Idaho Strategic Resources, Inc.’s IDR shares closed at $16.87 yesterday, just 2% below its 52-week high of $17.25 reached on Oct. 2.

IDR shares have returned 166.4% year to date, outpacing the Zacks Mining - Gold industry’s growth of 38.2%. In comparison, the Zacks Basic Materials sector and the S&P 500 have rallied 6.1% and 22.4%, respectively. The company has also outscored major gold miners like Barrick Gold GOLD and Newmont’s NEM gains of 12.4% and 36.5%, respectively.

IDR Outperforms Industry, Sector & S&P 500

Image Source: Zacks Investment Research

IDR shares have benefitted from increased production and solid financial results in the first half of 2024, as well as the upward trajectory in gold prices. The recent discovery of a high-grade gold vein at its Golden Chest Mine has boosted its share price.

IDR Shares Trade Above 50-Day & 200-Day SMA

Image Source: Zacks Investment Research

The Idaho Strategic stock is trading above its 50-day and 200-day moving averages, indicating solid upward momentum and price stability. This reflects a positive market sentiment and confidence in the company's financial health and long-term prospects.

Factors Favoring Idaho Strategic

IDR’s Golden Chest Mine Displays Solid Potential

The company’s gold properties include the Golden Chest Mine (currently in production), the New Jersey Mill (majority ownership interest), the Eastern Star exploration property and other less advanced properties.

In 2023, the Golden Chest mine was fully transitioned to underground production. In the year, Idaho Strategic mined 37,780 tons of ore at an average grade of 6.36 gpt gold. The ore came from stopes on the H-Vein and Idaho Vein in the Skookum shoot. IDR produced 8,247 ounces of gold contained in concentrates and doré, a 35% year-over-year increase. IDR has a target of producing 10-15 thousand ounces of gold annually.

The Golden Chest Gold Mine lies within the Murray Gold Belt. Idaho Strategic has consolidated many historic gold mines and prospects within the belt to form an impressive land package consisting of 1,500 acres of patented mining claims and 5,800 acres of unpatented claims — the largest private land position in the area.

Idaho Strategic recently announced that it discovered Red Star Vein during a drill program in the Klondike area at the Golden Chest mine. The tonnage and production potential of the Red Star Vein is, however, not fully known at this time. So far, 12 drill holes have been completed, with four holes encountering high-grade gold intercepts of the Red Star Vein with impressive widths and grades.

In addition to the Red Star intercepts, the company encountered several veins during the 2024 drill program. These hold promise, considering their proximity to the current production. While it may be early to determine the economic feasibility of these intercepts, investors are upbeat about this discovery, given the solid potential of the Golden Chest mine.

Idaho Strategic Delivers Impressive Results in H1

The company produced 6,019 ounces of gold in the first half of 2024, a 55% jump from 3,877 ounces in the first half of 2023. This momentum is expected to continue for the remainder of the year as mining on the H-Vein continues.

Idaho Strategics’ revenues increased 82.8% year over year to around $12 million in the first half of 2024, aided by increased gold production and higher average gold prices. Earnings per share for the first half of 2024 was 34 cents, marking a 325% year-over-year surge. The substantial increase in underground production led to low cash costs. Increased efficiencies have also benefitted earnings.

Liquidity & Cash Flow to Aid IDR’s Growth Plans

The company ended the second quarter of 2024 with cash and cash equivalents of $1.8 million, and short-term investments of $6.3 million. IDR’s total debt-to-total capital ratio was at 0.07 as of June 30, 2024, much lower than the industry’s 0.17, which is impressive.

Improved cash flow and low debt levels allow the company to invest in existing mines while exploring and developing gold, and rare earth element (REE) prospects. IDR plans to drill its Eastern Star property soon after the winter months, expand drilling at the Golden Chest and also explore the broader Murray Gold Belt District.

IDR has been constructing its paste backfill plant at the New Jersey mill. This is expected to reduce costs by $0.5-$0.8 million annually.

Solid Rally in Gold Prices Bodes Well for Idaho Strategic

Gold prices have gained 30.6% year to date and are currently at $2,700 per ounce, hitting a record high. Gold has gained on safe-haven demand amid uncertainty surrounding the U.S. election and rising tensions in the Middle East. Expectations of further interest rate cuts from major central banks have also boosted prices.

