Teva Pharmaceuticals TEVA announced a funding agreement with Royalty Pharma plc RPRX, under which the latter will provide up to $500 million to accelerate the development of Teva’s anti-IL-15 antibody, TEV-’408. IL-15 plays a central role in driving multiple immune-mediated disease pathways. The candidate is currently in early-stage development for vitiligo and other autoimmune diseases.

Royalty Pharma’s $500 million commitment includes $75 million in R&D co-funding for a phase IIb vitiligo study expected to begin in 2026, with an option to invest a further $425 million to co-fund phase III development pending phase IIb results. If the drug is eventually approved and commercialized, Teva will pay Royalty Pharma a milestone payment and ongoing royalties on global net sales.

How Does the Deal Benefit TEVA?

Teva has strengthened its immunology pipeline through a strategic collaboration with Royalty Pharma, which significantly de-risks and accelerates the development of TEV-’408 for vitiligo. The partnership provides substantial non-dilutive funding to Teva, enabling faster clinical progression and positioning the company to move more efficiently through mid- and late-stage development.

The structure of the $500 million funding agreement with Royalty Pharma reduces Teva’s financial exposure while preserving meaningful long-term upside through full commercial control, milestone achievements, and global sales.

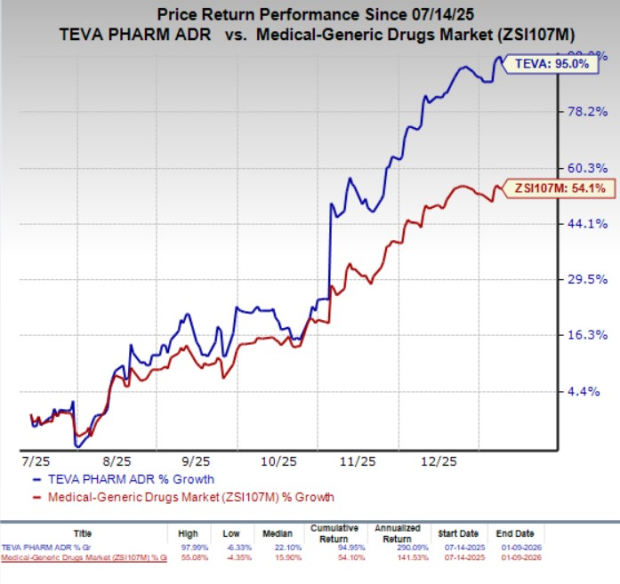

In the past six months, Teva’s shares have rallied 95% compared with the industry’s 54.1% growth.

Image Source: Zacks Investment Research

Per TEVA, early phase Ib data from the ongoing TEV-’408 vitiligo study offer initial validation of IL-15 as a promising therapeutic target across a wide range of autoimmune diseases. Additional clinical updates from the vitiligo program are expected in 2026.

Vitiligo is a chronic autoimmune condition marked by loss of skin pigmentation. It represents a large and underpenetrated market with limited treatment options and no approved systemic therapies. With a global prevalence estimated at 0.5% to 2% and a significant unmet medical need, TEV-’408 could address both the physical and psychosocial burden of the disease by targeting the IL-15 pathway responsible for immune-driven melanocyte destruction.

Please note that TEVA is also currently evaluating TEV-’408 in a phase IIa study for celiac disease. In 2025, the FDA granted the Fast Track designation to the candidate for the celiac disease indication, underscoring its potential clinical and regulatory value.

TEVA’s Ongoing Collaboration Deal With RPRX

The funding agreement for TEV-’408 clinical development marks Teva’s second collaboration agreement with Royalty Pharma.

The companies first entered into a funding agreement in 2023 to accelerate the development of Teva’s long-acting injectable olanzapine (TEV-’749) for schizophrenia. Royalty Pharma committed up to $100 million to cover development costs, which Teva has already fully received and recognized as R&D reimbursement.

Per the agreement, Teva retained global development and commercialization rights of the candidate, but is liable to make milestone and royalty payments to RPRX upon its potential approval and launch. Last month, TEVA announced submitting a new drug application to the FDA seeking approval for olanzapine to treat adults with schizophrenia.

Teva Pharmaceutical Industries Ltd. Price and Consensus

Teva Pharmaceutical Industries Ltd. price-consensus-chart | Teva Pharmaceutical Industries Ltd. Quote

TEVA's Zacks Rank & Stocks to Consider

Teva currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the biotech sector are CorMedix CRMD and Indivior INDV, each currently sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Over the past 60 days, 2026 EPS estimates for CorMedix have risen from $2.49 to $2.88. Shares of CRMD have lost 32.8% over the past six months.

CorMedix’s earnings beat estimates in each of the trailing four quarters, with the average surprise being 27.04%.

Over the past 60 days, estimates for Indivior’s earnings per share for 2026 have risen to $2.85 from $2.60. Indivior stock has rallied 126.9% over the past six months.

Indivior’s earnings beat estimates in three of the trailing four quarters and were in line in the remaining quarter, with the average surprise being 68%.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the favorite stock to gain +100% or more in the months ahead. They include

Stock #1: A Disruptive Force with Notable Growth and Resilience

Stock #2: Bullish Signs Signaling to Buy the Dip

Stock #3: One of the Most Compelling Investments in the Market

Stock #4: Leader In a Red-Hot Industry Poised for Growth

Stock #5: Modern Omni-Channel Platform Coiled to Spring

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor. While not all picks can be winners, previous recommendations have soared +171%, +209% and +232%.

Download Atomic Opportunity: Nuclear Energy's Comeback free today.Teva Pharmaceutical Industries Ltd. (TEVA) : Free Stock Analysis Report

Royalty Pharma PLC (RPRX) : Free Stock Analysis Report

CorMedix Inc (CRMD) : Free Stock Analysis Report

Indivior PLC (INDV) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.