Fintel reports that on March 1, 2024, Truist Securities downgraded their outlook for International Game Technology (NYSE:IGT) from Buy to Hold .

Analyst Price Forecast Suggests 22.76% Upside

As of February 24, 2024, the average one-year price target for International Game Technology is 33.35. The forecasts range from a low of 27.88 to a high of $50.40. The average price target represents an increase of 22.76% from its latest reported closing price of 27.17.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for International Game Technology is 4,285MM, an increase of 0.28%. The projected annual non-GAAP EPS is 1.70.

What is the Fund Sentiment?

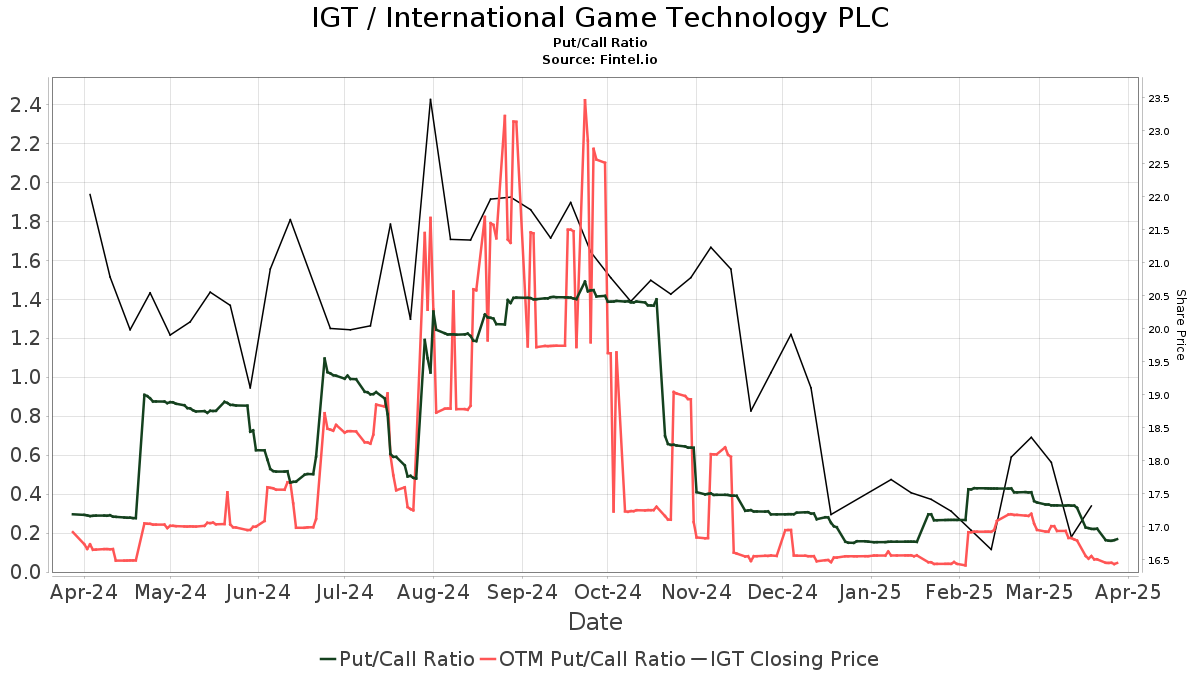

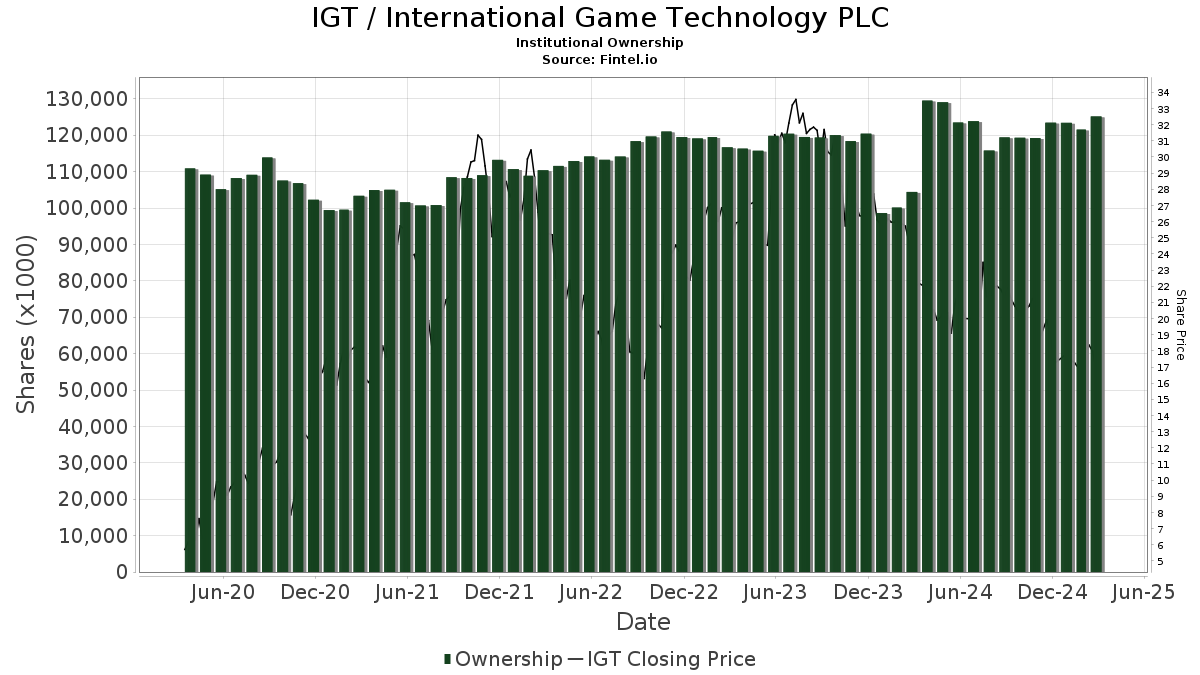

There are 335 funds or institutions reporting positions in International Game Technology. This is a decrease of 167 owner(s) or 33.27% in the last quarter. Average portfolio weight of all funds dedicated to IGT is 0.21%, a decrease of 43.26%. Total shares owned by institutions decreased in the last three months by 13.29% to 104,417K shares.  The put/call ratio of IGT is 0.33, indicating a bullish outlook.

The put/call ratio of IGT is 0.33, indicating a bullish outlook.

What are Other Shareholders Doing?

Bank of New York Mellon holds 13,033K shares representing 6.50% ownership of the company. In it's prior filing, the firm reported owning 10,565K shares, representing an increase of 18.94%. The firm increased its portfolio allocation in IGT by 2.87% over the last quarter.

Tpg Gp A holds 9,025K shares representing 4.50% ownership of the company. In it's prior filing, the firm reported owning 8,236K shares, representing an increase of 8.74%. The firm decreased its portfolio allocation in IGT by 7.39% over the last quarter.

Massachusetts Financial Services holds 6,712K shares representing 3.35% ownership of the company. In it's prior filing, the firm reported owning 7,106K shares, representing a decrease of 5.87%. The firm decreased its portfolio allocation in IGT by 87.87% over the last quarter.