IDR Offers Exposure to Promising REE Market

Idaho Strategic has three REE exploration properties in Idaho — Lemhi Pass, Diamond Creek and Mineral Hill. The company has conducted numerous exploration programs on its REE properties, which include drilling, trenching, sampling and mapping of certain areas within its 19,090-acre landholdings.

REE is essential in many of today’s rapidly growing clean energy technologies, from wind turbines and electricity networks to electric vehicles. Per the International Energy Agency, REE may see three to seven times higher demand in 2040 from the current levels, while supply is expected to merely double.

The market is currently dominated by China and there has been an increasing focus in the United States to develop domestic REE capabilities. IDR is taking calculated steps to capitalize on this opportunity.

Rising Estimates Instill Confidence in Idaho Strategics’ Earnings

The Zacks Consensus Estimate for IDR’s 2024 earnings has moved up 7% over the past 60 days. Earnings estimates for 2025 have also been revised upward by 13%.

Image Source: Zacks Investment Research

Find the latest earnings estimates and surprises on Zacks Earnings Calendar.

The consensus mark for 2024 earnings is pegged at 77 cents, suggesting a year-over-year surge of 756% from the 9 cents reported in 2023. The estimate for 2025 indicates no year-over-year changes.

Image Source: Zacks Investment Research

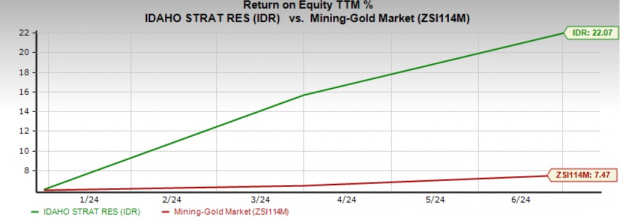

IDR Offers Industry-Leading Returns

IDR’s return on equity (ROE) — a profitability measure of how prudently the company utilizes its shareholders’ funds — is 22.07%, higher than the industry’s 7.47%. This outscores Barrick Gold’s ROE of 5.53% and Newmont’s 8.35%.

Image Source: Zacks Investment Research

Idaho Strategic’s return on assets (ROA) is 18.94%, ahead of the industry’s 4.73%, indicating that the company has been utilizing its assets efficiently to generate returns. GOLD has a ROA of 3.87% and NEM has a ROA of 4.37%.

Image Source: Zacks Investment Research

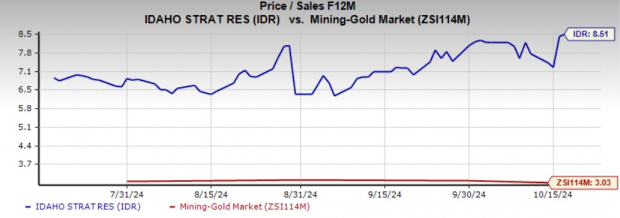

Is IDR’s Premium Stock Valuation Justified?

Idaho Strategic is currently viewed as relatively expensive, with the stock trading at 8.51X forward 12-month price to sales, higher than the industry average of 3.03X.

Image Source: Zacks Investment Research

The positive developments have likely led to IDR’s premium valuation, as investors have high expectations for the company’s prospects and profitability. Consequently, they are willing to pay a premium for the stock, expecting it to outperform its peers and the broader market in the coming months.

Our Final Take on Idaho Strategic

Despite the stock trading near its 52-week high and premium valuation, it is still an opportune time to buy IDR, backed by its growth prospects. Idaho Strategic offers investors the stability of profitable gold production and the added benefit of diversification, given its exposure to REE elements. The increasing demand for REEs in clean energy technologies and the push for supply chains independent of China is a growth opportunity for IDR.

Idaho Strategic currently flaunts a Zacks Rank #1 (Strong Buy) and has a VGM Score of B. The VGM Score rates each stock on the combined weighted styles, helping identify the ones with the most attractive value, best growth forecast and most promising momentum across the board.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Research Chief Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpNewmont Corporation (NEM) : Free Stock Analysis Report

Barrick Gold Corporation (GOLD) : Free Stock Analysis Report

Idaho Strategic Resources, Inc. (IDR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.