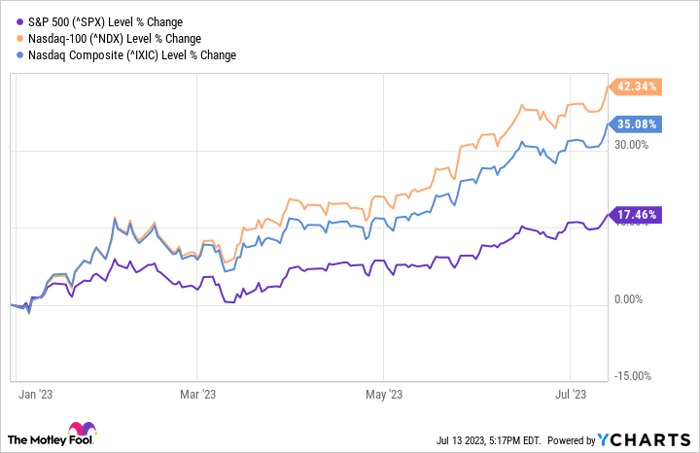

The Nasdaq-100 index tracks the 100 largest non-financial stocks on the Nasdaq stock exchange. The index consists mainly of technology stocks, but a few other sectors are represented. So far this year, the Nasdaq-100 has surged over 42%, far outpacing the 17% gain of the S&P 500, the stock market's typical benchmark.

However, this rally has presented a bit of an issue, causing Nasdaq to announce it would implement a "Special Rebalance" to the Nasdaq-100 index.

Data by YCharts.

Why is the Nasdaq-100 rebalancing?

When you invest in a fund, your money is divided between the companies based on the fund's construction methodology. The two most common are equal-weighted and market-cap-weighted. Equal-weighted funds split your money equally among the stocks they hold. Investing $1,000 in a fund with 100 companies would effectively mean investing $10 into each one.

The Nasdaq-100 is market-cap weighted, meaning the money you invest is divided based on the market cap of the companies within. The larger the company, the more of your investment it receives. Investing $1,000 in a fund with 100 companies could mean the largest company receives 5%, and the smallest receives a fraction of a percent, for example.

Generally, there's nothing wrong with market-cap-weighted indexes. But in the Nasdaq-100's case, the large gains for the top handful of companies recently have made the index far more top-heavy and unbalanced than preferred. Just the top five companies currently account for more than 43% of the index:

- Microsoft: 12.67%

- Apple: 12.04%

- Nvidia: 7.36%

- Amazon: 6.88%

- Meta Platforms: 4.49%

Add in Tesla and Alphabet, and the situation gets even worse with those seven companies accounting for over 55% of the index. According to the Nasdaq-100's methodology, this concentration warrants a rebalance, and this will actually be the index's third special rebalance, mimicking similar moves made in 1998 and 2011. Companies that could see a boost in their concentration include:

- Starbucks

- Mondelez International

- Booking Holdings

- Gilead Sciences

- Intuitive Surgical

- Analog Devices

- Automatic Data Processing

How will this impact investors?

Many investors invest in the Nasdaq-100. The Invesco QQQ ETF (NASDAQ: QQQ), which mirrors the index, is the second-most traded ETF on the U.S. stock exchange. That means the special rebalance will impact a lot of investors.

But looking beyond the near-term volatility the rebalance will generate for the stocks that see their weighting adjusted, investors should also reevaluate their portfolio composition to see where it stands. Decreasing the weight of top tech stocks, for example, could noticeably lower how much of your portfolio is in the tech sector, which could be good if your portfolio is too concentrated. With the S&P 500 also being market-cap weighted (Apple and Microsoft make up over 14% of it), it's sometimes easy for the portfolios of investors in both indexes to become too concentrated without them realizing.

Increasing the weight of companies like Starbucks and Mondelez International will increase your exposure to the consumer-discretionary sector, so ensuring the composition of your portfolio still fits your financial goals and risk tolerance is important.

Most major brokerages will allow you to see your portfolio's composition with a simple visual chart that breaks it down by sector.

The importance of diversification

"Don't put all of your eggs in one basket" is wisdom as old as time, and it's no different in investing. If you could pick a few investing rules to follow and ignore the rest, having a diversified portfolio should be one of them. It all comes down to risk management.

The stock market is unpredictable and volatile, and many factors -- including politics, geographic location, economic conditions, and changing trends -- influence how companies' stocks perform. In other words: You just never know what surprises might get thrown your way. Spreading your investments across different sectors, for example, can help protect your portfolio against unfavorable sector-specific disruptions that could potentially drag that part of the economy down.

For example, low interest rates from the Federal Reserve could lower banks' profitability. High inflation affects how much people spend on discretionary items. And policies around healthcare could directly impact pharmaceutical companies. Conversely, you can find stocks that flourish under those same conditions. Diversification ensures you have the balance to prevent outsized losses in any one sector (and that concept also applies to seeking out companies of different sizes and geographic footprints).

Don't lose sight of diversification by chasing trends (like over-accumulating tech stocks because of AI hype). Diversification won't protect you from losses entirely, but it'll put your portfolio in a much better position to produce good long-term results.

10 stocks we like better than Invesco Qqq Trust, Series 1

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

They just revealed what they believe are the ten best stocks for investors to buy right now... and Invesco Qqq Trust, Series 1 wasn't one of them! That's right -- they think these 10 stocks are even better buys.

*Stock Advisor returns as of July 10, 2023

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's board of directors. Stefon Walters has positions in Apple and Microsoft. The Motley Fool has positions in and recommends Alphabet, Amazon.com, Apple, Booking Holdings, Gilead Sciences, Intuitive Surgical, Meta Platforms, Microsoft, Nvidia, Starbucks, and Tesla. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.