AT&T, Inc. T recently introduced the AT&T IoT Network Intelligence, a leading-edge solution designed to enhance enterprise visibility across its connected devices ecosystem. Businesses across sectors are rapidly incorporating IoT devices to streamline workflow and improve organizational efficiency. However, new problems are arising with these growing digital transformation efforts.

Companies often lack the visibility of how IoT devices are performing on the network. When a device fails to function properly, organizations are often not able to understand the root cause of the issue. This leads to slow and costly troubleshooting and increases downtime, ultimately leading to dissatisfaction from end users.

AT&T IoT Network Intelligence brings leading-edge features to ensure comprehensive visibility into the distributed IoT network of the organization. It efficiently ensures visibility into several critical components such as signal strength, data throughput, and latency. Access to such key performance indicators allow organization to swiftly take action and ensure faster troubleshooting. The solution’s insightful analytics provide greater opportunities for improvement, and also showcase how IoT devices perform in different geographic areas. Such innovative features can effectively bolster IoT visibility, intelligence and security, streamline operations across multiple sectors such as healthcare, transportation, logistics and more.

Per a report from Fortune Business Insights, the global IoT market was valued at $864.32 billion in 2025. It is expected to grow at a compound annual growth rate of 24.3% from 2025 to 2030. AT&T is expanding its portfolio offering to capitalize on this market trend.

How are Competitors Faring?

AT&T faces competition from Verizon Communications, Inc. VZ and T-Mobile, US, Inc. TMUS in the IoT connectivity space. T-Mobile offers a comprehensive portfolio of IoT network technologies that include Narrowband IoT, LTE-M, LTE and 5G. The technologies support a wide range of use cases such as smart meters, industrial sensors, fleet management, asset tracking and many other applications. T-Mobile is collaborating with Deutsche Telekom drive advancement in IoT technology.

Verizon has developed a platform like ThingSpace that supports businesses at various stages of IoT development, from prototyping to enterprise-ready. It also offers a wide range of network technologies to support the different requirements of IoT devices. Verizon is also expanding collaboration with various IoT OEMs to ensure their device compatibility with the Verizon network.

T’s Price Performance, Valuation & Estimates

AT&T has gained 8.9% over the past year against the industry’s decline of 0.3%.

Image Source: Zacks Investment Research

From a valuation standpoint, AT&T trades at a forward price-to-earnings ratio of 10.5, below the industry tally of 11.49.

Image Source: Zacks Investment Research

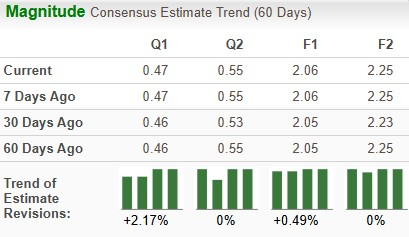

Earnings estimates for 2025 have increased 0.49% to $2.06 over the past 60 days, while those for 2026 have remained unchanged.

Image Source: Zacks Investment Research

AT&T currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks' Research Chief Names "Stock Most Likely to Double"

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is a little-known satellite-based communications firm. Space is projected to become a trillion dollar industry, and this company's customer base is growing fast. Analysts have forecasted a major revenue breakout in 2025. Of course, all our elite picks aren't winners but this one could far surpass earlier Zacks' Stocks Set to Double like Hims & Hers Health, which shot up +209%.

Free: See Our Top Stock And 4 Runners UpAT&T Inc. (T) : Free Stock Analysis Report

Verizon Communications Inc. (VZ) : Free Stock Analysis Report

T-Mobile US, Inc. (TMUS) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.