Cryptocurrencies have really hit the mainstream this year. According to the Global Crypto Adoption Index released by Chainalysis, worldwide adoption of cryptocurrencies jumped by over 880% yoy in August this year, with the most rapid adoption rates seen in emerging markets. This trend has been facilitated by 'Crypto 3.0' scaling advancements, which have lowered transaction fees, making crypto a cheaper, safer and faster way of sending money across borders.

Crypto 3.0 – with its emphasis on scalability, sustainability, governance and blockchain interoperability – has also managed to stave off the criticisms that have plagued Crypto 1.0 and 2.0 on scalability and environmental sustainability. Crypto 3.0 improves environmental sustainability by 99.99% and transactional scalability by nearly 100x. Newer blockchains use much less energy and can process more transactions per second than older models.

These are just a couple of the crypto trends we've seen emerge this year. Here are 10 of the biggest for 2022 and beyond:

1) Crypto goes further mainstream

The adoption of cryptocurrencies will continue to become an important part of many companies and even some countries' roadmaps going into 2022.

El Salvador adopted Bitcoin as legal tender in September and high-profile companies such as Microsoft, Twitch, Whole Foods, BMW and AMC all now accept cryptocurrency payments.

Meanwhile, dominant fintech companies PayPal and Square have started offering users the ability to purchase various cryptocurrencies on their platforms, as well as making direct investments in crypto. Square has purchased US$170mn-worth of Bitcoin in 2021, adding to the US$240mn it already held.

Tesla, for its part, continues to go back and forth on its acceptance of Bitcoin payments, despite the company owning US$2.6bn in crypto assets.

2) Crypto to eclipse the value of gold

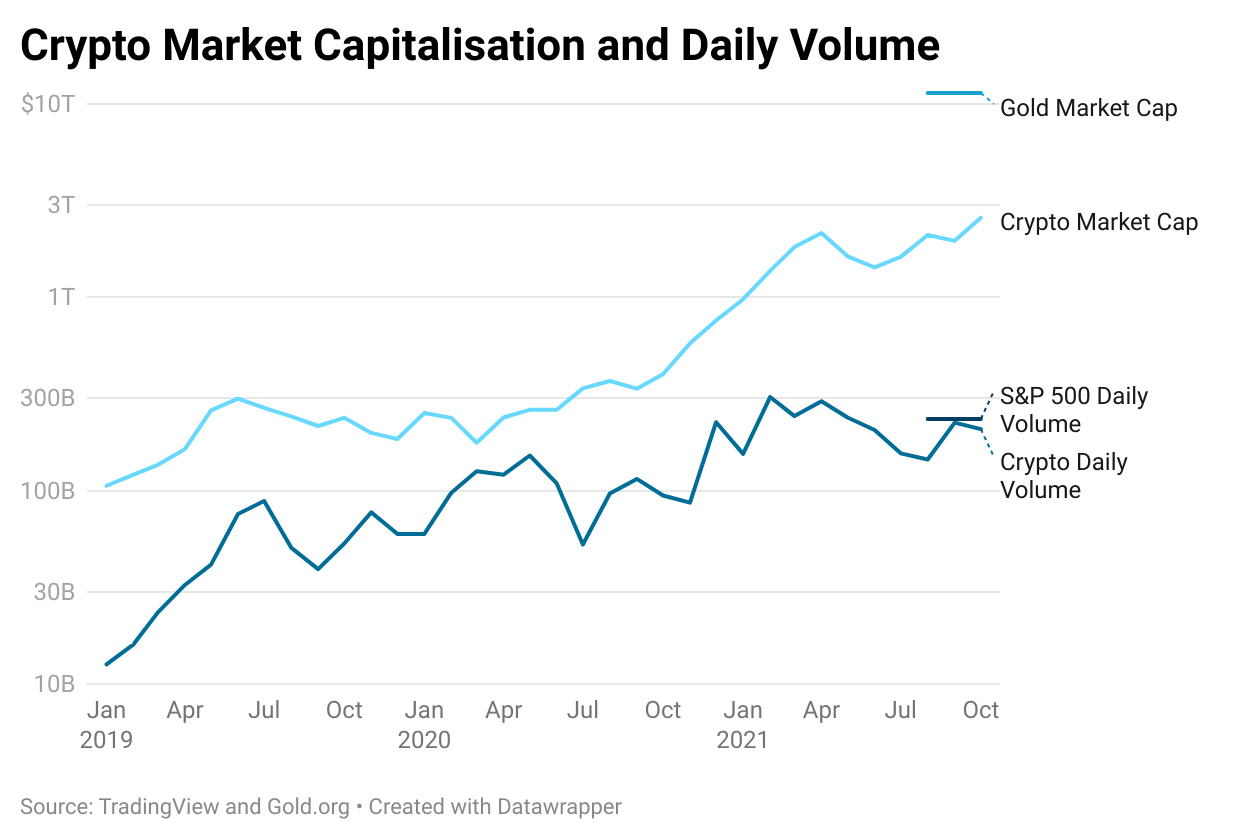

Crypto's total market capitalisation has reached an all-time high of US$2.6tn and it continues to grow at an astonishing rate of 9.7% per month. This puts it on a path to eclipse gold's current US$11.4tn market cap within 16 months, by February 2023.

