Fintel reports that on April 26, 2023, SVB Securities maintained coverage of AlloVir (NASDAQ:ALVR) with a Outperform recommendation.

Analyst Price Forecast Suggests 544.83% Upside

As of April 24, 2023, the average one-year price target for AlloVir is 22.44. The forecasts range from a low of 16.16 to a high of $31.50. The average price target represents an increase of 544.83% from its latest reported closing price of 3.48.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for AlloVir is 0MM, a decrease of �%. The projected annual non-GAAP EPS is -2.28.

What is the Fund Sentiment?

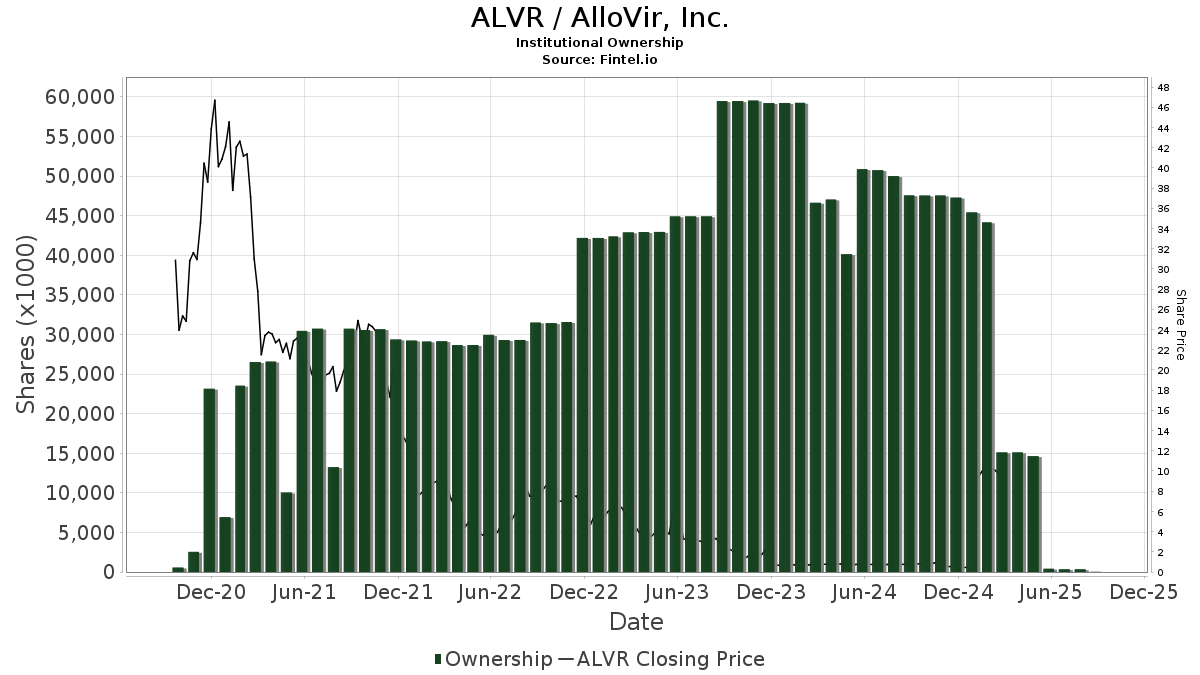

There are 229 funds or institutions reporting positions in AlloVir. This is an increase of 8 owner(s) or 3.62% in the last quarter. Average portfolio weight of all funds dedicated to ALVR is 0.04%, a decrease of 10.48%. Total shares owned by institutions increased in the last three months by 1.60% to 42,952K shares.  The put/call ratio of ALVR is 0.09, indicating a bullish outlook.

The put/call ratio of ALVR is 0.09, indicating a bullish outlook.

What are Other Shareholders Doing?

Artal Group holds 5,577K shares representing 5.96% ownership of the company. No change in the last quarter.

Alkeon Capital Management holds 4,605K shares representing 4.92% ownership of the company. In it's prior filing, the firm reported owning 4,923K shares, representing a decrease of 6.91%. The firm decreased its portfolio allocation in ALVR by 27.39% over the last quarter.

Gmt Capital holds 2,759K shares representing 2.95% ownership of the company. No change in the last quarter.

Acap Strategic Fund holds 2,297K shares representing 2.46% ownership of the company. In it's prior filing, the firm reported owning 2,467K shares, representing a decrease of 7.38%. The firm decreased its portfolio allocation in ALVR by 34.66% over the last quarter.

FDGRX - Fidelity Growth Company Fund holds 2,158K shares representing 2.31% ownership of the company. In it's prior filing, the firm reported owning 2,232K shares, representing a decrease of 3.44%. The firm decreased its portfolio allocation in ALVR by 1.29% over the last quarter.

AlloVir Background Information

(This description is provided by the company.)

AlloVir is a leading late clinical-stage cell therapy company with a focus on restoring natural immunity against life-threatening viral diseases in patients with severely weakened immune systems. The company’s innovative and proprietary technology platforms leverage off-the-shelf, allogeneic, multi-virus specific T cells targeting devastating viruses for patients with T cell deficiencies who are at risk from the life-threatening consequences of viral diseases. AlloVir’s technology and manufacturing process enables the potential for the treatment and prevention of a spectrum of devastating viruses with each single allogeneic cell therapy. The company is advancing multiple mid- and late-stage clinical trials across its product portfolio.

See all AlloVir regulatory filings.This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.