Verona Pharma VRNA has signed a definitive agreement with pharma bigwig Merck MRK. Per the terms, the pharma giant will acquire all outstanding shares of VRNA for $107 per American depositary share (ADS), valuing the deal at around $10 billion.

Post this acquisition, Merck will add Ohtuvayre — Verona’s first marketed drug and the first inhaled therapy with a new mechanism of action for chronic obstructive pulmonary disease (COPD) in more than 20 years. The drug was approved by the FDA last year as a maintenance treatment for COPD in adult patients. Regulatory filings for this COPD drug are expected to be filed soon in Europe. Verona is also evaluating Ohtuvayre in separate clinical studies for other respiratory diseases, including bronchiectasis, cystic fibrosis (CF) and asthma.

The Financial Times ("FT") reported on the deal just hours before the official announcement.

The transaction, unanimously approved by the boards of both companies, is expected to be closed in the fourth quarter. Merck plans to capitalize most of the purchase price as an intangible asset related to Ohtuvayre, which will be amortized as a GAAP-only charge over the drug’s commercial life.

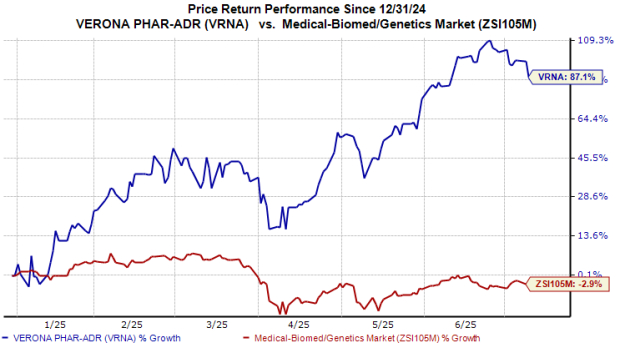

VRNA Share Price Performance

Following this news, shares of Verona jumped 20% in pre-market trading today. Year to date, the stock has surged 87% against the industry’s 3% decline.

Image Source: Zacks Investment Research

What’s Driving Merck’s Interest in Verona?

The motivation behind the deal is clear — Merck aims to diversify its current revenue base, which has become highly dependent on Keytruda. In 2024, MRK generated nearly 46% of its total revenues from the drug’s sales. With concerns over Keytruda’s potential loss of exclusivity (LOE) after 2028, Merck remains under pressure from investors to pursue deals for new drugs that could help reduce its dependence on a single product for growth.

Once closed, Verona Pharma would mark Merck’s largest acquisition since its $10.8 billion takeover of immunology-focused Prometheus Bioscience in 2023. The deal would also help it secure a strong foothold in the respiratory disease market.

In the past year, Merck has been tapping Chinese biotechs for licensing deals. Toward the end of 2024, the company struck multi-billion-dollar deals with Hansoh Pharma, LaNova Medicines and Hengrui Pharma. While the Hansoh deal added the investigational oral GLP-1 receptor agonist HS-10535 to Merck’s pipeline, the LaNova deal added the experimental bispecific VEGF/PD-1 antibody LM-299. With the Hengrui Pharma deal, Merck acquired rights to an investigational oral small-molecule lipoprotein(a) inhibitor, HRS-5346.

Recent M&A Transactions in the Pharma Space

While broader macroeconomic concerns — including Trump-era tariffs and leadership shifts at the FDA — have weighed on deal-making in 2025, Big Pharma continues to pursue strategic assets in key growth areas.

Last month, Sanofi SNY announced a $9.5 billion acquisition of Blueprint Medicines to strengthen its immunology pipeline and reduce reliance on the blockbuster drug Dupixent. Through this transaction, Sanofi intends to add Ayvakit — an inhibitor of KIT and PDGFRA proteins with growing commercial traction — and several early-stage pipeline assets focused on systemic mastocytosis. Sanofi expects to close this deal in the third quarter of 2025.

Eli Lilly LLY also recently announced its intent to acquire small biotech Verve Therapeutics for up to $1.3 billion. Post this acquisition, Lilly will add Verve’s pipeline of gene therapies targeting heart diseases. The FT also reported on this deal ahead of its official confirmation.

These transactions highlight Big Pharma's continued interest in small biotechs with promising and innovative assets.

Verona Pharma PLC American Depositary Share Price

Verona Pharma PLC American Depositary Share price | Verona Pharma PLC American Depositary Share Quote

VRNA’s Zacks Rank

Verona currently carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in the coming year. While not all picks can be winners, previous recommendations have soared +112%, +171%, +209% and +232%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>Sanofi (SNY) : Free Stock Analysis Report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

Eli Lilly and Company (LLY) : Free Stock Analysis Report

Verona Pharma PLC American Depositary Share (VRNA) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.