Tilray Brands TLRY delivered a notable turnaround in profitability during the first quarter of fiscal 2026, marking a sharp improvement from the prior-year period. The company generated net income of $1.5 million compared to a net loss of $34.7 million in the prior-year quarter. This performance reflects the effectiveness of its ongoing efforts to reinforce financial discipline and streamline operations.

During theearnings call Tilray highlighted that the return to profitability was supported by sustained progress in cost control, greater operational efficiency, and portfolio optimization across its Cannabis, Beverage, Wellness and Distribution segments.

The fiscal first quarter also saw a sharp increase in adjusted net income. The metric rose to $3.9 million from an adjusted net loss of $6 million a year earlier. Management explained that these gains were driven largely by lower SG&A expenses and reduced amortization costs, both of which contributed meaningful savings to the bottom line. It is emphasized that these improvements, along with stronger revenue contributions across key segments, underscore the success of Tilray’s strategic initiatives aimed at enhancing profitability.

Peer Update

Verano VRNO faces revenue pressure from a challenged domestic environment. As VRNO derives all of its revenues from the U.S. market, persistent price compression, competitive intensity and uneven regulatory progress have weighed on its top-line performance. Margin performance also reflected these market conditions. Gross margin contracted approximately 300 basis points to 47% in third-quarter 2025, due to promotional activity and retail price adjustments. However, Verano’s disciplined focus on operating efficiency supported cost performance. Selling, general, and administrative (SG&A) expenses declined 13% year over year to $80.6 million, underscoring ongoing optimization efforts even amid store expansion and product launches.

Sales of Aurora Cannabis’ ACB medical cannabis segment rose 37% year over year to nearly $65 million in the first quarter of fiscal 2026. This increase was primarily driven by increased revenues in Canada from insurance-covered and self-paying patients, as well as higher sales in international markets like Australia, Ger/many, Poland and the UK. The higher sales also helped improve adjusted gross margin numbers (for the medical cannabis segment), which climbed to an impressive 69% from 67% in the year-ago period. This improvement was driven by higher selling prices, sustainable cost reductions and enhanced production efficiencies.

TLRY’s Price Performance

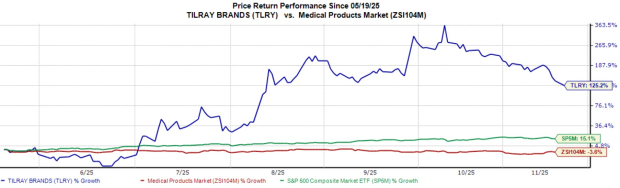

In the past six months, Tilray Brands’ shares have gained 125.2%, outperforming the industry’s 3.6% decline. The S&P 500 composite has grown 15.1% in the same period.

Image Source: Zacks Investment Research

Discounted Valuation

TLRY currently trades at a forward 12-month Price-to-Sales (P/S) of 1.35X compared with the industry average of 3.16X.

Image Source: Zacks Investment Research

TLRY Stock Estimate Trend

Over the past 30 days, its loss per share estimate for 2025 has remained unchanged at 5 cents.

Image Source: Zacks Investment Research

TLRY stock currently has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Names #1 Semiconductor Stock

This under-the-radar company specializes in semiconductor products that titans like NVIDIA don't build. It's uniquely positioned to take advantage of the next growth stage of this market. And it's just beginning to enter the spotlight, which is exactly where you want to be.

With strong earnings growth and an expanding customer base, it's positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $971 billion by 2028.

See This Stock Now for Free >>Tilray Brands, Inc. (TLRY) : Free Stock Analysis Report

Aurora Cannabis Inc. (ACB) : Free Stock Analysis Report

Verano Holdings Corp. (VRNO) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.