US$208bn-worth of cryptocurrency is already changing hands each day and that number is increasing by 8.6% per month, meaning it is likely to surpass the US$225bn-worth of S&P500 stocks that are traded each day, possibly by the end of the year.

3) The 'cryptoisation' of emerging markets

The growth of crypto in emerging markets has been especially rapid because of the recent Crypto 3.0 scaling advancements that have lowered transaction fees, making crypto a cheaper, safer and faster way of sending money across borders. Digital assets such as stablecoins (which are usually pegged to the US dollar) help protect savings from high inflation and fluctuations in local currencies.

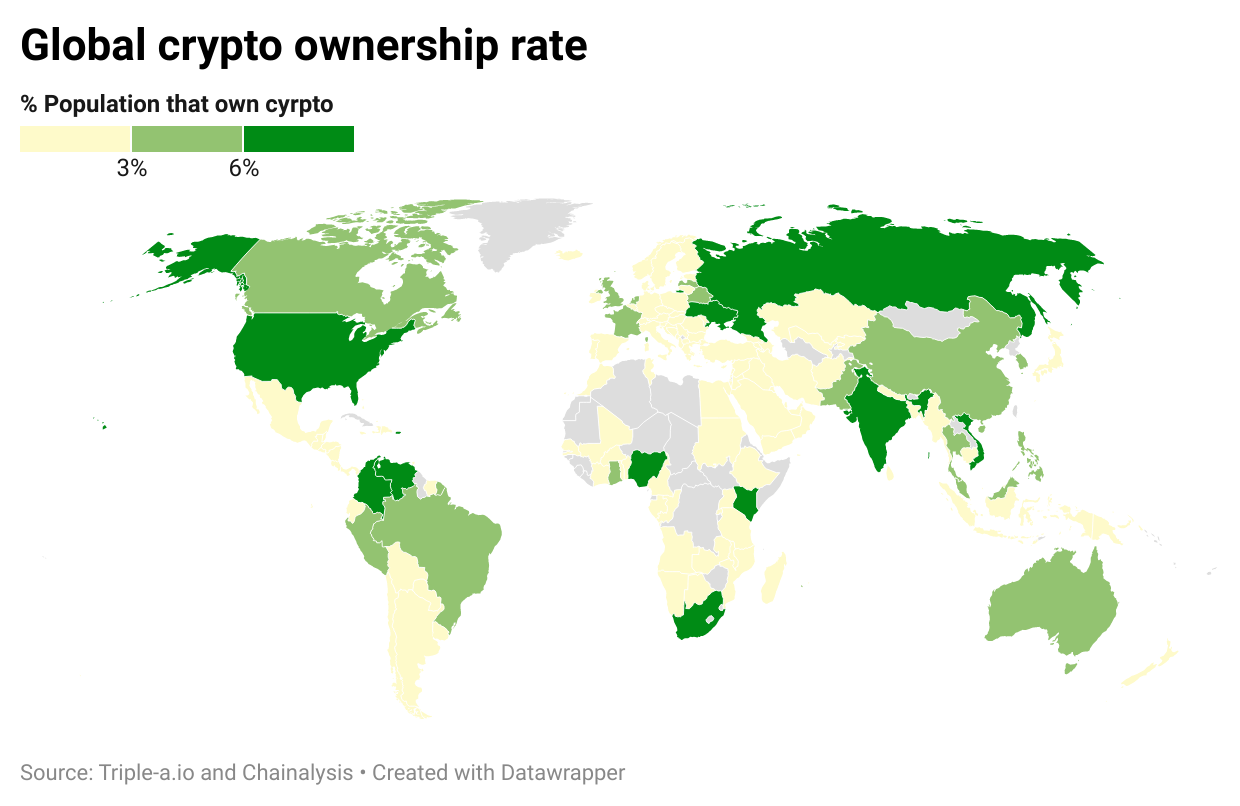

In fact, nine of the 10 countries with the highest cryptocurrency adoption (the percentage of people who own crypto) are emerging markets.

And, with more emerging market venues supporting payments and a plethora of centralised and decentralised exchanges popping up, the growth in emerging market crypto ownership is set to accelerate still further over the next few years.

A map of global crypto ownership rates highlights that much of central Europe and the Middle East have surprisingly low levels of ownership, while much of the Americas, Eastern Europe and Asia/Pacific have the highest levels, at over 6%.

