Visa Inc. V, long known as a global card network, is increasingly positioning itself as more than just a transaction processor. With its value-added services (VAS), the company is on a mission to elevate the payment experience for both businesses and consumers. These services include real-time fraud monitoring, AI-powered analytics, digital checkout solutions and tools for small and medium businesses to manage payments more efficiently.

The ability of V’s VAS to streamline complex payments while enhancing security is its real potential. Merchants can tap into cutting-edge fraud prevention tools advanced from traditional card verification, while customers benefit from smoother, quicker checkout experiences. Additionally, the company is exploring new ways to generate revenues, shifting its focus from merely facilitating payments to offering tech solutions that enhance value.

Visa’s value-added services reported strong 26% year-over-year growth in constant dollars in the third quarter of fiscal 2025, fueled by its key portfolios like advisory and other services, issuing solutions and acceptance solutions. This momentum was supported by innovations in AI-driven risk models, tokenization, consulting partnerships, and cutting-edge risk and security solutions that enabled large-scale fraud prevention and enhanced client trust.

Additionally, the renewal of key partnerships alongside new client wins underscores Visa’s ability to both retain long-term relationships and attract fresh partnerships across regions and sectors. VAS has become an essential part of the company’s growth, fostering deeper client relationships rather than being merely an extra feature. In the third quarter of fiscal 2025, the company’s payment volume rose 8% year over year.

How Are Competitors Faring?

Some of V’s competitors in the value-added services include Mastercard Incorporated MA and American Express Company AXP.

Mastercard is one of the closest competitors of Visa in providing value-added services. Mastercard’s VAS enhances payment experience with features like AI-driven fraud detection, digital wallets and tokenization. These innovative solutions boost security, streamline transactions and build strong client relationships.

American Express offers a range of valuable services, including real-time fraud monitoring, secure digital payment options, merchant analytics and loyalty support. These efforts not only enhance security and improve transactions but also help American Express build stronger connections with consumers and businesses around the globe.

Visa’s Price Performance, Valuation & Estimates

Shares of Visa have jumped 8.1% in the year-to-date period compared with the 2.3% rise of the industry.

Image Source: Zacks Investment Research

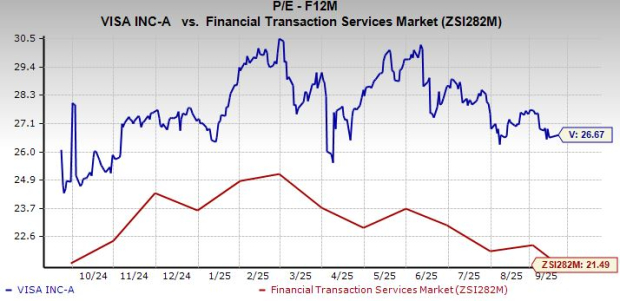

From a valuation standpoint, V trades at a forward price-to-earnings ratio of 26.67, above the industry average of 21.49. V carries a Value Score of D.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for Visa’s fiscal 2025 earnings implies a 13.7% jump from the year-ago period.

Image Source: Zacks Investment Research

Visa stock currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Free Report: 3 Software Stocks Poised to Skyrocket

Software stocks are poised to catapult higher in the coming months (and years) thanks to several factors, especially the explosive growth of AI. Zacks' urgent report reveals 3 top software stocks to own right now.

Access the report free today >>Mastercard Incorporated (MA) : Free Stock Analysis Report

Visa Inc. (V) : Free Stock Analysis Report

American Express Company (AXP) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.