Trimble TRMB has made Trimble Earthworks Grade Control Platform software and Trimble Siteworks software available worldwide as a subscription-based service.

The software solutions are provided at a contracted and fixed monthly price, with flexible terms of one year, three years or five years.

The subscription service also includes the cloud-based application named Trimble WorksManager Software, which helps customers to wirelessly transfer data from the office to the field.

In addition, hardware and software upgrades, accidental damage protection for hardware as well as local technical support, training, and customer service packages from the SITECH construction technology are included in the subscription service.

With the help of these subscription-based solutions, contractors can modernize large fleets and survey equipment inventories without requiring large capital investment.

Hence, the recent move will help the company in expanding its reach to contractors.

Further, the move is expected to contribute well to its Buildings and Infrastructure segment.

Trimble Inc. Price and Consensus

Trimble Inc. price-consensus-chart | Trimble Inc. Quote

Buildings and Infrastructure Segment in Focus

Trimble has been persistently making strong efforts to boost the construction segment prospects by providing advanced technological solutions to construction professionals so that they can develop quality projects.

In addition to the recent move, the company Introduced a connected model-based estimating workflow to help contractors gain more project insight and visibility, and attain better collaboration & enhancement in project execution.

Trimble also collaborated with One Click LCA to help users in measuring carbon emissions at different phases of construction projects.

Further, it launched a connected and cloud-based construction management platform named Trimble Construction One to help contractors get accurate real-time data and accordingly make strategic decisions related to construction projects.

This segment has become an integral part of the company. It contributed 39% to fiscal third-quarter 2021 revenues. Also, segment revenues increased 10.2% year over year.

Trimble’s Portfolio Strength

Trimble is focusing more on strengthening the product portfolio for better positioning, modeling, connectivity, and data analytics to benefit customers with enhanced productivity, quality, safety as well as sustainable solutions. The software solutions have further added strength to its portfolio.

We believe its strengthening product portfolio will continue to drive customer momentum in the days ahead, which in turn will benefit financial performance. This will aid the company in winning investors’ confidence.

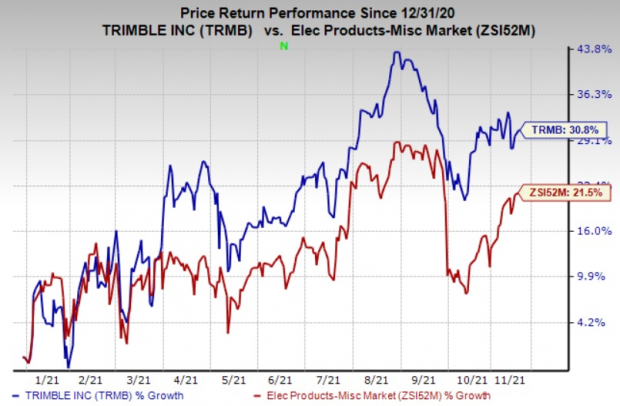

Trimble has gained 30.8%, outperforming the Zacks industry’s 21.5% growth on a year-to-date basis.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Apart from the recent move, the company launched the TrimbleDA2 Global Navigation Satellite System receiver for enhancing the performance of the Trimble Catalyst positioning service.

It also introduced Trimble Vegetation Manager for enhanced management operations in vegetation and various solutions to cut operating expenses as well as improve safety, regulatory compliance, performance, and the reliability of electric transmission and distribution infrastructure.

Further, its introduction of the Trimble GuidEx Machine Guidance System for efficient and faster guide machines along route corridors as well as specific target areas remains noteworthy.

Zacks Rank & Stocks to Consider

Currently, Trimble carries a Zacks Rank #3 (Hold).

Investors interested in the broader technology sector can consider stocks like ON Semiconductor ON, Advanced Micro Devices AMD and Mimecast Limited MIME. While ON Semiconductor sports a Zacks Rank #1 (Strong Buy), Advanced Micro Devices and Mimecast carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

ON Semiconductor has gained 80.8% on a year-to-date basis. The long-term earnings growth rate for the stock is currently projected at 53.9%.

Advanced Micro Devices has gained 59.7% on a year-to-date basis. The long-term earnings growth rate for the stock is currently projected at 46.2%.

Mimecast has gained 45.5% on a year-to-date basis. The long-term earnings growth rate for the stock is currently projected at 35%.

Zacks' Top Picks to Cash in on Artificial Intelligence

In 2021, this world-changing technology is projected to generate $327.5 billion in revenue. Now Shark Tank star and billionaire investor Mark Cuban says AI will create "the world's first trillionaires." Zacks' urgent special report reveals 3 AI picks investors need to know about today.

See 3 Artificial Intelligence Stocks With Extreme Upside Potential>>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Advanced Micro Devices, Inc. (AMD): Free Stock Analysis Report

Trimble Inc. (TRMB): Free Stock Analysis Report

ON Semiconductor Corporation (ON): Free Stock Analysis Report

Mimecast Limited (MIME): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.