Twilio TWLO is augmenting its product portfolio with the integration of artificial intelligence (AI) and collaborations with AI leaders to enhance its customer engagement capabilities. Last year, Twilio launched Conversational AI through a partnership with OpenAI by integrating OpenAI’s Realtime API into this platform. The platform was developed for enterprises so they can automate their customer engagement with natural-sounding interaction.

Conversational AI serves across various channels, including voice, SMS, WhatsApp, and web chat. Integrated with features like ConversationRelay, Conversational Intelligence and large language models, the platform simplifies the development and deployment of voice AI agents. The platform can analyze voice and messaging conversations for structured data extraction. The platform also supports real-time streaming, speech recognition, interruption handling, and expressive voices, making customer interactions seamless.

Recently, the company launched a unified platform for customer engagement by integrating its messaging tools, customer data platform, and AI tools to enable enterprises to deliver greater personalization for automated customer interaction. Twilio also enhanced the capabilities of its Customer Data Platform and Communications Platform as a Service (CPaaS) through new updates like conversational AI tools, secure communications channels, and intelligent compliance solutions.

In one of its research reports, Twilio stated that 58% of non-profits and 47% of B2C businesses in the private sector are using AI with their CPaaS solution. Moreover, 68% of non-profits and 64% of B2C brands are using AI to analyze end-user data to understand their needs and pain points, implying a large-scale adoption of AI. These factors are driving the growth of Twilio’s communications division, which grew 13% to reach $1.1 billion in the first quarter of 2025.

Twilio expects its 2025 revenues to grow in the range of 7.5-8.5% organically. The Zacks Consensus Estimate for the same has been pegged at $4.81 billion, indicating year-over-year growth of 7.9%. However, Twilio also faces competition from other players in the customer engagement space.

How Competitors Fare Against Twilio

RingCentral, Inc. RNG started as a leader in cloud phone systems but now offers messaging, video and AI-powered contact center tools. RNG launched RingSense in 2023 as a proprietary AI engine across its communications tools. Unlike Twilio, which uses OpenAI’s AI models, RingCentral uses its proprietary models for auto-generated call summaries and follow-ups and topic extraction from phone and video calls.

Bandwidth BAND focuses mostly on voice and messaging services through application programming interfaces. Bandwidth is expanding into emergency services and call protection features, making its platform essential with strong customer retention.

Both RingCentral and Bandwidth are growing in the communications space on the back of their uniqueness, but Twilio’s edge lies in its broader platform and AI integration.

Twilio’s Price Performance, Valuation & Estimates

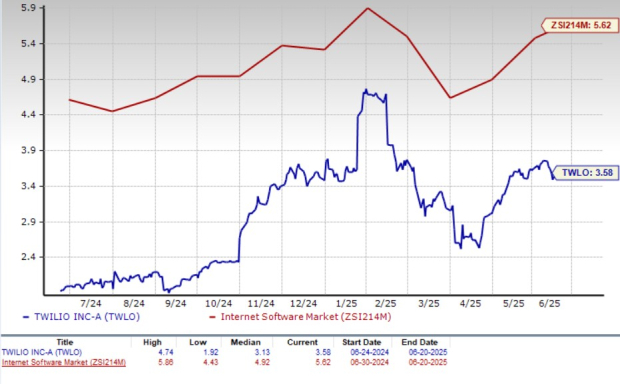

Shares of Twilio have returned 7.8% year to date compared with the Zacks Internet – Software industry’s growth of 11.2%.

Image Source: Zacks Investment Research

From a valuation standpoint, TWLO trades at a forward price-to-sales ratio of 3.58, significantly below the industry’s average of 5.62. The company carries a Value Score of F.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for Twilio’s 2025 earnings is pegged at $4.49 per share, revised downward by a cent over the past 30 days. The estimated earnings figure suggests year-over-year growth of 22.34%.

Image Source: Zacks Investment Research

Twilio currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Zacks' Research Chief Names "Stock Most Likely to Double"

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is a little-known satellite-based communications firm. Space is projected to become a trillion dollar industry, and this company's customer base is growing fast. Analysts have forecasted a major revenue breakout in 2025. Of course, all our elite picks aren't winners but this one could far surpass earlier Zacks' Stocks Set to Double like Hims & Hers Health, which shot up +209%.

Free: See Our Top Stock And 4 Runners UpRingcentral, Inc. (RNG) : Free Stock Analysis Report

Twilio Inc. (TWLO) : Free Stock Analysis Report

Bandwidth Inc. (BAND) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.