Lazard Asset Management holds 6,581K shares representing 3.28% ownership of the company. In it's prior filing, the firm reported owning 4,739K shares, representing an increase of 27.99%. The firm decreased its portfolio allocation in IGT by 73.30% over the last quarter.

Capital Research Global Investors holds 6,194K shares representing 3.09% ownership of the company. In it's prior filing, the firm reported owning 3,064K shares, representing an increase of 50.53%. The firm increased its portfolio allocation in IGT by 63.26% over the last quarter.

International Game Technology Background Information

(This description is provided by the company.)

IGT is the global leader in gaming. We deliver entertaining and responsible gaming experiences for players across all channels and regulated segments, from Gaming Machines and Lotteries to Sports Betting and Digital. Leveraging a wealth of compelling content, substantial investment in innovation, player insights, operational expertise, and leading-edge technology, its solutions deliver unrivaled gaming experiences that engage players and drive growth. The Company has a well-established local presence and relationships with governments and regulators in more than 100 countries around the world, and creates value by adhering to the highest standards of service, integrity, and responsibility. IGT has approximately 11,000 employees.

Fintel is one of the most comprehensive investing research platforms available to individual investors, traders, financial advisors, and small hedge funds.

Our data covers the world, and includes fundamentals, analyst reports, ownership data and fund sentiment, options sentiment, insider trading, options flow, unusual options trades, and much more. Additionally, our exclusive stock picks are powered by advanced, backtested quantitative models for improved profits.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.