Key Points

Finding the needle in the haystack is tough. This "buy the haystack" strategy exposes investors to the tech sector's biggest winners.

Losers will be present too, but history shows that extreme winners overwhelm them over time.

- 10 stocks we like better than Vanguard Information Technology ETF ›

I wouldn't blame anyone for being confused by the tech sector's recent whipsaw movements. From shares of Microsoft cratering 10% on the same day that it reports a 60% jump in year-over-year profits, to shares of Apple falling despite the company beating analysts' expectations, the outlook for tech stocks feels especially murky today.

One solution, in the words of legendary investor John Bogle, would be to "buy the haystack" rather than trying to just find the needle. The Vanguard Group founder, whose teachings on the advantages of low-cost index funds created legions of fans, preached simplicity and diversification in capturing the market's long-term upside.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Getty Images.

It may seem counterintuitive, but casting a wide net and having exposure to hundreds of companies can position you for tremendous returns. After all, the S&P 500 index -- which tracks the performance of America's 500 largest public companies -- has returned 667% so far this century.

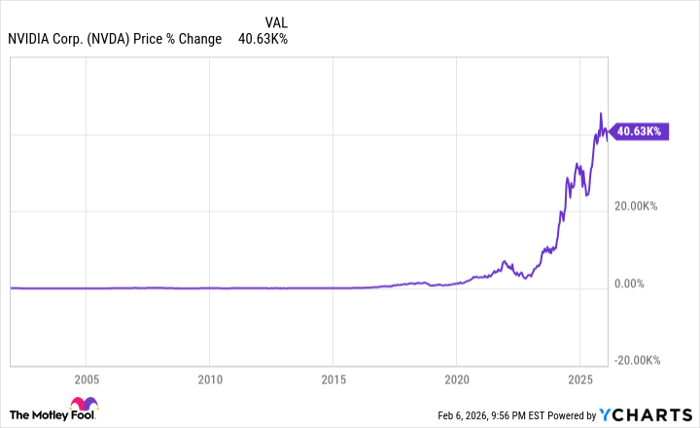

This approach will expose investors to plenty of losers, of course. But while the farthest that a stock can fall is 100%, others go on to return hundreds of thousands of percent or more. It's very rare, but that's where buying the haystack comes in. Anyone buying the S&P 500 in November 2001 would have gained exposure to Nvidia's 40,630% rise (ironically, it joined the index back then by replacing Enron).

Data by YCharts.

Of course, the S&P 500 contains companies across every sector. For investors seeking exposure to technology, a fund to consider is the Vanguard Information Technology ETF (NYSEMKT: VGT).

Buy the haystack for just 0.09% per year in fees

The Vanguard Information Technology ETF offers broad exposure to the information technology sector, with some of its biggest holdings including Nvidia with 17.5% of funds invested, Apple with 14.89% of funds invested, and Microsoft with 12.19% of funds invested.

Despite these sizable positions, the fund counts 320 information technology stocks among its holdings. For this broad exposure, it charges an expense ratio of just 0.09%, meaning it takes $9 in fees annually for every $10,000 invested. For context, the average index equity ETF expense ratio 0.15% in 2023.

For long-term shareholders, this arrangement has paid off. The fund's average annual return of 13.96% since its 2004 inception would have turned every $10,000 invested into $177,236.

For investors who value simplicity, diversification, low fees, and the prospect of powerful long-term upside as the ongoing tech boom plays out, this fund is a buy.

Should you buy stock in Vanguard Information Technology ETF right now?

Before you buy stock in Vanguard Information Technology ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard Information Technology ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $439,362!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,164,984!*

Now, it’s worth noting Stock Advisor’s total average return is 918% — a market-crushing outperformance compared to 196% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of February 11, 2026.

William Dahl has positions in Apple. The Motley Fool has positions in and recommends Apple, Microsoft, and Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.