Visa Inc. V recently partnered with International Money Express, Inc. IMXI or Intermex to enhance the latter’s money transfer services. The partnership involves integrating Visa Direct into Intermex's platform. The move is expected to enable Intermex to provide improved service to its customers, like sending money to unserved areas.

Visa Direct is a service provided by Visa that acts as a single point of access to numerous endpoints. This facilitates the global movement of money by enabling swift delivery of funds to eligible cards, bank accounts and wallets on a worldwide scale. Visa continues to leverage its cutting-edge technologies to build partnerships and expand its market reach.

Thanks to this collaboration, customers of Intermex, a remittance services company, can now enjoy expedited transfers to eligible Visa cards and bank accounts in over 20 countries that were previously not served by Intermex. The move is expected to provide the company with a competitive advantage in the market and attract new customers while retaining existing ones.

This partnership is expected to broaden the range of choices and flexibility for consumers, particularly migrant workers in the United States sending money abroad. On Dec 15, 2023, Intermex launched the service.

The partnership is expected to help Visa with increased transaction volumes, expanding remittance services and boosting global presence and consumer base. In the last reported quarter, V’s processed transactions totaled 56 billion, which rose 10% year over year.

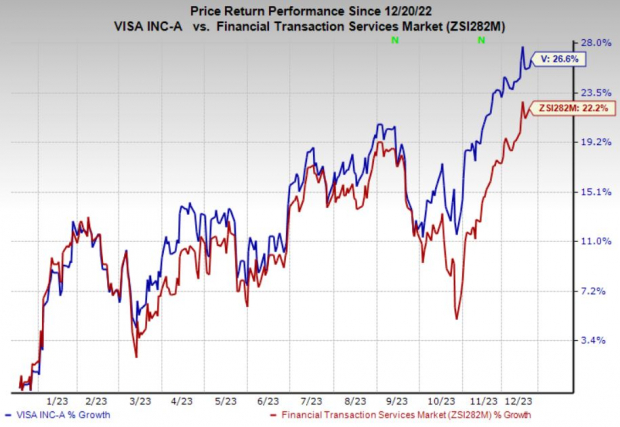

Price Performance

Shares of Visa have gained 26.6% in the past year compared with the industry’s 22.2% jump.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Visa currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader Business Services space are FirstCash Holdings, Inc. FCFS and Shift4 Payments, Inc. FOUR, each currently sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for FirstCash’s current year bottom line indicates 13.1% year-over-year growth. Headquartered in Fort Worth, TX, FCFS beat earnings estimates in all the past four quarters, with an average surprise of 7.9%.

The Zacks Consensus Estimate for Shift4 Payments’ current year earnings is pegged at $2.92 per share, which indicates 110.1% year-over-year growth. Allentown, PA-based FOUR beat earnings estimates in all the past four quarters, with an average surprise of 25%.

Zacks Naming Top 10 Stocks for 2024

Want to be tipped off early to our 10 top picks for the entirety of 2024?

History suggests their performance could be sensational.

From 2012 (when our Director of Research, Sheraz Mian assumed responsibility for the portfolio) through November, 2023, the Zacks Top 10 Stocks gained +974.1%, nearly TRIPLING the S&P 500’s +340.1%. Now Sheraz is combing through 4,400 companies to handpick the best 10 tickers to buy and hold in 2024. Don’t miss your chance to get in on these stocks when they’re released on January 2.

Be First to New Top 10 Stocks >>Visa Inc. (V) : Free Stock Analysis Report

FirstCash Holdings, Inc. (FCFS) : Free Stock Analysis Report

INTERNATIONAL MONEY EXPRESS, INC. (IMXI) : Free Stock Analysis Report

Shift4 Payments, Inc. (FOUR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.