Timothy Plan - Timothy Plan International ETF said on September 5, 2023 that its board of directors declared a regular monthly dividend of $0.04 per share ($0.52 annualized). Previously, the company paid $0.01 per share.

Shareholders of record as of September 7, 2023 will receive the payment on September 8, 2023.

At the current share price of $24.64 / share, the stock's dividend yield is 2.10%.

Looking back five years and taking a sample every week, the average dividend yield has been 2.37%, the lowest has been 1.60%, and the highest has been 7.34%. The standard deviation of yields is 1.43 (n=173).

The current dividend yield is 0.19 standard deviations below the historical average.

- Read the Ultimate Guide to Dividend Harvesting.

The company's 3-Year dividend growth rate is -0.07%.

What is the Fund Sentiment?

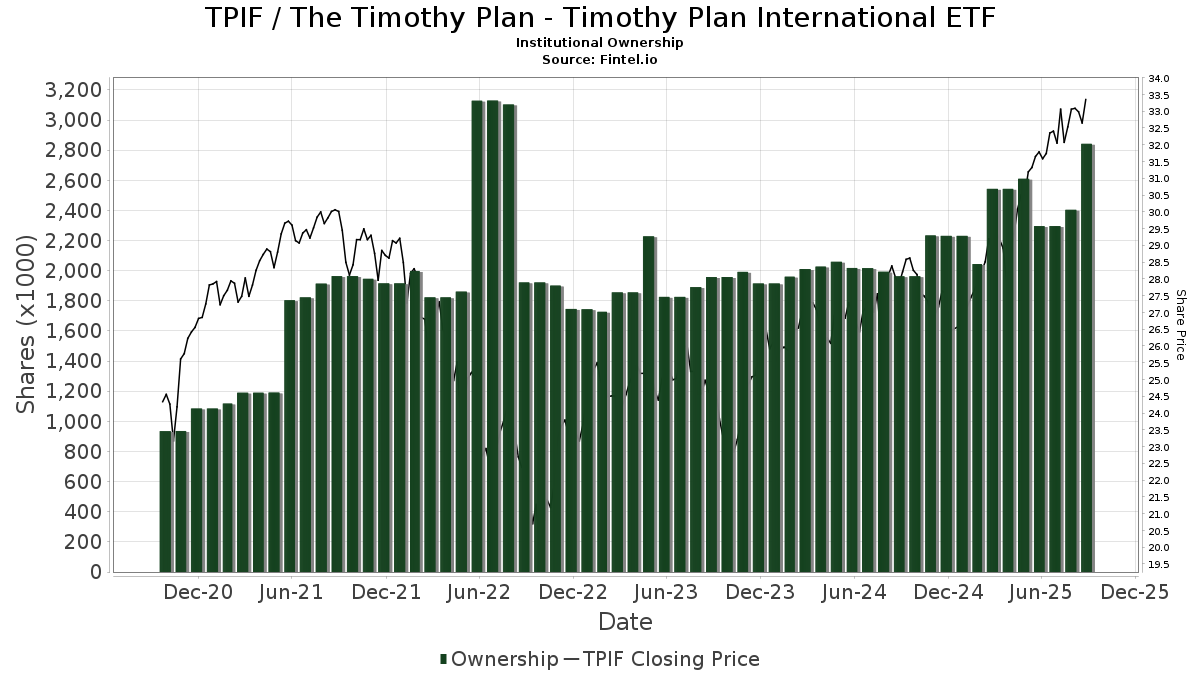

There are 41 funds or institutions reporting positions in Timothy Plan - Timothy Plan International ETF. This is an increase of 4 owner(s) or 10.81% in the last quarter. Average portfolio weight of all funds dedicated to TPIF is 0.81%, a decrease of 7.23%. Total shares owned by institutions increased in the last three months by 7.23% to 1,958K shares.

What are Other Shareholders Doing?

O'Connor Financial Group holds 353K shares. In it's prior filing, the firm reported owning 318K shares, representing an increase of 9.97%. The firm increased its portfolio allocation in TPIF by 2.85% over the last quarter.

Change Path holds 315K shares. In it's prior filing, the firm reported owning 379K shares, representing a decrease of 20.49%. The firm increased its portfolio allocation in TPIF by 36.27% over the last quarter.

TSGAX - Timothy Strategic Growth Fund holds 220K shares. In it's prior filing, the firm reported owning 229K shares, representing a decrease of 3.95%. The firm decreased its portfolio allocation in TPIF by 1.95% over the last quarter.

Ambassador Advisors holds 188K shares. In it's prior filing, the firm reported owning 203K shares, representing a decrease of 7.65%. The firm increased its portfolio allocation in TPIF by 6.17% over the last quarter.

TCGAX - Timothy Conservative Growth Fund holds 148K shares. In it's prior filing, the firm reported owning 157K shares, representing a decrease of 6.08%. The firm decreased its portfolio allocation in TPIF by 1.82% over the last quarter.

Additional reading:

- Schedule A (as supplemented effective January 23, 2023) Sub-Advisory Fee Schedule

- ADVISORY FEE WAIVER AGREEMENT

- THE TIMOTHY PLAN INVESTMENT ADVISORY AGREEMENT JANUARY 19, 1994 CONSOLIDATED AND RESTATED AS OF FEBRUARY 26, 2021 Amended as of July 27, 2021

Fintel is one of the most comprehensive investing research platforms available to individual investors, traders, financial advisors, and small hedge funds.

Our data covers the world, and includes fundamentals, analyst reports, ownership data and fund sentiment, options sentiment, insider trading, options flow, unusual options trades, and much more. Additionally, our exclusive stock picks are powered by advanced, backtested quantitative models for improved profits.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.