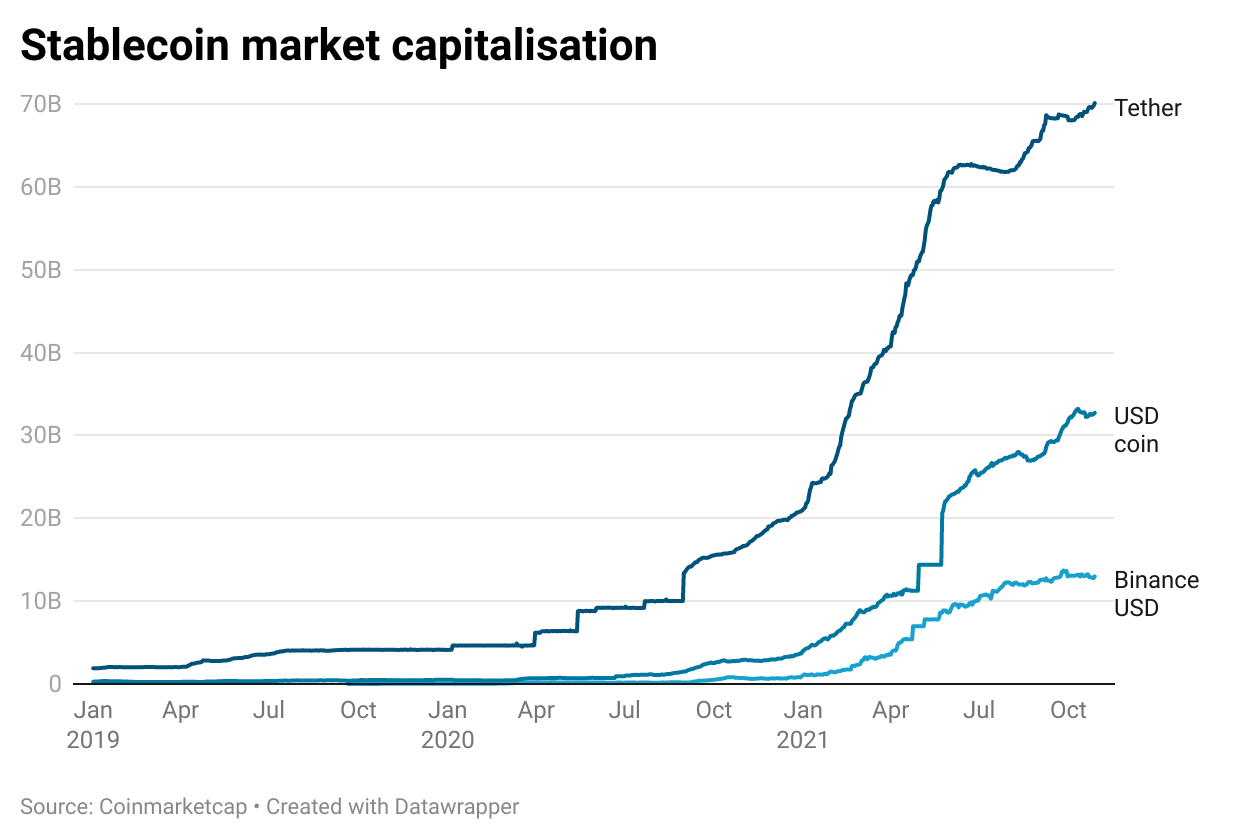

The three most popular stablecoins – Tether, USD Coin and Binance USD (which are all popular in emerging markets) – have a combined market cap of US$133bn and are projected to grow in popularity as ownership of crypto increases across the globe.

4) Sustainability and scalability

Major criticisms of Crypto 1.0 and 2.0 (see below) are of their scalability and, ultimately, their environmental sustainability. Bitcoin and Ethereum's proof-of-work blockchains are hugely energy-intensive because they involve solving purposely difficult computational puzzles to validate transactions to reach a consensus; energy itself is the arbiter used to secure these blockchains.

