Being a leading provider of semiconductor memory solutions, Micron Technology MU is the most searched for stock on Zacks.com outside of Nvidia NVDA.

This comes as the storied memory chip shortage has made Micron a central beneficiary of the AI hardware boom.

The rapid expansion of AI hardware — data centers, GPUs, and accelerators — is consuming most of the memory chip supply and bandwidth, driving a sharp increase in demand for Micron’s offerings.

With the demand shock being structural and not a temporary spike, Micron’s stock more than tripled last year and is already up more than 40% in 2026.

While this is an unprecedented surge, analysts argue that Micron’s valuation remains compelling because earnings are rising even faster than the stock price.

Following a recent pullback from an all-time high of $455 a share, the surge in Micron’s stock looks poised to continue.

To that point, Micron is still seeing an eye-catching trend of positive EPS revisions, and has held a spot on the coveted Zacks Rank #1 (Strong Buy) list since this past August.

Micron’s Memory Products

Micron’s HBM (high-bandwidth memory), server-class DRAM (dynamic random-access memory), DDR5 (double data rate), and broader DRAM portfolio are seeing explosive demand.

Notably, AI chips from Nvidia, AMD AMD, and Alphabet GOOGL require enormous amounts of HBM, making it the single most supply-constrained memory type in the world right now.

DDR5 is the fifth generation of advanced synchronous DRAM and has been in short supply as well, making this category a major growth driver for Micron as the latest, fastest, and most efficient memory standard powering modern servers, PCs, and AI systems.

Reflecting the exceptionally favorable supply and demand dynamic, Micron’s FY25 sales hit a record $37.38 billion, with annual earnings near multi-year highs at $8.29 per share. And of course, top and bottom line peaks are projected this year.

Micron’s Blazing EPS Revisions

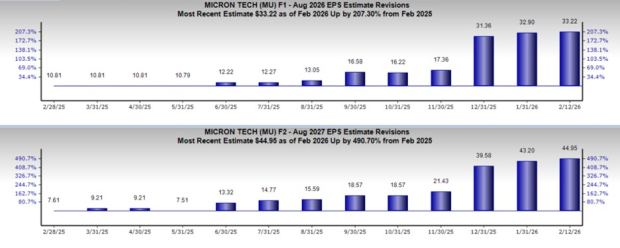

Wall Street expects Micron’s EPS to spike 300% in FY26 to a record $33.22, a staggering acceleration that reflects both pricing power and volume growth. Better still, FY27 EPS is projected to climb another 35% to a whopping $44.95.

Since most recently crushing earnings expectations for its fiscal first quarter in December, Micron’s FY26 and FY27 EPS estimates have continued to trend higher and are now up 78% and 91% in the last 60 days, respectively.

Image Source: Zacks Investment Research

Astonishingly, the year-ago earnings estimates picture shows that FY26 and FY27 EPS revisions have now skyrocketed 207% and 490%, respectively.

Image Source: Zacks Investment Research

Micron’s “Cheap” P/E Valuation

Just as captivating is that despite such an exhilarating rally, Micron stock still trades at 12X forward earnings. This is well below the rather stretched P/E premiums other high-growth tech stocks can command and offers a distinct discount to the benchmark S&P 500.

More intriguing, MU trades nicely beneath Sandisk Corporation SNDK and Western Digital’s WDC forward earnings multiples of 23X and 31X, as two of the other prime beneficiaries of the global memory chip shortage.

Image Source: Zacks Investment Research

Bottom Line

Micron has enjoyed exceptional pricing power, an advantage that strongly supports the continued momentum in its stock. Since being added to the Zacks Rank #1 (Strong Buy) list on August 20, 2025, Micron stock has soared a staggering 865%.

Research Chief Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpMicron Technology, Inc. (MU) : Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Western Digital Corporation (WDC) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Sandisk Corporation (SNDK) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.