The Battle for Public vs Private Equities

Way back in 2017, in one of his first speeches, SEC Chairman Jay Clayton talked about the importance of capital formation and addressing the decline in U.S.-listed companies to help Mr. and Mrs. 401k secure their future through investments.

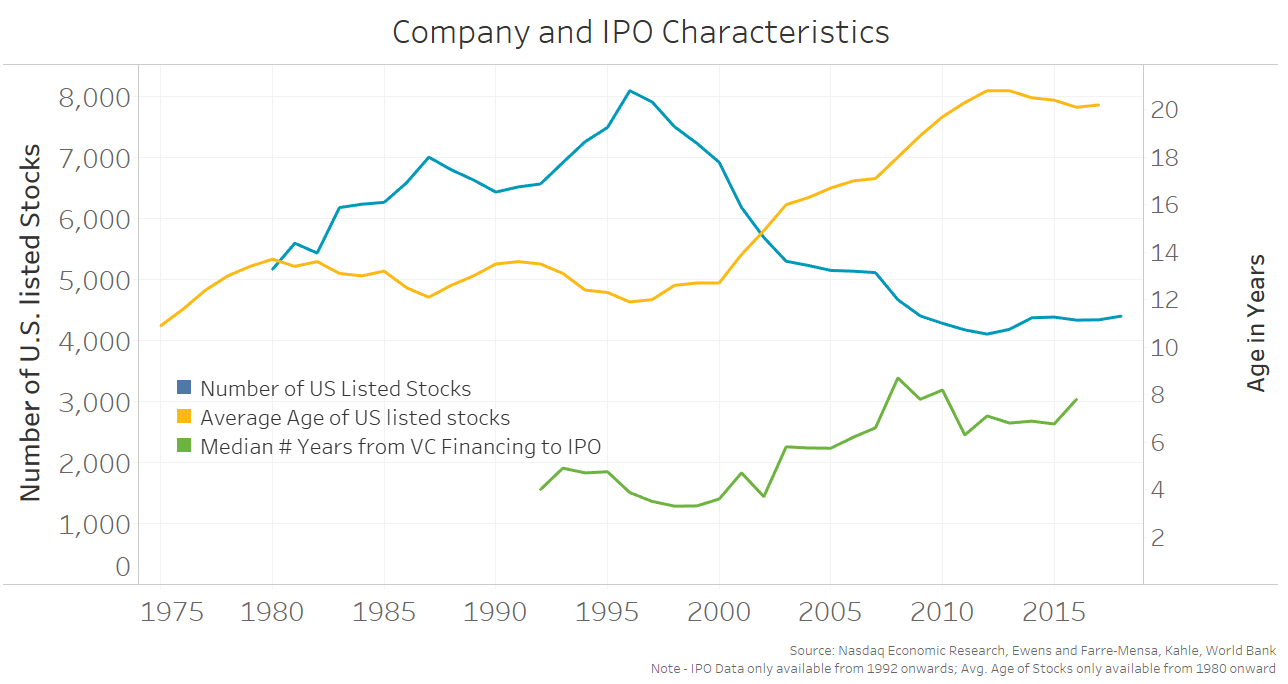

Data clearly show that listed companies have fallen (blue line in Chart 1) while the average age of listed companies has climbed (yellow line). Other data show that the average age of a company at the time of its IPO is also rising (green line).

All of that points to the fact that companies are choosing to stay private longer. This is consistent with the commonly held view that the burden of additional regulations and disclosures seem to be causing companies to “eschew our public markets.”

Chart 1: Listed company and IPO characteristics over time

Deregulation boosted private markets

So it was interesting to read a new academic study that looks at an alternative cause for the reduction in listed companies.

Instead of regulation being a disincentive to go public, this paper suggests that deregulation created an incentive to stay private.

They focus on the introduction of NSMIA in 1996, a new rule that:

- Streamlined private capital raising by removing costly state-by-state blue-sky rule compliance.

- Introduced the concept of “qualified purchasers” to help private equity funds avoid the costs of the 1940 Act.

This is all consistent with the timing of the growth in the U.S private equity (PE) market, which has outstripped PE growth other countries since 1996. Data show that there are:

- More than 8,000 firms with PE backing, up nearly five-fold since 2000.

- Around 5.8 trillion in PE assets, including 2.4 trillion in dry powder.

Chart 2: Private Equity funding has expanded significantly in the past 20 years

Which has boosted private market valuations

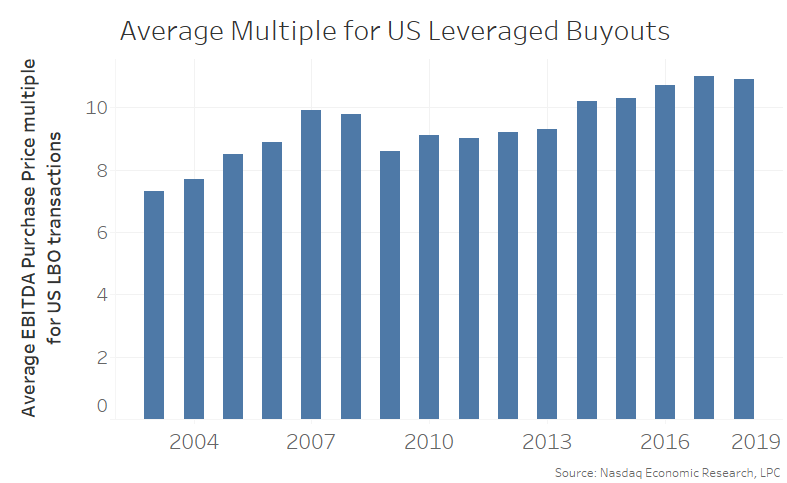

It’s also interesting to see data that shows that as private equity markets grow, they seem to be getting more competitive and efficient.

