Fintel reports that Vanguard Group has filed a 13G/A form with the SEC disclosing ownership of 4.45MM shares of Pool Corporation (POOL). This represents 11.39% of the company.

In their previous filing dated February 10, 2022 they reported 4.41MM shares and 11.01% of the company, an increase in shares of 0.83% and an increase in total ownership of 0.38% (calculated as current - previous percent ownership).

Analyst Price Forecast Suggests 4.58% Downside

As of February 9, 2023, the average one-year price target for Pool is $367.51. The forecasts range from a low of $293.91 to a high of $441.00. The average price target represents a decrease of 4.58% from its latest reported closing price of $385.13.

The projected annual revenue for Pool is $6,236MM, an increase of 1.91%. The projected annual EPS is $17.63, a decrease of 10.33%.

What is the Fund Sentiment?

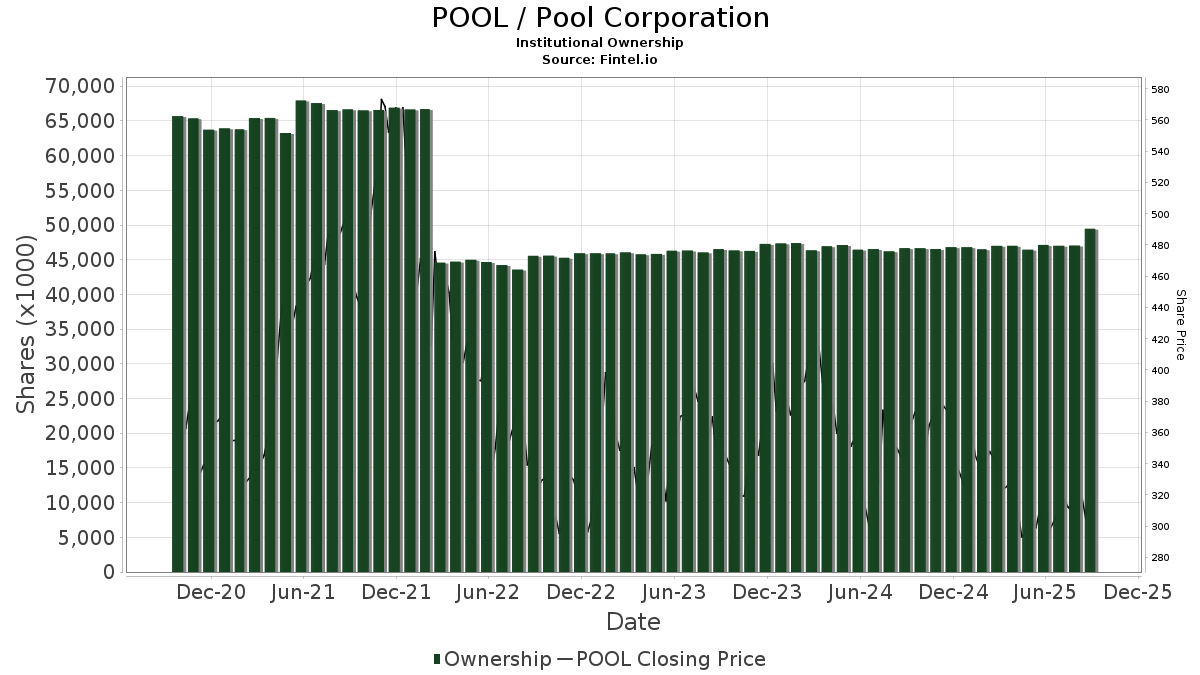

There are 1344 funds or institutions reporting positions in Pool. This is a decrease of 32 owner(s) or 2.33% in the last quarter. Average portfolio weight of all funds dedicated to POOL is 0.30%, a decrease of 3.05%. Total shares owned by institutions increased in the last three months by 1.52% to 45,741K shares. The put/call ratio of POOL is 3.75, indicating a bearish outlook.

What are large shareholders doing?

Select Equity Group holds 1,362K shares representing 3.49% ownership of the company. In it's prior filing, the firm reported owning 1,200K shares, representing an increase of 11.94%. The firm increased its portfolio allocation in POOL by 12.06% over the last quarter.

Kayne Anderson Rudnick Investment Management holds 1,321K shares representing 3.38% ownership of the company. In it's prior filing, the firm reported owning 1,330K shares, representing a decrease of 0.71%. The firm decreased its portfolio allocation in POOL by 5.48% over the last quarter.

Neuberger Berman Group holds 1,145K shares representing 2.93% ownership of the company. In it's prior filing, the firm reported owning 1,153K shares, representing a decrease of 0.75%. The firm decreased its portfolio allocation in POOL by 6.58% over the last quarter.

VTSMX - Vanguard Total Stock Market Index Fund Investor Shares holds 1,119K shares representing 2.87% ownership of the company. In it's prior filing, the firm reported owning 1,120K shares, representing a decrease of 0.08%. The firm decreased its portfolio allocation in POOL by 5.63% over the last quarter.

VFINX - Vanguard 500 Index Fund Investor Shares holds 898K shares representing 2.30% ownership of the company. In it's prior filing, the firm reported owning 887K shares, representing an increase of 1.15%. The firm decreased its portfolio allocation in POOL by 5.22% over the last quarter.

Pool Declares $1.00 Dividend

On October 27, 2022 the company declared a regular quarterly dividend of $1.00 per share ($4.00 annualized). Shareholders of record as of November 9, 2022 received the payment on November 23, 2022. Previously, the company paid $1.00 per share.

At the current share price of $385.13 / share, the stock's dividend yield is 1.04%. Looking back five years and taking a sample every week, the average dividend yield has been 0.95%, the lowest has been 0.54%, and the highest has been 1.37%. The standard deviation of yields is 0.23 (n=237).

The current dividend yield is 0.39 standard deviations above the historical average.

Additionally, the company's dividend payout ratio is 0.20. The payout ratio tells us how much of a company's income is paid out in dividends. A payout ratio of one (1.0) means 100% of the company's income is paid in a dividend. A payout ratio greater than one means the company is dipping into savings in order to maintain its dividend - not a healthy situation. Companies with few growth prospects are expected to pay out most of their income in dividends, which typically means a payout ratio between 0.5 and 1.0. Companies with good growth prospects are expected to retain some earnings in order to invest in those growth prospects, which translates to a payout ratio of zero to 0.5.

The company's 3-Year dividend growth rate is 0.82%, demonstrating that it has increased its dividend over time.

Pool Background Information

(This description is provided by the company.)

Pool Corporation is the world's largest wholesale distributor of swimming pool and related backyard products. POOLCORP operates approximately 375 sales centers in North America, Europe and Australia, through which it distributes more than 200,000 national brand and private label products to roughly 120,000 wholesale customers.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.