AT&T, Inc. T recently introduced its first end-to-end IoT solution, the AT&T Connected Spaces, in AWS Marketplace. The comprehensive solution suite offers several features that simplify IoT adoption for enterprises.

By combining pre-integrated wireless sensors with a secure cloud platform, it offers an intuitive dashboard, enabling businesses to access actionable insights. Its plug-and-play deployment ensures seamless installation. It empowers businesses to track critical metrics such as temperature, humidity, motion, energy usage and security in real time.

Traditionally, businesses looking to develop an end-to-end IoT ecosystem had to rely on multiple vendors for different aspects, from sensors, connectivity and cloud integration, to analytics. This makes the process complex and slow. AT&T’s end-to-end offering and collaboration with AWS will significantly streamline the process. This is particularly game-changing for small and medium-sized businesses that often lack the resources and reach to develop an IoT ecosystem for their businesses.

AT&T's solution offers actionable insights that will allow businesses to optimize resource allocation and utilization, improve operational uptime and enhance end-user experience. As enterprises upscale their businesses, AT&T Connected Devices allows them to seamlessly expand their IoT devices, ensure reliable performance with longer battery life and extended range. With such leading-edge capability, the solution can support a wide range of use cases across several sectors such as retail, hospitality, healthcare, warehousing and property management. Its listing on AWS market place significantly increase its accessibility to customers.

Per a report from Fortune Business Insights, the global IoT market is valued at $864.32 billion in 2025. It is expected to grow at a 24.3% compound annual growth rate, reaching $4,062.34 billion in 2032. AT&T is expanding its portfolio to capitalize on this emerging trend.

How Are Competitors Faring?

AT&T faces competition from Verizon Communications, Inc. VZ and T-Mobile, US, Inc. TMUS in the IoT connectivity space. The Verizon ThingSpace platform supports businesses at various stages of IoT development, from prototyping to enterprise-ready. The solution also offers various network technologies that cater to the various requirements of IoT devices. Kodiak AI, an leading edge autonomous driving technology provider, recently opted to use the solution. Kodiak is leveraging Verizon’s advanced and improved 5G connectivity and IoT telematics for real-time communication, remote monitoring, software updates and centralized fleet management. Verizon is also expanding its collaboration with various IoT OEMs to ensure their device compatibility with the Verizon network.

T-Mobile boasts a robust portfolio of IoT network technologies that include Narrowband IoT, LTE-M, LTE and 5G. The technologies support a wide range of use cases such as smart meters, industrial sensors, fleet management, asset tracking and many other applications. T-Mobile is collaborating with Deutsche Telekom drive advancement in IoT technology.

T’s Price Performance, Valuation & Estimates

AT&T has declined 3.7% over the past year compared with the industry’s decline of 9.3%.

Image Source: Zacks Investment Research

From a valuation standpoint, AT&T trades at a forward price-to-earnings ratio of 10.35, below the industry tally of 11.14.

Image Source: Zacks Investment Research

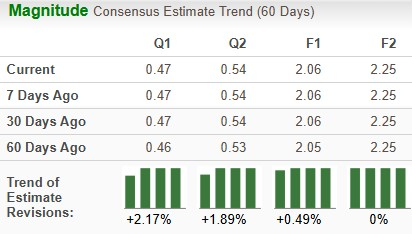

Earnings estimates for 2025 have increased 0.49% to $2.06 over the past 60 days, while those for 2026 have remained unchanged.

Image Source: Zacks Investment Research

AT&T currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Just Released: Zacks Top 10 Stocks for 2026

Hurry – you can still get in early on our 10 top tickers for 2026. Handpicked by Zacks Director of Research Sheraz Mian, this portfolio has been stunningly and consistently successful.

From inception in 2012 through November, 2025, the Zacks Top 10 Stocks gained +2,530.8%, more than QUADRUPLING the S&P 500’s +570.3%.

Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2026. You can still be among the first to see these just-released stocks with enormous potential.

See New Top 10 Stocks >>AT&T Inc. (T) : Free Stock Analysis Report

Verizon Communications Inc. (VZ) : Free Stock Analysis Report

T-Mobile US, Inc. (TMUS) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.