Didi, the Chinese ride-hailing giant, has filed for an IPO with the SEC. The listing will be the largest IPO of the pandemic era and its valuation could eclipse that of Uber's current market capitalisation of US$90bn.

Didi acquired Uber's China business for US$35bn in 2016, and was valued at US$62bn at its latest funding round in August 2020.

The prospectus does not mention the valuation or the float. Reuters estimates that Didi is seeking an enterprise valuation of US$100bn and is looking to raise US$10bn.

We are confident that Didi will achieve an enterprise valuation of US$100bn for three reasons:

(1) Didi's net revenue growth potential is greater than Uber

Didi's FY20 net revenue is half that of Uber, but its revenue growth potential is far greater. Didi reports gross revenue as revenue in its income statement. This includes the total fare from the rides, inclusive of the payout to the drivers.

Uber, Lyft and the other ride-hailing players report net revenue. This is the gross revenue after subtracting the payout to the drivers. A close look at the Didi prospectus reveals that this figure is reported as "platform sales".

Uber's take rate (the proportion of the fee that the company gets from each ride) is higher than that of Didi. Uber typically charges US$0.50 cents for a US$2 ride. This equates to a take rate of 25%. The driver collects about US$1 in gross profit, after paying US$50 cents in car costs, petrol and depreciation.

Didi's take rate is much lower than that of Uber, ranging between 3% and 5%. This suggests that Didi could increase its net revenue at a faster clip than Uber, by gradually increasing the take rate.

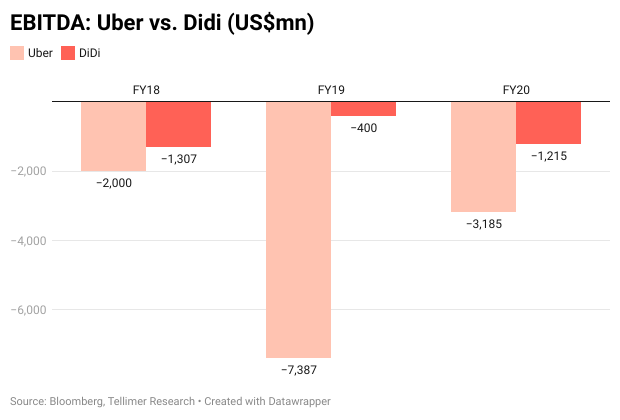

(2) Profitability is on Didi's horizon, while Uber is facing a sea of red

Didi has increased net revenue by 36% yoy in FY20. In contrast, Uber's net revenue fell by 13% in FY20.

Even with the reopening in the US and other markets, Uber is still struggling. In Q1 21, Uber's net revenue was down 1% yoy, while Didi's net revenue rose by 106% yoy over the same period.

As Uber falters, its prospects for profitability are dimming. Meanwhile, Didi has a chance to generate a net profit by FY22. In Q1 21, it reported comprehensive net income of US$95mn on gross revenue US$6.4bn.

(3) Didi is heavily invested in EV and Robotics

Didi already has the largest network of electronic vehicles (EV), with 1 million EVs as of 31 December 2020. It also has the largest EV charging network in China, with a 30% market share.

In addition, it operates 100 autonomous vehicles. Autonomous vehicles are driverless vehicles that rely on robotics rather than human intervention.

Both EV and robotics are set to disrupt the auto industry. EV is more energy efficient, with Tesla having led the way in this field. Robotic vehicles are the next stage in the ride-hailing revolution.

Didi states that it will use its IPO proceeds to invest in EV and robotic vehicles.

Hence, Didi can be viewed as a disrupter of disrupters. Disruption squared! It is a ride-hailing company that is at the cutting edge of technological innovation and change.

Uber has more limited exposure to EV and robotic vehicles, with just 200,000 EVs in its network.

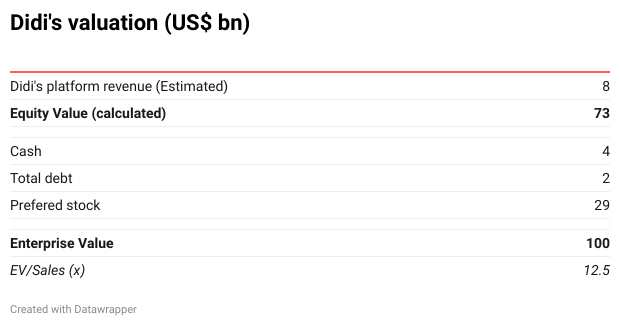

Valuation summary

We estimate Didi could achieve US$8bn net revenue in FY21.

Didi's superior revenue growth and profitability metrics suggest that it deserves a vast premium to Uber. Didi's exposure to EV and robotic vehicles is an added attraction.

Tesla trades at 10 times the EV/Sales multiple of traditional autos like General Motors. Uber is at 9x EV/Sales. Didi may command a 12.5x FY21 projected EV/Sales valuation due to its superior prospects. This would place it at a US$100bn enterprise value, edging ahead of Uber's enterprise value of US$98bn.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.