With discretionary categories underperforming and consumer traffic under pressure, Target Corporation TGT is banking on its third-party digital marketplace, Target Plus. The company aims to grow the platform’s gross merchandise volume ("GMV") to $5 billion by 2030. That’s a high-stakes bet for a company wrestling with soft sales and shifting consumer behavior. However, behind those macro challenges lies a digital engine that’s gaining meaningful traction.

The goal hinges on greatly expanding the variety of brands and products for guests, particularly in home and apparel, where a broad selection significantly influences consumer choices. In the last reported quarter, Target Plus demonstrated significant momentum, growing its GMV by more than 20% and onboarding hundreds of new partners. This expansion has been instrumental in boosting online traffic and conversion rates.

More than just a sales lever, this marketplace initiative stands as a key pillar of Target’s broader digital transformation. It is designed to deepen engagement, grow market share and extend assortment without incurring the inventory burden of traditional retail. Crucially, Target Plus integrates tightly with other high-margin, digitally native assets, including Roundel, Target’s advertising business, and its fulfillment infrastructure powered by store hubs and Shipt.

The push behind Target Plus highlights a calculated move to capitalize on the marketplace model, offering guests more of what they desire and positioning it as a key component in Target's future digital success. While ambitious, the strong quarterly growth suggests Target Plus could indeed be a strategic goldmine for the retailer.

Target’s Price Performance, Valuation and Estimates

Target stock has declined 22.9% year to date against the industry’s growth of 2.1%. The company has underperformed key peers such as Dollar General Corporation DG and Costco Wholesale Corporation COST. During the same period, Dollar General shares have rallied 41%, while Costco has seen a modest gain of 2%.

Image Source: Zacks Investment Research

Target’s forward 12-month price-to-earnings ratio of 13.28 reflects a lower valuation compared with the industry’s average of 31.65. TGT carries a Value Score of B. TGT is trading at a discount to Dollar General (with a forward 12-month P/E ratio of 17.60) and Costco (47.31).

Image Source: Zacks Investment Research

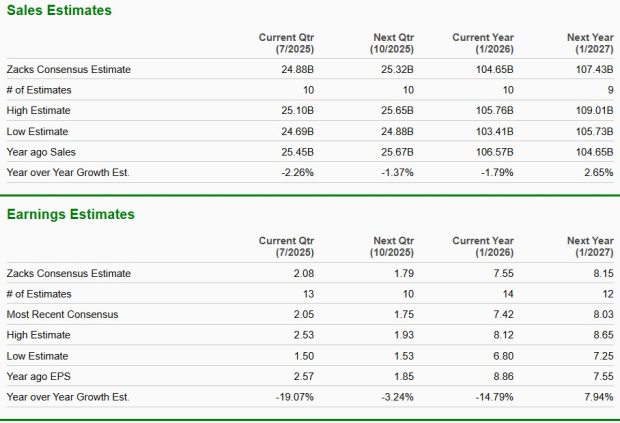

The Zacks Consensus Estimate for Target’s current financial-year sales and earnings per share implies a year-over-year decline of 1.8% and 14.8%, respectively.

Image Source: Zacks Investment Research

Target currently carries a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

#1 Semiconductor Stock to Buy (Not NVDA)

The incredible demand for data is fueling the market's next digital gold rush. As data centers continue to be built and constantly upgraded, the companies that provide the hardware for these behemoths will become the NVIDIAs of tomorrow.

One under-the-radar chipmaker is uniquely positioned to take advantage of the next growth stage of this market. It specializes in semiconductor products that titans like NVIDIA don't build. It's just beginning to enter the spotlight, which is exactly where you want to be.

See This Stock Now for Free >>Target Corporation (TGT) : Free Stock Analysis Report

Dollar General Corporation (DG) : Free Stock Analysis Report

Costco Wholesale Corporation (COST) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.