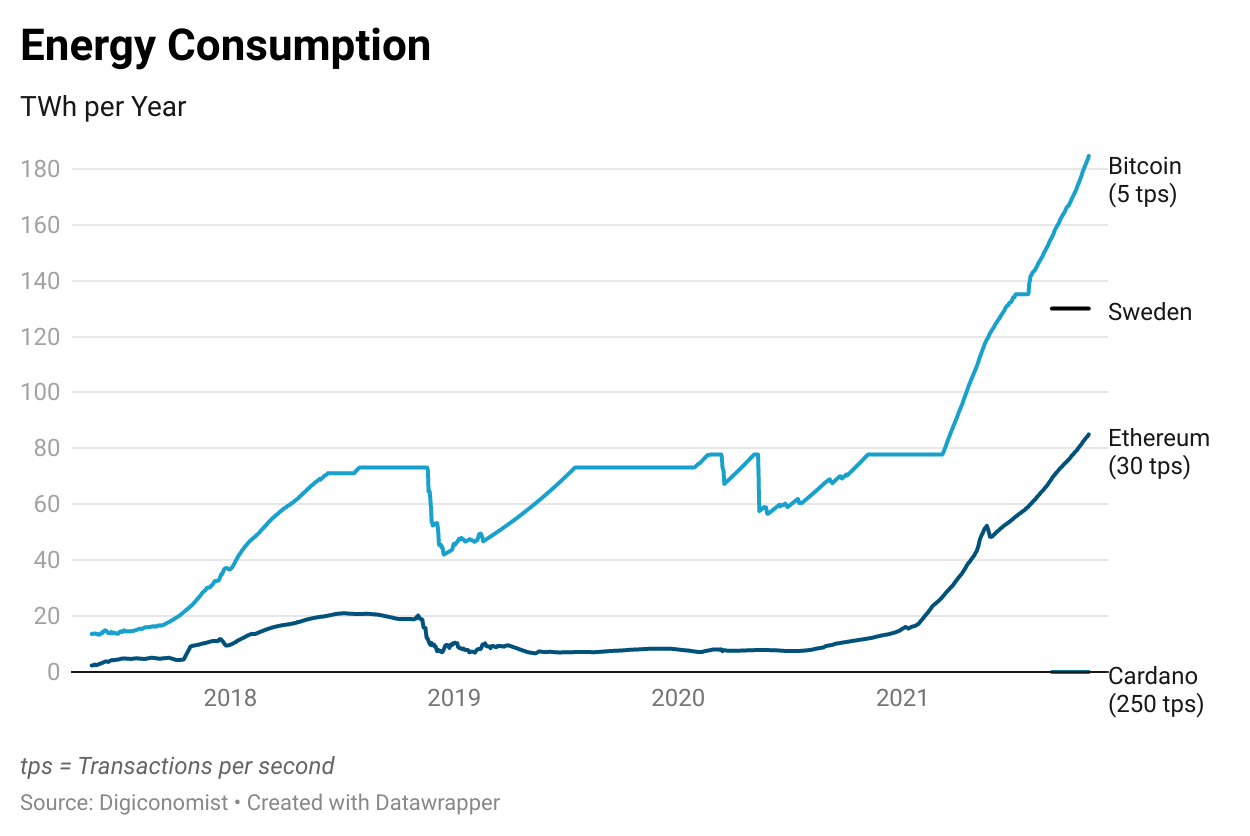

Bitcoin currently uses more energy than Sweden every year – a whopping 184 Terawatt-hours – and processes five transactions per second. When compared with Visa, which handles around 1,700 transactions per second, you can see why scalability is a serious concern for Bitcoin.

Ethereum is more efficient, needing 84 TWh of energy to process 30 transactions per second, but Cardano – a Crypto 3.0 blockchain – only uses 0.006 TWh of energy and processes 250 transactions per second.

5) Crypto 3.0

Crypto 1.0: Blockchain-based decentralised digital currency. Bitcoin was the first in 2009.

Crypto 2.0: Smart contracts built into the blockchain, allowing increasingly complex digital assets to be traded, not just currencies. Ethereum was the first in 2015.

