Crypto has caught many eyes over recent months, with investors clamoring for exposure following the bullish move. The U.S. election helped light the fire in a big way, with President-elect Donald Trump’s favorable stance on digital assets providing a big boost.

But it’s no secret that crypto is a volatile asset class, spooking many with a more conservative approach. Still, market participants can still obtain decent exposure through several stocks, a list that includes Robinhood Markets HOOD and Coinbase COIN.

Both companies facilitate crypto trading services, with upcoming results likely to be positive thanks to higher inflows and trading fees. Let’s take a closer look at each for those seeking exposure to cryptocurrency.

Robinhood Sees Crypto Transactions Soar

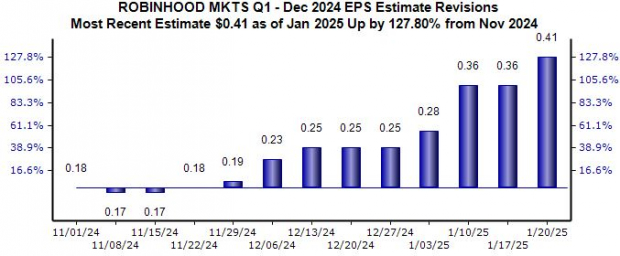

Robinhood’s easy-to-use platform lets investors trade a wide variety of assets, which includes cryptocurrencies. Analysts have taken a bullish stance on the company’s upcoming quarterly release, with the $0.41 per share estimate up more than 120% over the last year and suggesting 1200% growth.

Image Source: Zacks Investment Research

Cryptocurrencies revenues of $61 million in its Q3 blasted 165% higher year-over-year to $61 million. And crypto notional trading volumes of $14.4 billion melted 112% year-over-year.

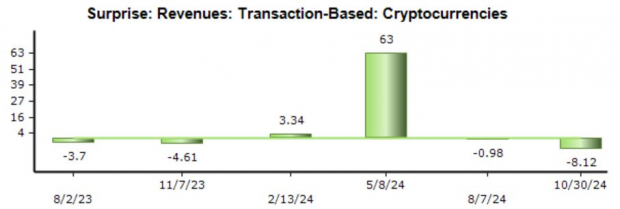

As shown by the year-over-year growth comps, the company’s crypto trading has rebounded in a big way. The company has overall struggled to exceed our consensus expectations concerning crypto-based revenues in recent periods, as shown below.

Image Source: Zacks Investment Research

Coinbase to See Outsized Sales Growth

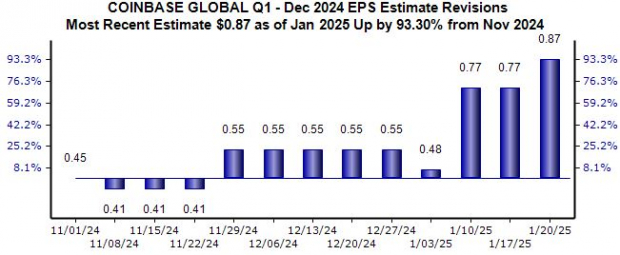

Coinbase is the largest U.S. cryptocurrency exchange. The outlook for its upcoming release has been considerably bullish, with the $0.87 Zacks Consensus EPS estimate up 93% over the last several months. Revenue revisions have also followed the same path, with COIN expected to see 67% year-over-year top line growth.

Image Source: Zacks Investment Research

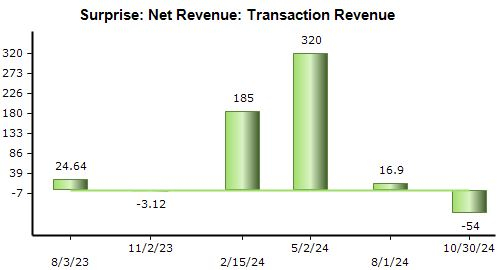

The company’s transaction revenues have overall been mixed relative to our consensus expectations over recent quarters. It’s reasonable to expect a strong print here in its next quarterly print given the current trading environment.

Image Source: Zacks Investment Research

Bottom Line

Crypto has again gripped investors, with the asset class going on a massive run over recent months. The momentum is undeniable, and for those seeking exposure through stocks, both companies above – Robinhood Markets HOOD and Coinbase COIN would provide precisely that.

Both companies stand to benefit in a big way from higher trading volumes, and we’ll likely see this development in their upcoming quarterly results.

Zacks' Research Chief Names "Stock Most Likely to Double"

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is among the most innovative financial firms. With a fast-growing customer base (already 50+ million) and a diverse set of cutting edge solutions, this stock is poised for big gains. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpCoinbase Global, Inc. (COIN) : Free Stock Analysis Report

Robinhood Markets, Inc. (HOOD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.