Recent advances in artificial intelligence (AI) could have a profound impact on our lives. The ability to automate and streamline tasks and create original content has the potential to increase productivity and save time and money.

One company that's been on the bleeding edge of that trend is Nvidia (NASDAQ: NVDA). The company's graphics processing units (GPUs) are the gold standard used to underpin this revolutionary technology, which has fueled a stratospheric increase in its sales and profits -- and, ultimately, its stock price.

Nvidia is up 850% since early last year, as of this writing, but it has also seen a commensurate increase in its valuation. The company currently has a price-to-earnings (P/E) ratio of 55, well above the 31 multiple for the S&P 500. While that might seem expensive at first glance, appearances can be deceiving, and the stock isn't as expensive as you might think.

History can be instructive

While valuation metrics can be helpful tools to assess whether a stock is fairly valued, they should never be considered in a vacuum. For example, a stock can trade at a premium if it has a strong potential for future growth, market dominance, or a strong history of innovation. Nvidia meets all of these criteria, which helps explain why investors are willing to pay up for the stock.

For example, for its fiscal fourth quarter, which ends Jan. 28, Nvidia is guiding for revenue of $37.5 billion, which would represent year-over-year growth of 70%, with a commensurate increase in its profitability. It's estimated that Nvidia controls between 70% and 95% of the advanced AI chip market, leaving crumbs for rivals. And its Blackwell AI processor is the most powerful AI-centric processor ever built, as Nvidia's history of innovation continues.

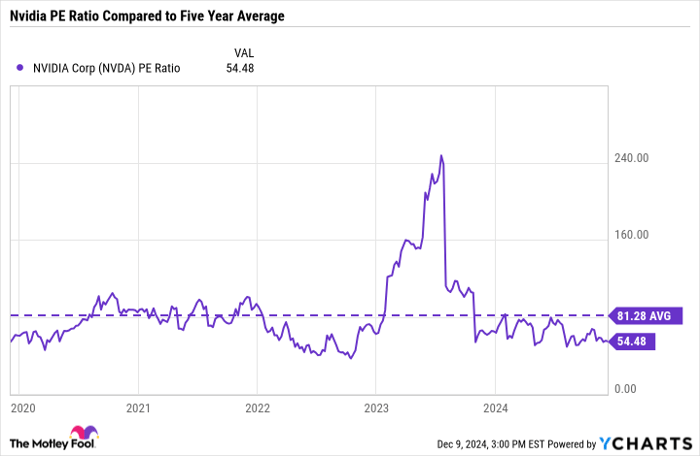

However, one chart shows Nvidia isn't as expensive as you might think.

Data by YCharts

You might think Nvidia is expensive at 55 times earnings, but that's a bargain compared with its five-year average multiple of 81. Furthermore, at 32 times next year's expected earnings, Nvidia is attractively priced, especially when considering its growth prospects.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $359,936!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $46,730!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $492,745!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of December 9, 2024

Danny Vena has positions in Nvidia. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.