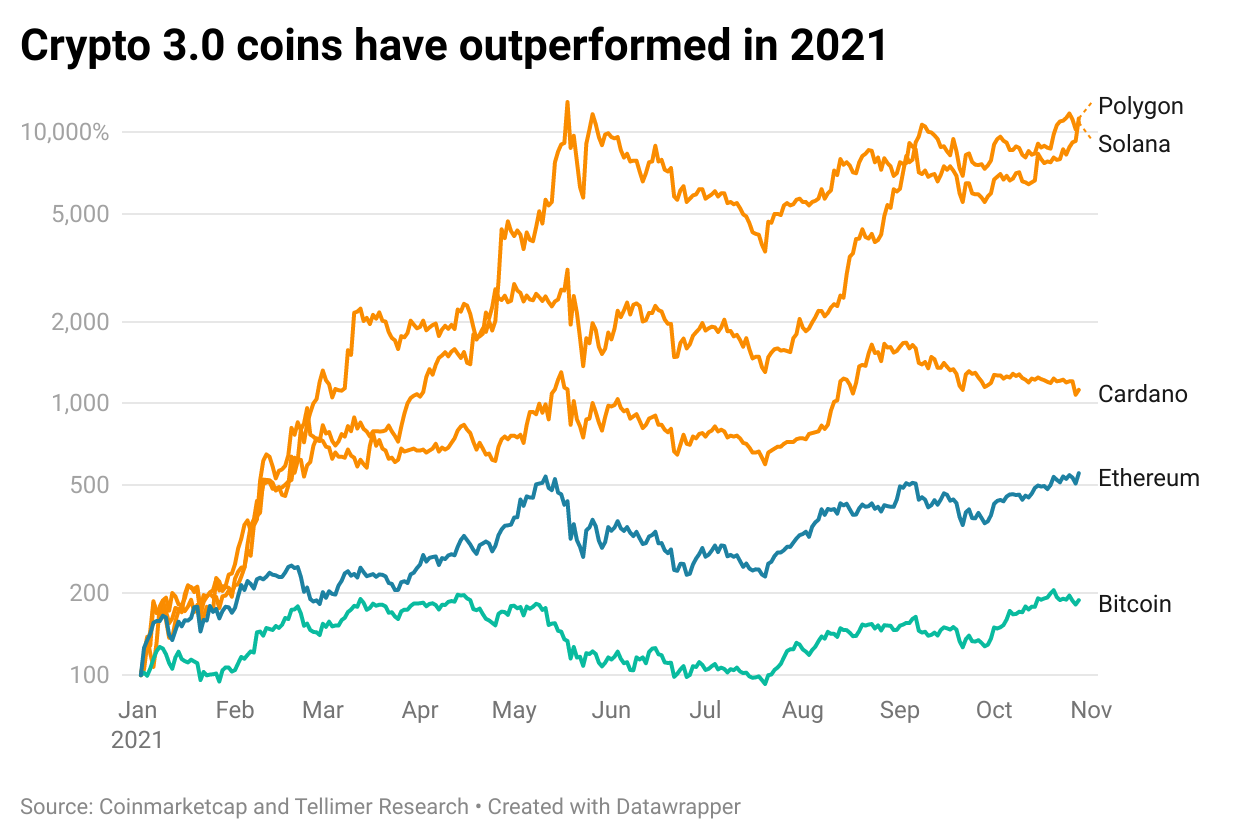

Crypto 3.0: Emphasis on scalability, sustainability, governance and blockchain interoperability. There is currently a race between the three largest new Crypto 3.0 blockchains – Cardano, Solana and Polkadot – to achieve dominance, along with Ethereum 2.0, which plans to upgrade the Ethereum blockchain with the latest tech.

Some of the techniques used by these newer blockchains are:

Proof of stake: An alternative to proof of work that has seen huge improvements in environmental sustainability. It uses 99.99% less energy and leverages large networks of people to reach a consensus. It works by choosing self-elected users at random to validate the next block of transactions and requires them to stake their crypto as a safety deposit. Validators lose their stake if they attempt to add fraudulent transactions; otherwise, their stake is returned along with a small reward for their work.

Layer-2 and sidechains: There is an increase in transaction scalability by moving the bulk of computations off the main blockchain (second layer) and leveraging optimistic and zero-knowledge mathematical rollups to validate that the work done is accurate before merging it back to the main chain. This can result in networks such as Solana being able to process transactions 30 times faster than the Visa network.

Governance: Voting systems are integrated into transparent blockchains, which makes the system more accessible and better secured

Interoperability: This adds the functionality for distinct blockchains to communicate with each other along with building bridges to external systems. Polkadot and Polygon are market leaders in their area.

