Shares of Unity Biotechnology, Inc. UBX plunged 53% after the company announced disappointing results from Part A of the phase II ENVISION study of UBX1325 in patients with wet age-related macular degeneration (AMD).

The proof-of-concept phase II ENVISION study is a multi-center, randomized, double-masked, active-controlled study designed to evaluate the safety, tolerability, efficacy and durability of a repeat intravitreal injection of UBX1325 in patients with neovascular AMD evaluated through 24 weeks.

The study enrolled 51 patients actively treated with anti-VEGF who had a visual acuity deficit and residual retinal fluid.

Patients treated with UBX1325 had a mean change from baseline in CST of +87.3 µm at 24 weeks compared to +30.5 µm in the aflibercept control arm.

The company will assess and optimize its resource allocation for the future development of UBX1325 following a complete analysis of ENVISION results.

The company will provide an update on Part B of the ENVISION study and share 48-week data from the phase II BEHOLD DME study in April. UBX1325 showed strong evidence of biological activity and improvement in visual acuity in the DME study. Hence, the company plans to initiate a phase IIb study in the second half of this year.

.The disappointing results might dent Unity Biotechnology’s efforts to develop the candidate successfully.

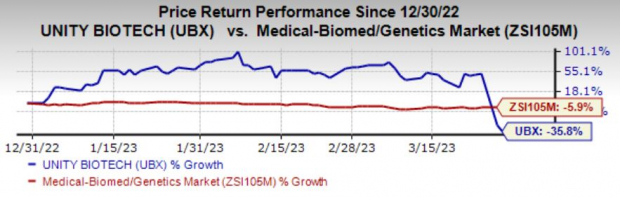

Shares of Unity Biotechnology are down 35.8% in the year so far compared to the industry’s decline of 6.9%.

Image Source: Zacks Investment Research

Regeneron REGN markets aflibercept under the brand name Eylea in collaboration with Bayer BAYRY. The drug is a market leader in this space.

Eylea is Regeneron’s lead drug approved for various ophthalmology indications.

Regeneron records net product sales of Eylea in the United States and Bayer records net product sales of Eylea outside the United States. Regeneron records its share of profits/losses in connection with sales of Eylea outside the United States.

Unity Biotechnology currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock And 4 Runners UpRegeneron Pharmaceuticals, Inc. (REGN) : Free Stock Analysis Report

Bayer Aktiengesellschaft (BAYRY) : Free Stock Analysis Report

UNITY Biotechnology, Inc. (UBX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.