AT&T, Inc. T recently, in collaboration with Cisco Systems, Inc. CSCO, rolled out a leading-edge cloud-delivered networking and security solution, the AT&T SASE (Secure Access Service Edge). By combining Cisco Secure Access Technology and AT&T’s network expertise, the collaboration has developed a single vendor SASE service solution that effectively addresses some key pain points in the enterprise network security environment.

Most of SASE deployments now are multi-vendor. This fragment setup creates information and security gaps, leading to higher complexities. With growing digital transformation across industries, enterprises are increasingly having to manage a large pool of devices and data all connected through a comprehensive network architecture. Businesses need a resilient and secure ecosystem to protect such vast and complex operations.

AT&T, with its single vendor SASE solution, aims to match this requirement. Multi-layer defense, intelligent network routing and optimization, intelligent zero-trust security, enhanced observability, multi-cloud connectivity and simplified network management are some of the key features offered by the solution. This effectively protects all the devices and data from edge to cloud. In a crowded enterprise connectivity and security market, a single vendor, fully integrated SASE offering is one of the major differentiating factors for AT&T. This will likely boost the company’s commercial prospects among mid-size businesses with multiple outlets or large-scale global enterprises as well.

How Are Competitors Faring?

AT&T faces competition from Lumen Technologies LUMN and Verizon Communications, Inc. VZ. Lumen offers a comprehensive SASE offering and boasts a solid footprint supporting more than 2,200 public and private data center connections worldwide. By collaborating with Fortinet and VMWare, Lumen offers cutting-edge features such as firewall as a service, zero trust network access and more.

Verizon business with its robust SASE offerings, is also gaining ground in the enterprise connectivity market. In partnership with major industry leaders Cisco, Versa and Zscaler, Verizon is aiming to solidify its position in the enterprise network security space.

T’s Price Performance, Valuation & Estimates

AT&T stock has risen 46.7% over the past year compared with the Wireless National industry’s growth of 22%.

Image Source: Zacks Investment Research

Going by the price/earnings ratio, the company’s shares currently trade at 13.23 forward earnings, lower than the industry’s 13.6 but above its mean of 12.09.

Image Source: Zacks Investment Research

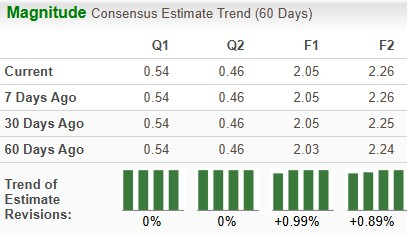

Earnings estimates for 2025 and 2026 have moved upward over the past 60 days.

Image Source: Zacks Investment Research

AT&T currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Names #1 Semiconductor Stock

This under-the-radar company specializes in semiconductor products that titans like NVIDIA don't build. It's uniquely positioned to take advantage of the next growth stage of this market. And it's just beginning to enter the spotlight, which is exactly where you want to be.

With strong earnings growth and an expanding customer base, it's positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $971 billion by 2028.

See This Stock Now for Free >>AT&T Inc. (T) : Free Stock Analysis Report

Verizon Communications Inc. (VZ) : Free Stock Analysis Report

Cisco Systems, Inc. (CSCO) : Free Stock Analysis Report

Lumen Technologies, Inc. (LUMN) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.