6) Bitcoin's dominance is waning

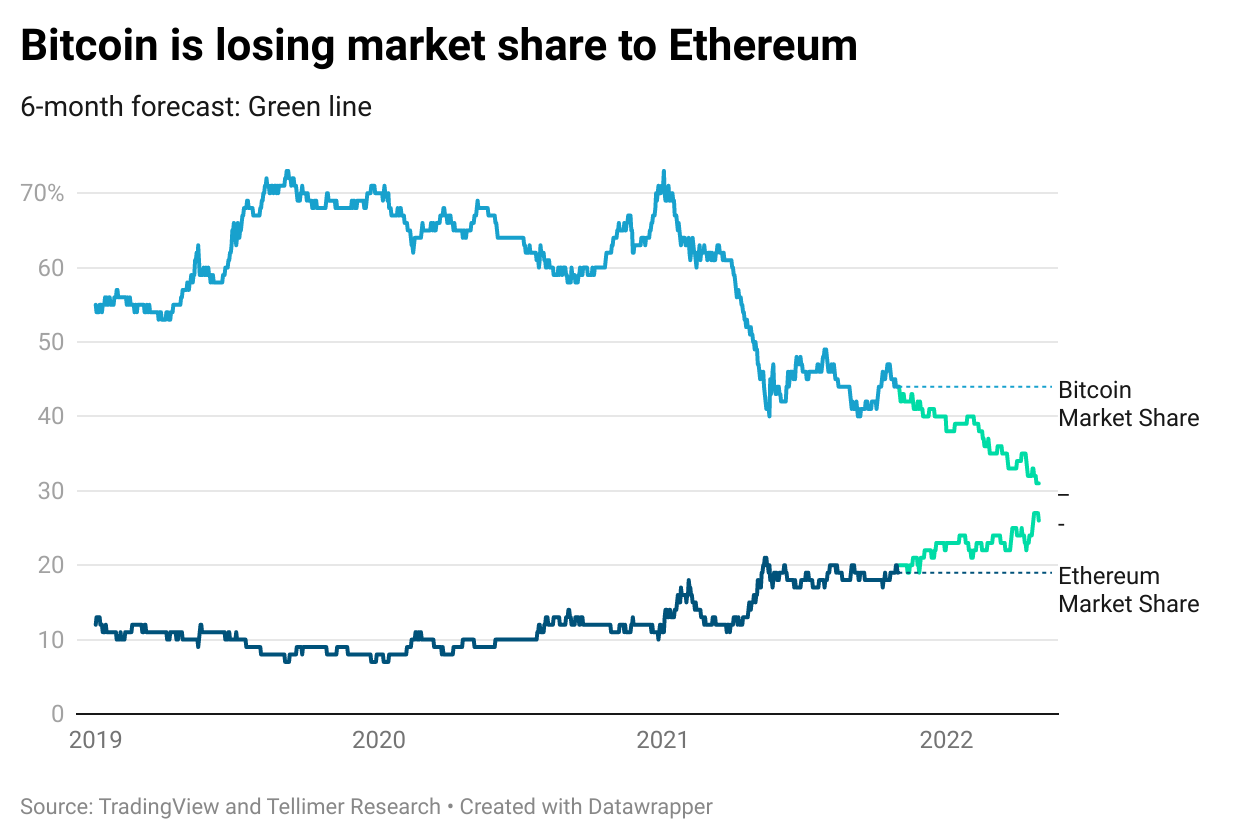

Bitcoin’s market cap dominance has fallen from 73% at the start of the year to its current level of 44%, while Ethereum has nearly doubled its market share from 11% to 19%.

Six of the 10 largest cryptocurrencies are built on top of the Ethereum blockchain and its smart contracts (including Ethereum itself) and, as noted above, Ethereum 2.0 is expected to emerge next year, featuring most of the Crypto 3.0 technology employed by newer coins.

Many experts predict that Ethereum will take over from Bitcoin as the dominant cryptocurrency by 2023 – an event that is colloquially known as “The Flippening”.

7) Decentralised autonomous organisations (DAOs) and the future of governance

A DAO is a decentralised corporate governance structure built around a cryptocurrency, where ownership of a certain number of tokens or NFTs (see below) grants you access to the organisation and forms the basis of an active voting system. This ownership-based democracy allows a DAO to rally around its initiatives and decides how organisational funds are spent.

Ownership of a DAO token helps incentivise engagement in a similar way to how traditional publicly listed stock equity does, by aligning an investor's best interests with the organisation's success.

DAOs allow for a large amount of creative freedom in their design and some nascent projects have started to take full advantage of that. For example, the Klima DAO has a treasury backed by carbon credits with the goal of accelerating the price appreciation of carbon assets.

The 20 largest DAOs hold US$6bn worth of digital assets. These include decentralised finance (DeFi, see below) projects such as Compound (lending), Uniswap (decentralised exchange – DEX, see below), Bankless (banking) and public-funding entities such as Gitcoin – which pays users to contribute to open-source software like Python.

8) Decentralised finance (DeFi) aims to replace traditional financial services

DeFi is an emerging ecosystem of financial applications leveraging smart contracts to conduct transactions without intermediaries.

The industry has grown from US$28bn to US$101bn in 2021 and is poised to continue its explosive growth.

The two most commanding areas in DeFi are decentralised exchanges (DEX) and decentralised banking and lending, which in combination are responsible for 80% of the sector.

