The Trade Desk (TTD) is benefiting from higher Connected TV (“CTV”) adoption amid the convergence of internet and television programming. This particular growth driver is fast becoming the focus of the company’s growth strategy.

In the last reported quarter, video advertising, which includes CTV, represented a high-40s percentage share of total business. TTD is looking to capitalize on the shift from linear to programmatic CTV. On the last earnings call, TTD referred to CTV as the “kingpin of the open internet.”

The company also highlighted that supply is outpacing demand in the current ad landscape, especially in CTV, therefore making it a buyer’s market. Major CTV players are not only “plugging directly” into TTD’s demand, but they are also adopting key innovations like UID2 and OpenPath.

Earlier in the year, TTD introduced its Ventura Operating System for CTV, designed to drive greater efficiency and transparency in advertising. This operating system enables better data management, allowing TTD to enhance its targeting capabilities, which are crucial as the CTV market expands. TTD is also executing its international expansion led by CTV.

Nonetheless, increasing macroeconomic uncertainty and escalating trade tensions do not augur well for TTD as well as other players in this intensely competitive landscape, as these could squeeze ad budgets. TTD highlighted the impact of the volatile macro backdrop, particularly on the large global brands. If macro headwinds worsen or persist into the second half of 2025, revenue growth may face further pressure due to reduced programmatic demand.

Taking a Look at How Competitors are Ramping up Their CTV Efforts

Like The Trade Desk, PubMatic, Inc PUBM is gaining from growth in the CTV business, which bolsters its strategic positioning in the high-growth programmatic video. PUBM is expected to gain from the continuing shift of ad dollars from linear TV to streaming, especially in a market favoring programmatic spot buys with flexibility over heavy upfront commitments. PubMatic has already secured more than 80% penetration among the top 30 streamers.

In the last reported quarter, CTV revenues surged more than 50% year over year, while omni-channel video revenues grew 20% and represented 40% of total revenues. PubMatic is also heavily investing in Activate for SPO, Convert for commerce media and Connect for curation to drive growth and create sticky customer engagement.

Magnite, Inc MGNI is gaining from robust growth in CTV, with overall contributions excluding Traffic Acquisition Costs (ex-TAC) increasing 12% year over year in the first quarter of 2025. CTV’s contribution ex-TAC was up 15%, representing 43% of Magnite’s total contribution ex-TAC mix. The growth is being driven by increased ad spend and programmatic adoption by leading giants like Fox, Vizio, Roku, LG, Warner Bros. Discovery, Walmart and Netflix. Netflix continues expanding its programmatic strategy globally and Magnite remains a core partner of its programmatic ad stack.

Momentum with the agency marketplaces and growth in live sports augurs well. The company recently debuted the next generation of SpringServe, integrating the ad server and advanced programmatic capabilities of its streaming SSP into one unified platform. It is set for general availability in July 2025.

TTD’s Price Performance, Valuation and Estimates

Shares of TTD have plummeted 40.6% year to date compared with the Internet – Services industry’s decline of 9.3%.

Image Source: Zacks Investment Research

In terms of forward price/earnings, TTD’s shares are trading at 35.58X, up from the Internet Services industry’s ratio of 17.8X.

Image Source: Zacks Investment Research

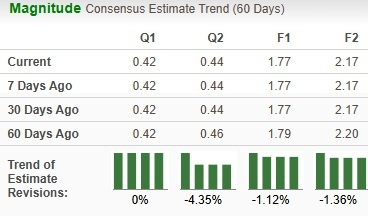

The Zacks Consensus Estimate for TTD’s earnings for 2025 has been unchanged over the past 30 days.

Image Source: Zacks Investment Research

TTD currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Research Chief Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpThe Trade Desk (TTD) : Free Stock Analysis Report

Magnite, Inc. (MGNI) : Free Stock Analysis Report

PubMatic, Inc. (PUBM) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.