Valuations have been increasing, and just this week it was reported that private equity returns were below (admittedly strong) stock returns for the first time last year.

Chart 3: PE Valuations are increasing, closing the gap to public market WACC

That’s good news for private companies. Two of the key benefits of raising money on public markets are:

- A lower cost of capital.

- Daily liquidity and access to more potential investors.

Investors also benefits from accountability and transparency brought by public listing rules.

But as private valuations converge with public, the cost of capital advantage falls. Ironically, with a reported $2.5 trillion in dry powder the liquidity premium itself might also be reduced. That in turn alters the cost-benefit calculation for owners and entrepreneurs looking to raise additional capital.

Some important policy implications

It’s generally agreed that public markets are good for the economy and employment too. In fact another recent academic study found that increased liquidity on public markets adds to a company’s investment and production by lowering their cost of capital. That’s good for America.

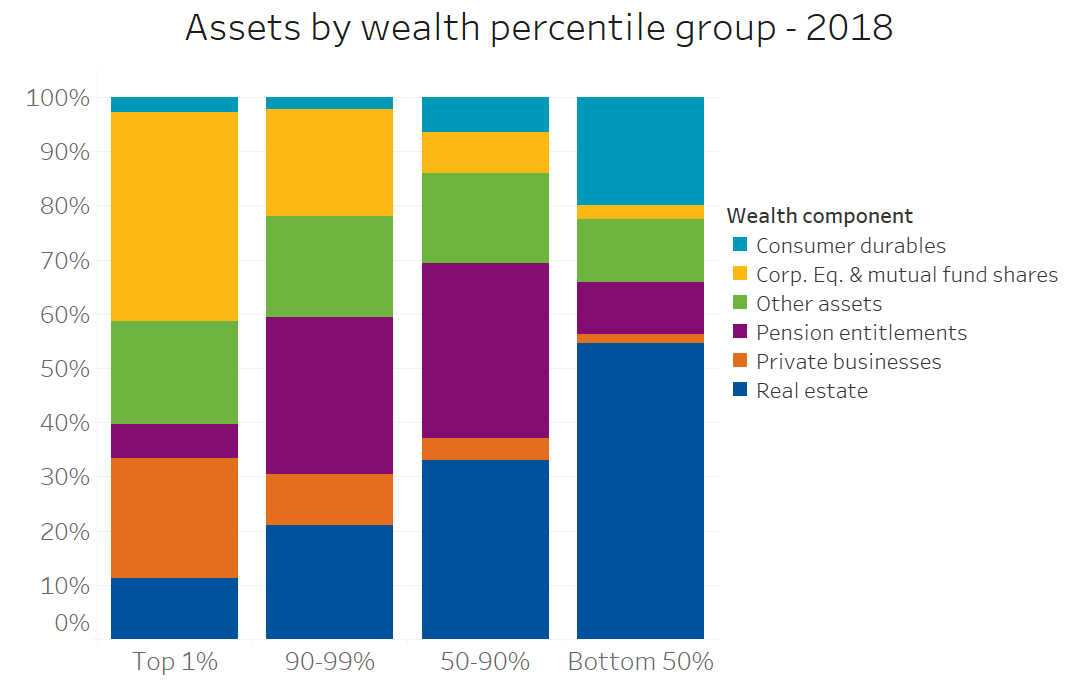

But there is also a social argument for public markets, as most ordinary Americans save for retirement with retail stock and mutual fund holdings, which are typically limited to listed securities.

We’ve already shown that over a lifetime the outperformance of stocks versus other asset classes is a significant contributor to individual wealth.

Unfortunately, low-income U.S. investors are mostly underinvested in stocks (Chart 4). Some data suggests around 45% of households have no stock exposure at all, while other data indicates the bottom 50% of households only own around 1% of equity wealth.

However, their access to private equity is even more limited. By definition only sophisticated investors, ironically defined by their existing wealth, can access most private equity funds.

That means typical households, the ones that need equity exposure the most, are missing out even more. No wonder Chair Clayton’s also said “the effects …on society are, in two words, not good.”

Chart 4: Lower income households are underinvested in stocks already

Ignoring the value of public markets hurts investors who need them the most

There are efforts to correct these imbalances. Although ironically many efforts revolve around making it (even) easier to access private equities.

Recently the SEC proposed loosening the Accredited Investor rules. That should allow more investors to participate in private offerings. Although mostly by including “less wealthy” households.

Buy-side fund-like solutions to invest in private equity may also soon be available to an even broader audience. Although even those will only be available to those with 401k plans or personal mutual fund investments.

As companies wait longer to go public, we’re providing liquidity solutions to staff and early stage investors. Helping to bridge the gap between public and private, but liquidity alone can’t offset economic incentives.

This study shows two important things:

- Deregulation and cost advantages have helped grow private equity markets.

- That’s been good for entrepreneurs, and additional competitive funding helps companies stay private longer, delaying the costs of being public.

It follows then that rules and economics need to change to make public markets more attractive to investors. And if we want to address low income retirement security, we need incentives that work for all investors.

Although the industry is closing the gap between public and private markets, the value that public markets add to society is too big to ignore.