Decentralised exchanges (DEX) – the future of trading

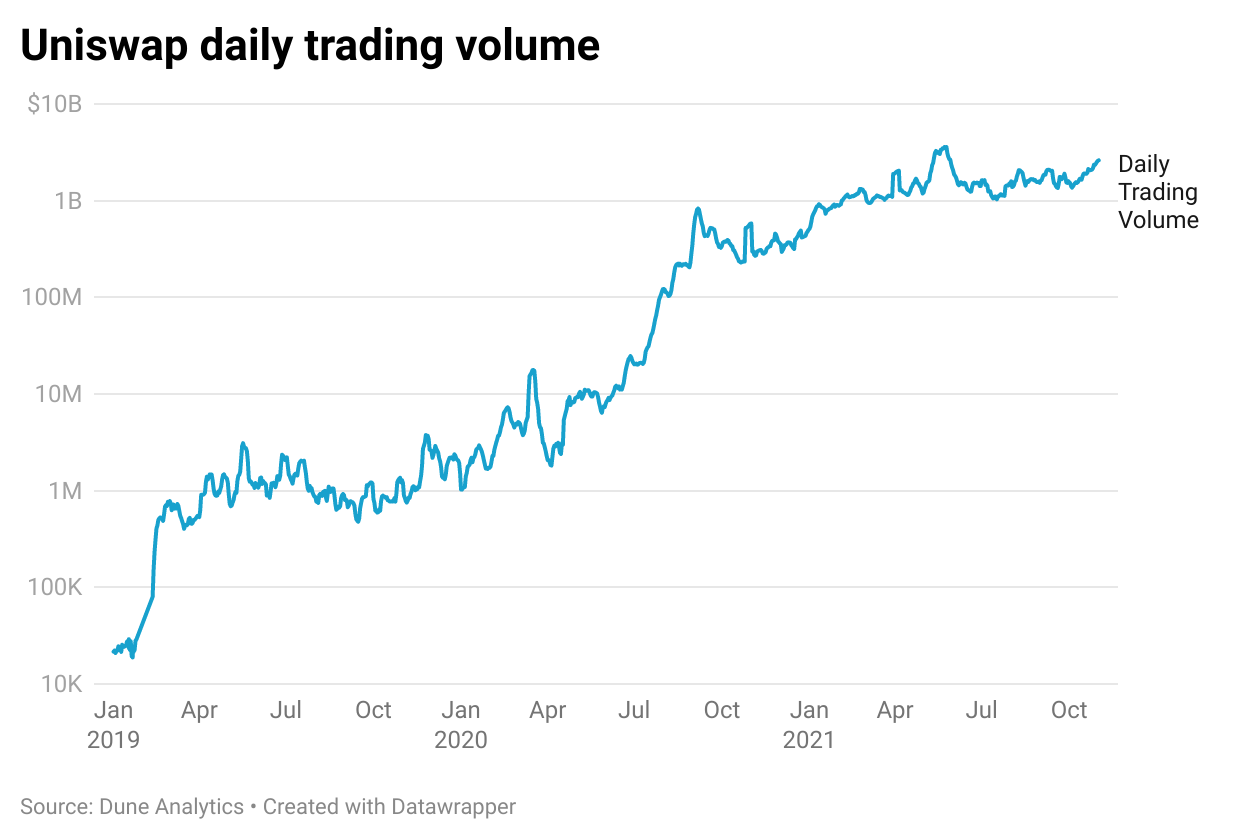

DEXs are currently responsible for 3% or US$6bn of US$195bn of total reported crypto volume, according to Coinmarketcap, and are rapidly growing in popularity.

They operate a trustless, non-custodial, transparent peer-to-peer settlement process by leveraging smart contacts on the blockchain. This is in stark contrast to centralised exchanges, which act as a custodian for their customers and undertake the majority of trades off-chain with very little transparency.

The largest DEX is Uniswap, which is built upon the Ethereum blockchain. It has an average daily trading volume of US$2.6bn, which has increased 53% month-on-month since its launch in November 2018.

Decentralised banking and lending – driving financial inclusion

Decentralised banking and lending is an alternative finance ecosystem where consumers transfer, trade, borrow and lend cryptocurrency, theoretically independently of traditional financial institutions and the regulatory structures that have been built around traditional banking. It has given millions of people around the world who do not have access to regular banks or financial services the opportunity to use financial services.

Decentralised lending sees the borrower deposit collateral that the lender will automatically receive – through the execution of a smart contract – if their loan is not repaid. Some lenders even accept NFTs as collateral. The system facilitates borrowing without credit checks or handing over private information.

Lenders have access to funds deposited from all over the globe, not just the funds in the custody of your chosen bank or institution, which makes loans more accessible and improves interest rates for all parties.

Maker, Aave, and InstaDApp are the largest lending platforms, with a combined US$42bn locked into their protocols.

9) Non-fungible tokens (NFTs) – a new economy for digital property

NFTs are one-of-a-kind digital assets, usually digital artwork, that can be bought and sold like any other piece of property, stored on the Ethereum blockchain. The digital tokens can be thought of as certificates of ownership.

The highest price paid for an NFT was achieved by Beeple’s Everydays (see image below) at Christie’s, which fetched US$69mn in March 2021.

