Artificial intelligence (AI) remains among the hottest market topics, with investors continuing to seek ways to obtain exposure. The theme has undoubtedly been one of the strongest we’ve seen in years, with many stocks benefiting, namely large-cap technology.

And for those seeking exposure, particularly concerning the data center angle, a top-ranked stock, Vertiv VRT, provides just that. Let’s take a closer look at what’s been driving the positivity.

VRT Business Momentum Remains Hot

Vertiv, a current Zacks Rank #1 (Strong Buy), provides services for data centers, communication networks, and commercial and industrial facilities with a portfolio of power, cooling, and IT infrastructure solutions and services.

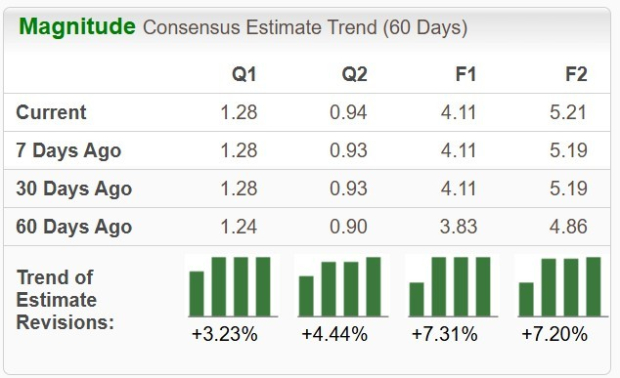

Analysts have dialed both their EPS and sales expectations higher over the past year thanks to bullish results stemming from strong demand, with the current $4.11 Zacks Consensus EPS estimate suggesting 45% YoY growth and up 15% over the past year.

Image Source: Zacks Investment Research

Importantly, Vertiv upped its full-year 2025 sales guidance following its latest release, again reflective of the favorable operating environment. Within the above-mentioned release, Giordano Albertazzi, CEO, stated –

"We delivered strong sales growth of 29% and built significant backlog, reflecting both accelerating market demand and our increasingly strong competitive position and unique capabilities to enable our customers' most advanced infrastructure needs at scale."

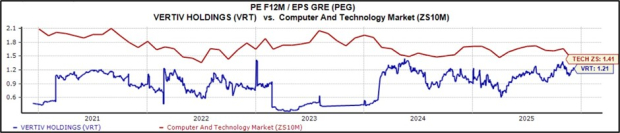

Valuation isn’t overly rich, with the current 1.2X PEG ratio sitting beneath the Zacks Computer & Technology sector average of 1.4X. The current forward 12-month earnings multiple works out to 36.1X, well below 2025 highs of 43.9X.

Image Source: Zacks Investment Research

Bottom Line

The AI trade continues to grip investors, with many seeking exposure. It’s easy to understand why there’s such excitement surrounding the topic, as the technology is expected to boost productivity and provide meaningful operational efficiencies for businesses for years to come.

And for those interested in the data center angle, Vertiv VRT reflects a prime consideration thanks to strong quarterly results stemming from healthy demand paired with a bullish EPS outlook.

Radical New Technology Could Hand Investors Huge Gains

Quantum Computing is the next technological revolution, and it could be even more advanced than AI.

While some believed the technology was years away, it is already present and moving fast. Large hyperscalers, such as Microsoft, Google, Amazon, Oracle, and even Meta and Tesla, are scrambling to integrate quantum computing into their infrastructure.

Senior Stock Strategist Kevin Cook reveals 7 carefully selected stocks poised to dominate the quantum computing landscape in his report, Beyond AI: The Quantum Leap in Computing Power.

Kevin was among the early experts who recognized NVIDIA's enormous potential back in 2016. Now, he has keyed in on what could be "the next big thing" in quantum computing supremacy. Today, you have a rare chance to position your portfolio at the forefront of this opportunity.

See Top Quantum Stocks Now >>Vertiv Holdings Co. (VRT) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.