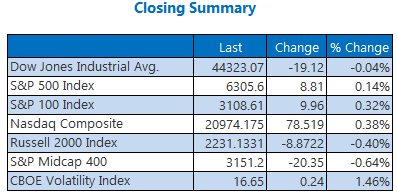

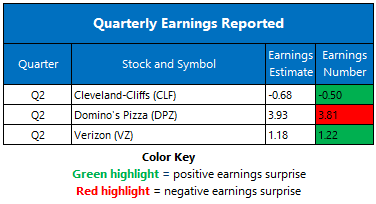

Stocks started the new week off with some late-session volatility. The Dow dropped 19 points, giving back a triple-digit gain and brushing off a post-earnings pop from telecom concern Verizon Communications (VZ). The S&P 500 and Nasdaq each nabbed record closes, the latter also notching its sixth-straight daily gain as the former nabbed its own 10th record settlement. Despite earnings optimism overshadowing persistent tariff tensions, the Cboe Volatility Index (VIX) snapped a three-day losing streak.

Continue reading for more on today's market, including:

- Chip stock has momentum heading into earnings.

- Block stock gets the SPX inclusion bump.

- Plus, PINS upgraded; retail stock whips around; and general market musings.

5 Things to Know Today

- China's rare earth magnets export numbers for June were ramped up. (Reuters)

- Design software company Figma's initial public offering (IPO) could be huge. (CNBC)

- Another analyst bullish on Pinterest stock.

- 3 retail stocks to keep on your radar going forward.

- Why price action is so important for the SPX right now.

Gold at 5-Week Highs as U.S. Dollar Deflates

Oil prices were muted today, a victim of a day without any major headlines. August-dated West Texas Intermediate (WTI) crude lost 14 cents, or 0.2%, to settle at $67.20 per barrel.

Gold prices moved to five-week highs as the U.S. dollar and bond yields cooled off. August-dated gold futures added 1.4% to settle at $3,406.40.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.