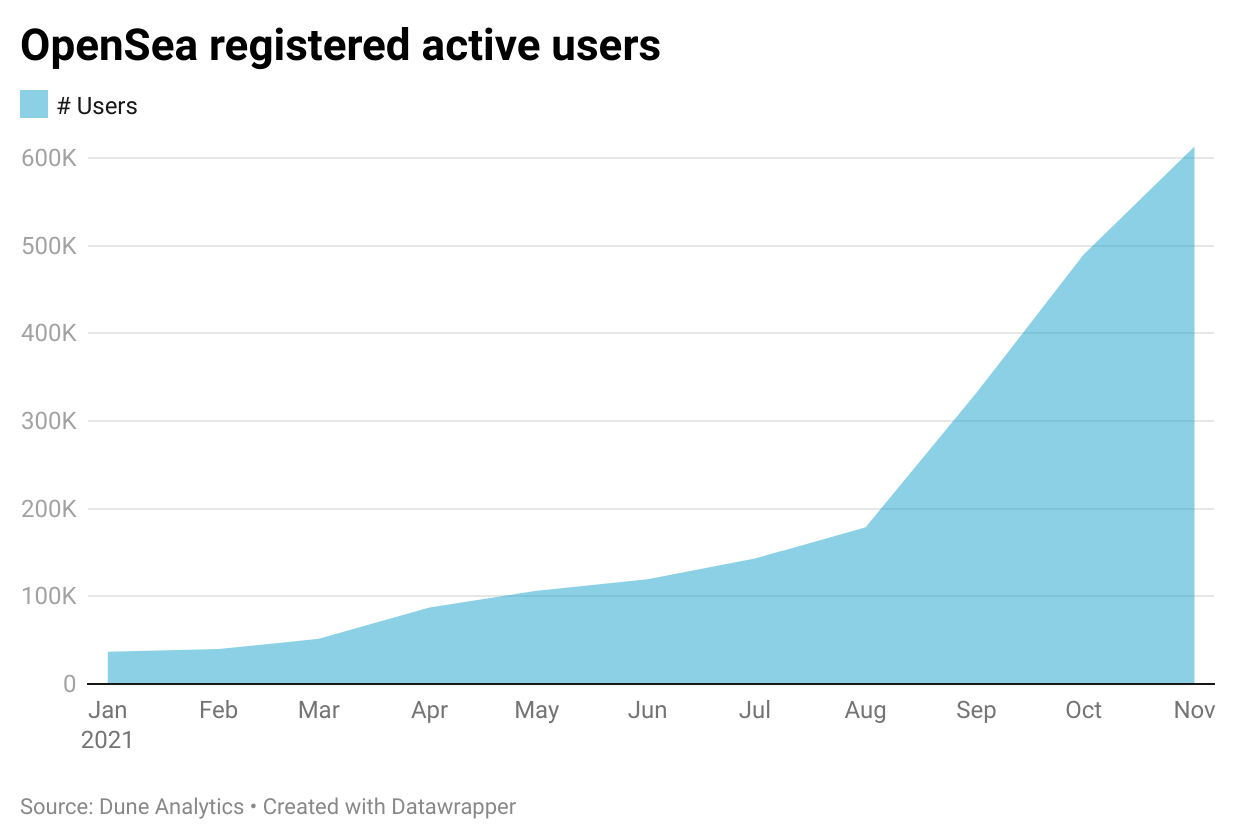

OpenSea is the largest marketplace for NFTs and has over 600,000 active users, growing at a rate of 29% a month.

NFTs were one of the biggest blockchain trends of 2021 but we expect them to be a big theme of next year, too.

10) Tokenisation of everything

Social tokens

Source: Pac Token website

A social token is a crypto token that is created (minted) by a particular group or individual with the purpose of it representing a form of 'digital equity'. Similar to how traditional shares represent equity in a company, social tokens can be used to represent ownership of a social media personality and their community. The token is built on top of the Ethereum blockchain (known as an ERC20 token) and is commonly traded on a decentralised exchange such as Uniswap.

Social tokens provide artists, musicians, writers, social media influencers, and sports professionals with a means of monetising themselves. Celebrities are often huge revenue drivers for media establishments, but they are often not adequately rewarded for their efforts. Their relationship with fans is intermediated through a third party, such as Instagram, which shares the revenue and exerts significant artistic control. Social tokens – whose value reflects fans' enthusiasm – directly reward creators for their work and could fundamentally disrupt the long-standing media models.

Some social tokens have smart contracts that peg their price to their performance, while others act as a platform for fans to invest in themselves as a collective. An example of this is Million Token, a social token minted by an ex-Google software engineer and popular YouTube personality, and the PAC Token minted by legendary boxer Manny Pacquiao.

The 'Metaverse' and online games

Image source: Meta website

The word 'metaverse' has rapidly found its way into the common lexicon, with many prominent tech companies keen to stake a claim to a piece of it (most notably Facebook's recent rebranding to Meta).

However, what really defines a complete metaverse over and above an online game? Many experts would define a metaverse as being a fully 3D world – likely leveraging virtual reality (VR) or augmented reality (AR) technology – that virtualises many of the facets found in the real world. The most important aspects are:

Social interaction – allows people to virtually interact with others in physical space (VR) and partake in many common activities ranging from work to entertainment.

Ownership in digital assets – such as NFT-based land, houses, businesses, artwork and other items used in the metaverse.

Virtual economy – utilises some form of 'play-to-earn' mechanism where players can at the very least earn a stipend from contributing to the metaverse, but ideally allows them to build businesses to serve different purposes.

Given the nascent nature of the current metaverses and the eagerness of marketers to be a part of the latest buzz, the label is being applied to even some 2D online games that contain only one of the above themes or perhaps companies that have aspirations to ultimately build a more complete metaverse.

An example of this is Axie Infinity, a 2D NFT metaverse whose blockchain play-to-earn economic design rewards players with their native cryptocurrency for contributing to the ecosystem and was built to encourage people to learn about blockchain technology. It is inspired by Pokemon and Tamagotchi games, but rewards have grown so large that top players are earning over US$400 a day!

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.