Coinbase Global COIN is set to report fourth-quarter 2025 results on Feb. 12, after market close.

The Zacks Consensus Estimate for COIN’s fourth-quarter revenues is pegged at $1.9 billion, indicating an 18.8% increase from the year-ago reported figure.

The consensus estimate for earnings is pegged at $1.15 per share. The Zacks Consensus Estimate for COIN’s fourth-quarter earnings has moved down 6.5% in the past 30 days. The estimate suggests a year-over-year decrease of 66.1%.

Image Source: Zacks Investment Research

COIN’s Decent Earnings Surprise History

COIN’s earnings beat the Zacks Consensus Estimates in three of the trailing four quarters and missed in one, the average surprise being 7.37%.

What the Zacks Model Unveils for COIN

Our proven model does not conclusively predict an earnings beat for Coinbase this time around. This is because a stock needs to have the right combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold), which increases the odds of an earnings beat. This is not the case, as you can see below.

Earnings ESP: Coinbase’s Earnings ESP is -30.95%. This is because the Most Accurate Estimate of 79 cents per share is pegged lower than the Zacks Consensus Estimate of $1.15. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Coinbase Global, Inc. Price and EPS Surprise

Coinbase Global, Inc. price-eps-surprise | Coinbase Global, Inc. Quote

Zacks Rank: Coinbase currently has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank stocks here.

Factors Likely to Shape COIN’s Q4 Results

A weak crypto market, as well as price declines, are likely to have weighed on trading volume in the fourth quarter of 2025. The Zacks Consensus Estimate for trading volume is pegged at 279 million, indicating a 36.4% decrease from the year-ago reported quarter. Both institutional and consumer trading are likely to have decreased in the to-be-reported quarter.

International expansion, the rise of derivatives and spot trading and the deeper integration of USD Coin into the crypto ecosystem are likely to have supported growth in Coinbase’s two largest revenue streams — trading fees and stablecoins.

Lower trading volume, coupled with lower prices, is likely to have weighed on transaction volumes. The Zacks Consensus Estimate for transaction revenues is pegged at $1,034 million, indicating a decline of 33.5% from the year-ago reported quarter.

Coinbase also expects transaction expenses to be in the mid-to-high teens as a percentage of net revenues.

Blockchain rewards, stablecoin-related income and revenues from Coinbase One subscriptions are likely to have aided subscription and services revenues. COIN expects fourth-quarter subscription and services revenues to be in the range of $710-$790 million, owing to growth of both USDC market capitalization and higher Coinbase One subscriber base. The Zacks Consensus Estimate is pegged at $754.65 million.

An increase in digital marketing spending is likely to have increased sales and marketing expenses. COIN projects sales and marketing to be between $215 million and $315 million.

Technology investments aimed at improving operational efficiency, combined with disciplined cost control, are likely to have improved margins.

Coinbase expects fourth-quarter technology and development and general and administrative expenses to be in the range of $925-$975 million, attributable to higher headcount.

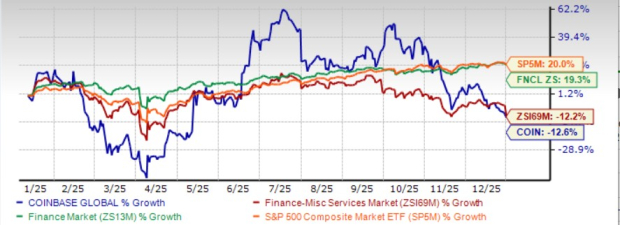

COIN’s Price Performance & Valuation

The stock underperformed the industry, sector and the S&P 500 in the fourth quarter of 2025.

Image Source: Zacks Investment Research

The stock is trading at a price-to-earnings ratio of 28.35, higher than the industry’s 13.35.

Image Source: Zacks Investment Research

Shares of Robinhood Markets HOOD and Interactive Brokers Group, Inc. IBKR, two other crypto-oriented stocks, are also trading at multiples higher than the industry average.

Investment Thesis

Coinbase is pursuing growth by expanding its U.S. spot and derivatives market share while broadening its product suite and global footprint. The company continues to list new cryptocurrencies and tokenized equities, with an ongoing focus on evaluating and launching digital assets that support a pro-crypto ecosystem.

In 2026, Coinbase plans to prioritize real-world asset (RWA) perpetuals, specialized exchanges and advanced trading terminals, next-generation decentralized finance infrastructure, and deeper integration of artificial intelligence and robotics. These initiatives are designed to create a more comprehensive and interconnected product ecosystem while reinforcing Coinbase’s leadership position in the industry.

From a financial standpoint, Coinbase remains fundamentally solid, supported by strong liquidity and continued debt reduction, which have improved its total debt-to-capital ratio. However, the issuance of $2.6 billion in convertible notes has introduced potential risks related to shareholder dilution and higher financial leverage.

Coinbase’s results also remain sensitive to crypto asset price volatility. Declines in the prices of Bitcoin, Ethereum, or other digital assets could affect earnings, asset valuations, cash flows, liquidity, and the company’s ability to meet ongoing obligations.

To support expansion, Coinbase has increased investment in technology and development, sales and marketing, and general and administrative functions. At the same time, pricing pressure on certain digital assets has led to ongoing impairment charges, while restructuring efforts have resulted in additional operating expenses.

What Should Investors Do Now With COIN Stock?

Coinbase’s focus on growing the broader crypto ecosystem, gaining spot trading share across both retail and institutional channels, and enhancing the trading experience through ongoing innovation is expected to have driven strong growth. In addition, rising average USDC balances, an expanding USDC market capitalization, and more resilient average crypto prices suggest improved revenue stability over time.

Given a premium valuation, lowered volatility, lowered asset prices, and below-average return on equity, it is wise to shy away from the stock.

Zacks Names #1 Semiconductor Stock

This under-the-radar company specializes in semiconductor products that titans like NVIDIA don't build. It's uniquely positioned to take advantage of the next growth stage of this market. And it's just beginning to enter the spotlight, which is exactly where you want to be.

With strong earnings growth and an expanding customer base, it's positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $971 billion by 2028.

See This Stock Now for Free >>Interactive Brokers Group, Inc. (IBKR) : Free Stock Analysis Report

Coinbase Global, Inc. (COIN) : Free Stock Analysis Report

Robinhood Markets, Inc. (HOOD) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.