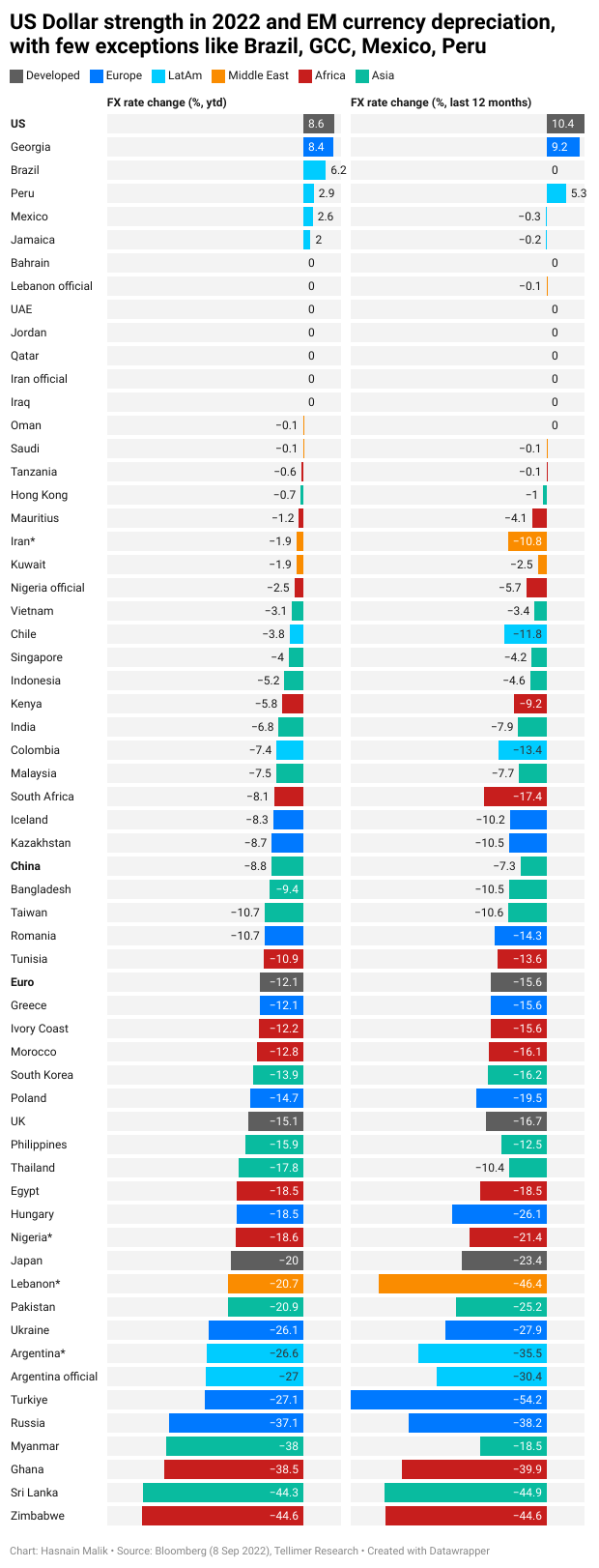

The appreciation of the US dollar has compounded other concerns for emerging markets. But, relative to the historical average, the dollar is expensive and many EM currencies and equities look cheap. But cheap currency valuation needs to be accompanied by credible monetary policy and a manageable level of external account pressure.

Brazil, alone, exhibits a real effective exchange rate below the 10-year median (suggesting an under-valued currency) and positive real interest rates (suggesting credible monetary policy, in terms of combatting inflation and attracting foreign portfolio flows in search of a 'carry trade'). However, there are several other countries in emerging markets that come close to meeting these criteria.

Dollar dagger

Slower global growth and higher developed market policy rates hurt emerging markets export (commodity and manufactured goods), remittance, tourism and capital flows.

Compounding these headwinds for EM is the seemingly unstoppable appreciation of the US dollar, particularly, for importers, its coincident rise with US$-denominated commodities like crude oil.

Although the diversity of the EM equity asset class should not be reduced to a single index, it is worth noting that the valuation of MSCI EM equities arguably compensates for the concerns listed above: eg trailing PB is at roughly a 15% discount to the five-year median, compared with a 15% premium for the S&P index.

We do not claim to be oracles on the outlook for the dollar but we note it looks expensive relative to the historical average.

Protective cover for EM portfolios

Below we survey:

Where in EM REER suggests undervaluation in the current spot FX rate; and

Where in EM real interest rates imply central banks are up to speed with inflation and may offer an attractive “carry trade” for foreigners.

We identify the following EMs that have downside in the spot FX rate should their REER revert to the 10-year median of no worse than 5% and a real interest rate that is positive or moderately negative (within negative 2%):

Large EM: Brazil, China, India;

Small EM: Colombia, Indonesia, Peru, the UAE;

Frontier: Bahrain, Iraq, Iraq, Ivory Coast, Jamaica, Kazakhstan, Oman, Tanzania, Tunisia, Ukraine.

Related reports and datasets

Currency risk is also incorporated in our EM Country Investability Index. This index weights c30 factors on growth (short and long term), policy credibility, politics, sanctions, ESG, equity valuation and liquidity. These weights can be changed in order to model different global themes and portfolio styles.

Much more in-depth analysis of external account and FX rate pressures is available from my colleague, Patrick Curran, in his Sovereign External Liquidity Dataset. He has also analysed crypto data to calculate a “parallel premium proxy” and identify currencies that may be at risk of devaluation and recently discussed the view of the IMF on the expensive dollar.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.