Now >>Target Corporation (TGT) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

Costco Wholesale Corporation (COST) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.